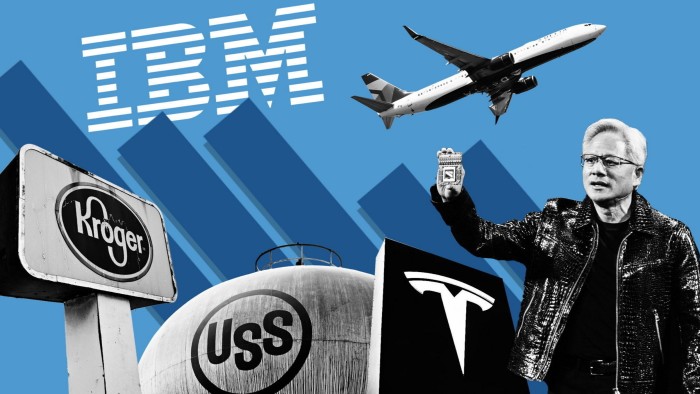

The rapid slump in US stocks over the past three weeks has been marked by dramatic falls for the biggest Wall Street names such as chipmaker Nvidia and carmaker Tesla.

But below the surface, there have been winners as well as losers as investors switch into stocks viewed as better insulated against economic concerns and cratering valuations.

Big Tech and big banks take a hit

The standout losers since the S&P 500’s record high on February 19 are the tech stocks and other high-growth companies whose valuations have soared in recent years.

Chipmaker Nvidia, the focus of the AI stock boom, is down more than 20 per cent, as investors continue to fret about the threat from China’s AI sector, while Tesla, whose shares surged following Donald Trump’s election victory has fallen 36 per cent as it surrendered all of those gains.

Peter Thiel’s data analytics company Palantir is down 30 per cent after reaching a record high last month as investors hoped for a windfall from US government cost cuts.

Of the “Magnificent Seven” big tech companies, Microsoft has weathered the sell-off best, losing 8 per cent.

“The stocks feeling this the most are the ones that have risen the most in recent years,” said Drew Pettit, equity strategist at Citigroup. He insisted there was still a “pretty good backdrop for corporate growth” and said investors now “need to buy a little bit of everything outside the Mag 7”.

Elsewhere, the worst performers have been stocks seen as most exposed to a slowdown in the US economy, as concerns rise about consumer and business sentiment. Airline stocks have been knocked by warnings of lower demand, with Delta Air Lines, American Airlines and United Airlines down almost 30 per cent since the S&P’s February peak.

Banks, another sector sensitive to growing recession fears, have also suffered. Citigroup, Morgan Stanley and Goldman Sachs are all down about 20 per cent.

Winners: defensives and ‘ignored stocks’

Investors have switched their focus to so-called defensive stocks, in sectors typically insulated from the ups and downs of the economy.

Among the biggest gainers since the S&P’s February peak are utilities such as American Water Works, up about 12 per cent, and healthcare stocks such as Merck & Co, up 11 per cent.

Major domestic steelmakers have avoided steep falls, with stocks such as US Steel and Nucor rising on Tuesday as Trump threatened 50 per cent tariffs on Canadian imports. The shares have outperformed the wider index since its February peak.

In the tech sector, the sell-off has allowed for a relative comeback in some hitherto unloved stocks beyond the Magnificent Seven.

Shep Perkins, chief investment officer at equities fund manager Putnam Investments, cited Cisco and IBM — both down about 6 per cent since the February peak, and in positive terms for the year — as examples of an “ignored stocks rally”.

Stocks that “didn’t have a story that really appeals to growth investors or to value investors” were having their time to shine, he added.

In a note on Tuesday, Goldman Sachs urged investors to switch into stocks “insensitive” to risks from economic growth, trade policy and AI, based on the share of recent returns it calculates as coming from these trends — its selection includes rating agency S&P Global and US grocer Kroger.

The shift away from tech has left the US market slightly less top-heavy than it was at its peak. The S&P 500 is down more than 9 per cent since its closing high last month, but the version of the index that weights each stock equally is down 6 per cent. The tech-heavy Nasdaq Composite has lost 13 per cent.

Small-cap optimism fades

There has been no reprieve, however, for smaller US stocks, confounding expectations they were likely to benefit from a tech stumble.

Small-caps have been dragged down by concerns over the health of the domestic economy, in a sharp turnaround from the all-time highs hit after the election as investors bet the new administration’s package of tax cuts and deregulation would boost growth.

The pain for small-caps contrasts with their strong performance during last August’s tech sell-off, when they rallied in a long-awaited market rotation. Their underperformance this year underscores the growing economic fears fuelling the recent sell-off.

Premium to Europe shrinks

US stocks’ years of outperformance had seen them open a big valuation gap with peers in Europe and other markets, cited by some investors as evidence of a bubble brewing on Wall Street.

The US “growth scare” caused this premium to shrink. Wall Street’s recent falls have taken the S&P’s forward price-earnings multiple — a core yardstick of stocks’ relative value — from more than 26 times to 21 times, according to Bloomberg, while the fall for European stocks has taken them from above 15 times to roughly 14 times forward earnings.

Equity bulls point to longer timeframes, over which the tech stocks have recovered from every setback to record highs. Tom Stevenson, investment director at Fidelity, said it was “worth remembering that volatility isn’t the same as risk”.

“Risk is losing your capital permanently, which only happens if you lose your nerve and sell during a downturn, rather than if you hang in there and wait for what has always happened in time — the recovery in prices.”

https://www.ft.com/content/874958e0-1e1c-4b5e-905e-6786b61674ff