ChatGPT’s XRP analysis reveals XRP surging +3.78% to $2.9543 with strong bullish momentum as the Bank of Japan’s SBI announces an official XRP lending program for institutional payments, while Ripple CTO David Schwartz announces his exit from the company.

At the same time, XRP shows exceptional technical strength, trading above all major EMAs, including the 20-day ($2.5049), 50-day ($2.9220), 100-day ($2.8386), and 200-day ($2.6160) support levels, positioning it for a potential $3.00+ breakthrough amid the October ETF decision timeline.

ChatGPT’s XRP analysis synthesizes 23+ real-time technical indicators to assess XRP’s trajectory, while testing psychological $3.00 resistance with multiple ETF decisions pending.

Technical Analysis: Strong Bullish Structure Above All EMAs

XRP’s current price of $2.9543 reflects a robust +3.78% gain from the opening price of $2.8468, establishing a volatile trading range between $2.9550 (high) and $2.8141 (low).

This 4.8% intraday range demonstrates exceptional volatility typical of major institutional catalyst responses.

The RSI at 52.52 maintains neutral positioning, providing substantial room for upside continuation without overbought conditions.

Moving averages reveal exceptional bullish positioning with XRP trading above all EMAs: 20-day at $2.5049 (-15.2%), 50-day at $2.9220 (-1.1%), 100-day at $2.8386 (-3.9%), and 200-day at $2.6160 (-11.5%).

MACD also shows slight bearish positioning at -0.0012 just below zero with the signal line at -0.0266, but a negative histogram at -0.0254 indicates improving momentum divergence.

Similarly, volume analysis shows exceptional activity at 97.71 million XRP, indicating massive institutional participation during the Bank of Japan announcement and CTO transition processing.

The ATR maintains high readings at 2.5709, suggesting continued volatility potential for moves toward psychological resistance levels.

Market Context: Bank of Japan Integration Validates Institutional Utility

XRP’s surge follows the Bank of Japan’s SBI announcement of an official XRP lending program, representing unprecedented institutional validation.

Community analysis highlights “Bank of Japan (SBI) announces official $XRP lending program,” signaling “Japan is preparing to utilize XRP for institutional payments at scale.”

The Japanese institutional integration provides concrete utility validation beyond speculation, with XRP surpassing Bitcoin in trading volume on South Korea’s largest exchange, Upbit, demonstrating accelerated Asian institutional demand.

This geographic concentration suggests systematic regional adoption patterns.

Ripple CTO David Schwartz’s transition to CTO Emeritus after 13 years marks a sign of institutional maturation rather than weakness.

Community interpretation suggests “XRP is ready to run without him” as infrastructure development reaches the self-sustaining institutional adoption phase, requiring less founder dependency.

Partnership expansion continues with Ondo Finance tokenizing U.S. treasuries on the XRP Ledger, while discussions on SWIFT integration persist despite recent Chainlink collaboration announcements.

ETF Timeline Convergence Creates October Catalyst Framework

October presents a massive convergence of catalysts with seven spot XRP ETF applications pending SEC decisions, beginning on October 18.

Applications from Grayscale, WisdomTree, and Franklin Templeton create an institutional infrastructure framework comparable to Bitcoin and Ethereum precedents.

Community sentiment emphasizes “Uptober” narrative with discussions of “biggest month in XRP history” as regulatory timeline convergence with technical positioning creates compelling setup.

The 2017 pattern comparison gains traction with analysts noting “XRP bullish quarterly close above the resistance for the first time since 2017,” suggesting historical parallel formation.

The technical structure mirrors previous cycle accumulation patterns preceding major appreciation phases.

Market Fundamentals: Exceptional Metrics Support Institutional Confidence

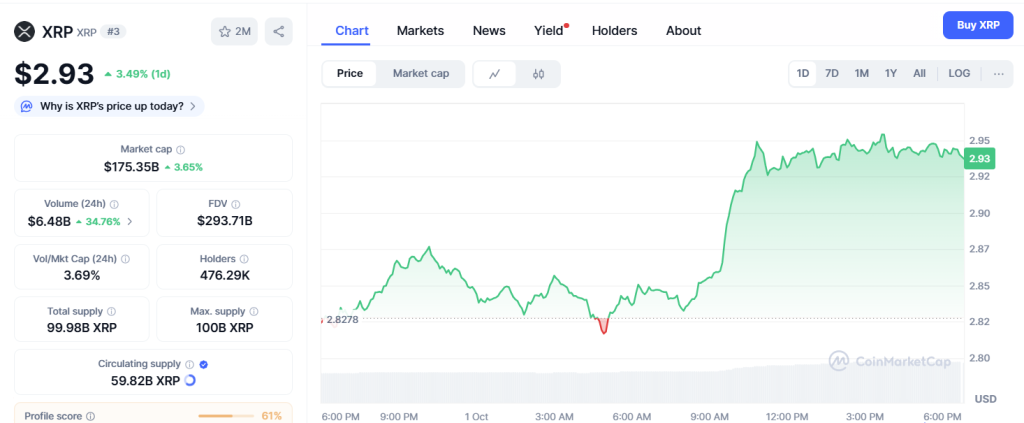

XRP maintains substantial positioning with $175.35 billion market cap (+3.49%). The market cap growth accompanies increased volume at $6.48 billion (+34.76%), indicating active institutional repositioning.

The 3.69% volume-to-market cap ratio suggests exceptional trading activity supporting price appreciation during catalyst events such as this.

Additionally, a market dominance of 4.41% (-0.15%) shows slight weakness relative to the broader market but maintains substantial altcoin leadership positioning.

However, a fully diluted valuation of $293.71 billion reflects the total network value, including future releases, while the holder count of 476,250 shows both retail interest and institutional adoption.

LunarCrush data reveals improving social performance with XRP’s AltRank at 253 (+12) during institutional developments.

Galaxy Score of 68 (+23) reflects an exceptional sentiment surge as participants process Japanese banking integration and ETF timeline convergence.

Engagement metrics show substantial increases with 20.07 million total engagements (+1.44M) and 65.3K mentions (+27.66K).

Additionally, social dominance of 3.7% (+1.5%) shows exceptional growth, while sentiment registers at a robust 83% positive.

Prominent analysts identify 2017 pattern similarities with some projecting “$20 by December” targets while others emphasize near-term $3.15 breakout levels.

Technical discussions center on quarterly close patterns and historical cycle comparisons, suggesting major appreciation potential.

ChatGPT’s XRP Analysis: Institutional Infrastructure Meets Technical Breakout

ChatGPT’s XRP analysis reveals XRP positioned for potential psychological $3.00 breakthrough following Japanese institutional program validation and leadership transition signs.

Immediate resistance emerges at the psychological $3.00 level, followed by key resistance at $3.05–$3.10 range.

Breaking above these levels would signal institutional adoption validation, driving momentum toward $3.20–$3.30+ targets based on previous resistance structures.

Support structure remains exceptional with 50-day EMA ($2.9220) providing immediate downside protection, followed by layered support at 100-day ($2.8386) and 200-day ($2.6160) EMAs.

The technical setup suggests bullish bias for catalyst-driven continuation with excellent risk-reward positioning.

Three-Month XRP Price Forecast: ETF and Institutional Scenarios

Institutional Breakthrough (55% Probability)

Successful break above $3.00 combined with October ETF approvals could drive XRP toward $3.50–$4.00, representing 18–35% upside from current levels.

This scenario requires regulatory validation and Japanese program scaling confirmation.

Consolidation Before Launch (30% Probability)

Continued resistance testing could result in consolidation between $2.85–$3.10, allowing institutional program development while awaiting ETF decisions before the next major catalyst-driven move.

Correction Risk (15% Probability)

Failure at $3.00 resistance could trigger selling toward $2.85–$2.80 support levels, representing 3–6% downside.

Recovery would depend on ETF decision outcomes and Japanese program adoption metrics.

ChatGPT’s XRP Analysis: Banking Integration Validates Payment Infrastructure

ChatGPT’s XRP analysis reveals XRP at a key inflection point between Japanese institutional banking validation and psychological resistance breakthrough requirement.

Next Price Target: $3.50-$4.00 Within 90 Days

The immediate trajectory requires a decisive break above $3.00 psychological resistance to validate institutional banking integration momentum.

From there, ETF approval acceleration could propel XRP toward $3.50 institutional target, with sustained Japanese program scaling driving toward $4.00+ breakout levels.

However, failure to break $3.00 would indicate extended consolidation toward $2.85–$2.90 range, creating a final accumulation opportunity before the next institutional wave drives XRP toward $5.00+ targets.

https://cryptonews.com/news/chatgpts-xrp-analysis-reveals-2-95-surge-as-bank-of-japan-launches-xrp-lending-program-is-4-possible/