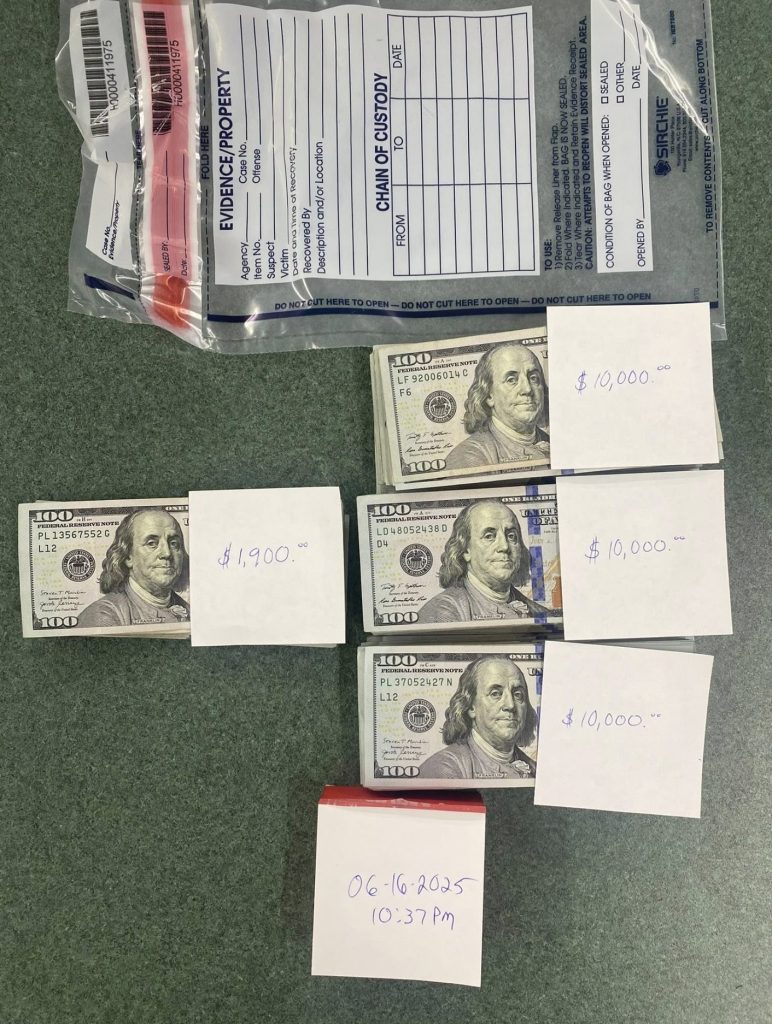

When a family was scammed out of $25,000 at a Bitcoin ATM in Texas, law enforcement agents didn’t mess around.

Detectives used power tools to break into the machine and recover the physical cash inside — with a grand total of $31,900 seized.

Although helping a fraud victim is certainly to be applauded, this has a feel of robbing Peter to pay Paul. Such an act doesn’t bring the scammer responsible to justice — it just harms the small business owner who owns the machine.

Nonetheless, stories like this powerfully illustrate the crackdown on Bitcoin ATMs that’s taking place across America right now.

Spokane in Washington State has actually banned them altogether, but other states and cities are instead proposing laws that would make it harder for fraudsters to drain the life savings of impressionable consumers.

Over in Illinois, any cash-to-crypto conversions facilitated through these ATMs would need to take a note of the address where funds have been sent. In theory, this could help detectives track down scammers at a later date, but it’s likely many seasoned criminals will use obfuscation tools to cover their tracks.

Perhaps a more sensible proposal comes from Vermont, which has passed a law that imposes daily transaction limits of $1,000 on Bitcoin ATMs. This would go a long way to limiting the amount of money victims lose.

Meanwhile, the likes of Nebraska have moved to license ATM operators. Not only does this mean they need to provide quarterly reports with transaction data, but fees are capped at 18% to prevent impressionable consumers from being ripped off.

A Growing Problem

The Federal Trade Commission has made its views on Bitcoin ATMs clear — describing them as a “payment portal for scammers.”

Official figures show fraud losses from these machines hit $12 million in 2020, surging almost tenfold to $114 million by 2023. Incomplete figures showed losses topped $66 million in the first six months of 2024 alone, indicating it was set to be yet another record-breaking year.

FTC research also sheds light on how victims are lured in, how much they lose, and who tends to be the most vulnerable. Scammers often attempt to impersonate governments and businesses, or pretend they’re from tech support. Median losses stand at an “exceptionally high” $10,000, with the government body adding:

“In the first half of the year, people 60 and over were more than three times as likely as younger adults to report a loss using a BTM. In fact, more than two of every three dollars reported lost to fraud using these machines was lost by an older adult.”

Put another way, there are more victims over 60 than in all other age groups combined.

Lawmakers in the U.S. Senate are also attempting to build upon the tightened laws being rolled out at a state and local level — led by Illinois Senator Dick Durbin.

He’s introduced the Crypto ATM Fraud Prevention Act, which would bring in literate measures designed to protect the public — while attempting to limit inconvenience for law-abiding users.

New users would be prevented from spending more than $2,000 a day at one of these machines, rising to $10,000 in a 14-day period. Operators would also need to have a detailed conversation whenever a new user is trying to complete a transaction with a value of over $500. Crucially though, they would also be entitled to refunds if a police report is filed within 30 days.

Reading between the lines, this is a bill that puts the onus on ATM operators to keep an eye on what’s happening in their stores — and intervene if something looks suspicious.

The clock is ticking to get the Crypto ATM Fraud Prevention Act signed into law. Durbin has confirmed that he won’t be seeking re-election during the midterms in 2026, with the 80-year-old Democrat resigning after decades of service.

Durbin also offered an amendment when the GENIUS Act was winding its way through the Senate, warning:

“Enough is enough. I urge my colleagues on both sides of the aisle: listen to the people you represent, particularly the senior citizens who are losing their life savings to these scams, and realize that with 30,000 crypto ATMs across the country, more and more of this will occur.”

It remains to be seen whether any of the efforts to prevent crypto ATM losses will make a difference. As Bitcoin’s price rises, and flirts with all-time highs, a greater number of opportunistic fraudsters will take the opportunity to strike.

The post Why the U.S. is Clamping Down on Bitcoin ATMs appeared first on Cryptonews.

https://cryptonews.com/exclusives/why-the-u-s-is-clamping-down-on-bitcoin-atms/