The crypto market is up today after several days of notable drops, with the cryptocurrency market capitalisation increasing by 0.9%, now standing at $3.21 trillion. 85 of the top 100 coins have gone up over the past 24 hours. At the same time, the total crypto trading volume is at 181 billion.

TLDR:

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have seen their prices rise over the past 24 hours.

Bitcoin (BTC) has appreciated by 1.5% since this time yesterday, currently trading at $91,381.

Ethereum (ETH) is up by 1.2%, now changing hands at $3,061.

The highest increase in this category today is 2.2% by Binance Coin (BNB), which currently stands at $930.

It’s followed by Dogecoin (DOGE)’s 2.1% to $0.1582.

Tron (TRX) is up the least, practically not changing over the past day: 0.1% to $0.2877.

When it comes to the top 100 coins, 85 are green at the time of writing. Among these, two saw double-digit gains. WhiteBIT Coin (WBT) is up by 19.5% to $60.63, while Cronos (CRO) appreciated 11.4% to $0.1134.

On the other side, two coins also saw double-digit drops. Monero (XMR) is down 10.4% to $363, while Internet Computer (ICP) fell by 10.3% to the price of $5.

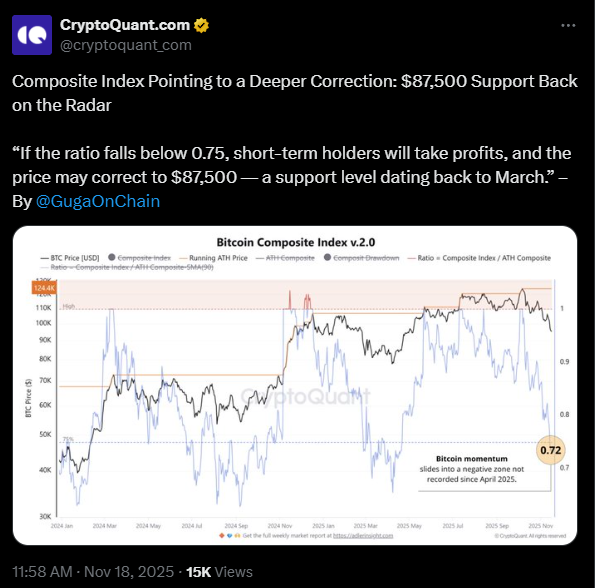

Meanwhile, according to on-chain data shared by analyst GugaOnChain, the market’s Composite Index fell to its lowest level since April 2025, a move which historically precedes sharper pullbacks. It indicates that BTC could revisit the $87,000 zone.

This comes as expectations of a December US Federal Reserve rate cut fade, while risk appetite thins. Moreover, even whales and long-term holders have decided to sell some of their holdings this time around.

‘Any Renewed Macro Pressure Could Easily Force Prices Lower’

According to Robin Singh, CEO of the crypto tax reporting platform Koinly, “Bitcoin appears to be settling into a period of directionless trading, gradually hovering around the low $90,000s and offering little relief to traders who came into November expecting a decisive rebound.”

The price is now sitting near $90,000, which is notably below its opening level for the year. The slide beneath $100,000 has seen sentiment plunge sharply, Singh writes in an email.

Now, “the market is trying to determine whether this is a temporary cooling-off phase or the early stages of a more prolonged reset. For now, conviction remains thin, and any renewed macro pressure could easily force prices lower.”

Moreover, a push back toward $95,000 or even a retest of $100,000 isn’t off the table, he argues. However, this “may require a clear macro catalyst emerging such as more market confidence in a US Federal Reserve rate cut in December, which the market is unsure about and not ready to price in confidently.”

Singh concludes that forecasts from earlier in the year that projected BTC at $250,000 by the end of this year “now seem increasingly far-fetched. With just over a month left in 2025 and momentum on shaky ground, those targets may seem more aspirational than realistic.”

Levels & Events to Watch Next

At the time of writing on Wednesday morning, BTC stood at $91,381. Over the past day, the coin initially saw a surge to the intraday high of $93,668, but it then plunged to the low of $90,021.

That said, it also fell 11.1% in a week, trading in a range between $89,455 and $105,023. It is now 27.3% away from its all-time high of $126,080.

If the coin resists falling below the $83,800 zone, it could move towards $96,000 and $99,000. However, if it fails to do so, lower levels could await, possibly around $74,500.

Ethereum is currently changing hands at $3,061. It rose to the day’s high of $3,162 before dropping to the lowest point in 24 hours (by the time of writing) of $2,995, which was followed by a moderate recovery.

Over the past week, ETH traded between the intraweek low of $2,980 and the intraweek high of $3,580. Overall, it’s down 10.6% in a week and 38% from its ATH of $4,946.

ETH is currently holding above $3,000, but there’s a threat of it falling below the $2,850 mark. Nonetheless, should bears defend this level, the price could push higher towards $3,280.

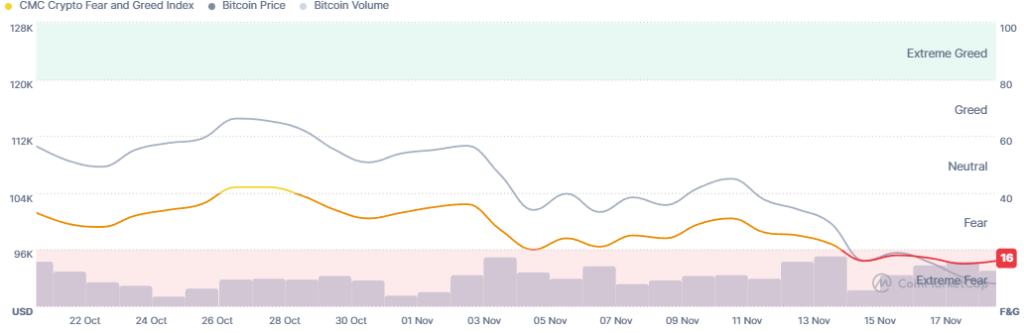

Meanwhile, the crypto market sentiment has entered the extreme fear zone over the past couple of days. The crypto fear and greed index stands at 16 today, only slightly higher from yesterday’s 15.

This is the lowest level in seven months. The last time this index went into the extreme fear territory was in April 2025.

The market is currently driven by concerns over the falling prices and potential of an incoming bear market. It is likely that market participants are worried about the near-term outcomes, and a number of them are resorting to selling their assets. Others are taking advantage of the dips to stack up on coins.

That said, once the market becomes oversold, it typically prepares for a rebound.

ETFs Continue Outflow Streak

On Tuesday, the US BTC spot exchange-traded funds (ETFs) recorded their fifths consecutive day of outflows, with $372.77 million. This brought the total net inflow back down to $58.22 billion, moving away from the $60 billion mark.

While two of the 12 BTC ETFs did see positive flows, the negative flows of a single company pulled the entire category into red.

Grayscale took in $139.63 million and Franklin noted $10.76 in inflows. At the same time, BlackRock let go of $523.15 million.

At the same time, the US ETH ETFs also continued their outflow streak for the eighth day in a row, seeing another $75.22 million leave on 18 November. The total net inflow pulled back to $12.88 billion.

Notably, four of the nine funds recorded inflows, but a single one recorded massive outflows, outweighing all the others.

Grayscale took in the most ($62.39 million), followed by Bitwise, VanEck, and Franklin. BlackRock, however, released $165.08 million.

Meanwhile, Cathie Wood’s ARK Invest bought $10.2 million worth of shares in Bullish (BLSH) on Monday as crypto-linked stocks plunged.

Moreover, El Salvador purchased 1,090 additional BTC valued more than $100 million despite their agreement with the IMF to restrict Bitcoin purchases as part of a $1.4 billion loan arrangement.

On the other hand, analysts at Samosa Capital Investment Fund have argued that Michael Saylor’s BTC strategy is actually “hurting Bitcoin’s price action”, which is detrimental for the Bitcoin community.

Saylor, however, pushed back against concerns that Wall Street’s increasing presence in BTC has intensified volatility.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has seen a slight increase over the past day, while the stock market closed lower on Tuesday, for a second consecutive session, pulled down by the AI-tied tech stocks. By the closing time on 18 November, the S&P 500 was down by 0.83%, the Nasdaq-100 decreased by 1.2%, and the Dow Jones Industrial Average fell by 1.07%.

- Is this rally sustainable?

While the crypto market has seen a slight increase today, it’s worth noting that it remains overwhelmingly red over the past week. It would take clear macro signals to push it upwards. Otherwise, we may see smaller ups and downs continue over the next couple of days or a deeper push downwards.

https://cryptonews.com/news/why-is-crypto-up-today-november-19-2025/