The crypto market has seen another rise today, with nearly all top 100 coins recording a price increase over the past 24 hours. The cryptocurrency market capitalization has decreased by 1% to $3.58 trillion. The total crypto trading volume is at $138 billion, the highest we’ve seen in several days.

TLDR:

Crypto Winners & Losers

Like yesterday, all top 10 coins per market cap have seen their prices increase over the past 24 hours.

The world’s top coin, Bitcoin (BTC) has risen by just 0.3%, meaning it’s unchanged in this timeframe, now trading at $109,531. This is also the smallest increase in this category.

Ethereum (ETH) has recorded another notable rise. It’s up 4.6% to the price of $2,798.

The category’s highest gainer is Dogecoin (DOGE), which is now up 5.4%, changing hands at $0.2013.

Moreover, looking at the top 100 coins, we find that only seven are down. Bittensor (TAO) fell the most among these: 3.1% to $421.

Uniswap (UNI) noted the highest increase today, as it appreciated 18.1% to $8.41.

Six other coins recorded double-digit increases.

Investors, both crypto and TradFi, were focused on the US-China discussions in London for the past two days, where participants addressed tariffs and restrictions on shipments of key products, such as rare earth minerals and chips. On Tuesday, the parties said they agreed on “a framework” on both issues, though the specifics remain unclear.

Moreover, Wednesday morning in the US will see the consumer price index for May, which will indicate how tariffs are affecting inflation.

Meanwhile, Sean Dawson, Head of Research at the onchain options AI-powered platform, Derive.xyz, argued that prices surged after the US Securities and Exchange Commission (SEC) announced exemptions for DeFi projects. ETH is “the big winner as it paves the way for rapid expansion.”

Sebastian Pfieffer, managing director of Impossible Cloud Network, noted that Ethereum works to comply with European laws, but that “now it’s Europe’s turn to embrace decentralization, rather than putting unnecessary roadblocks in place.” This way, “Europe can be free of US political control over its cloud infrastructure,” he says.

All Eyes on US Inflation Report

Ruslan Lienkha, Chief of Markets at YouHodler, said that there is a strong possibility for BTC to hit a new ATH soon. The price currently stands just a few percentage points below its previous peak. “Broadly speaking, financial markets remain optimistic,” he says.

“However, the risk of a reversal remains, particularly if upcoming economic data disappoints. All eyes are now on [today’s] US inflation report. While markets are pricing in a moderate uptick, a higher-than-expected reading could trigger increased volatility across risk assets, including cryptocurrencies.”

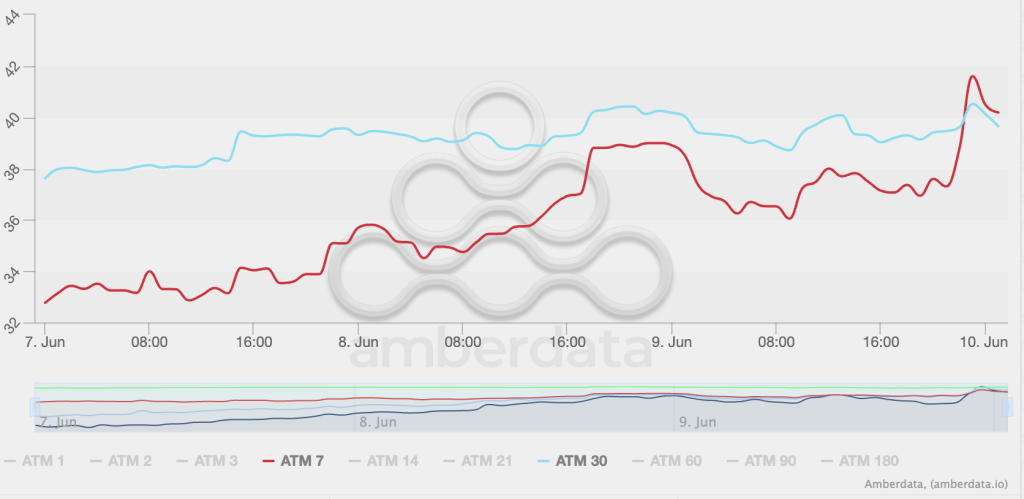

Derive.xyz’s Sean Dawson commented that, despite the recent uptick in price, BTC implied volatility still hovers around its lowest levels this year. He explains that this could indicate “significant mispricing, offering traders opportunities to access cheap upside leverage or downside protection.”

BTC 7-day (red) and 30-day (cyan) implied volatility.

Dawson says that the muted response of implied BTC volatility despite the price rise suggests “a potential disconnect between market pricing and underlying risk. This presents a strategic window for traders to capitalize on relatively low-cost options, enabling efficient positioning for either further upside or potential downside in BTC.”

Levels & Events to Watch Next

At the time of writing, BTC trades at $109,531, still nearing the all-time high of $111,814, which it hit on 22 May. The coin tested the $110,200 yet again today, reaching the intraday high of $110,237, but failed to maintain it. That said, should it break the ATH again, it will proceed to test the key resistance levels of $115,103 and $118,358.

In the same period, Ethereum hit an intraday high of $2,821, seeing a minor pullback since, but gradually climbing on a daily basis. The coin broke the resistance level of $2,720, suggesting additional increases to follow.

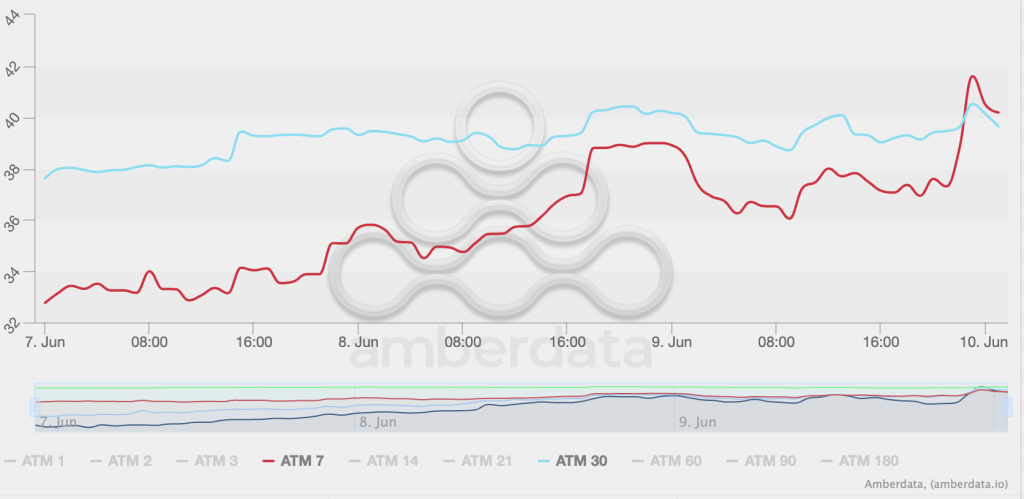

Sean Dawson commented that ETH volatility has jumped nearly 5% to 70% for 7-day volatility. It’s also holding at 66% for 30-day volatility. This means that daily ETH price moves “could be approximately twice as large as BTC’s,” he argued.

ETH 7-day (red) and 30-day (cyan) implied volatility

Moreover, the crypto market sentiment keeps climbing after entering the greed zone yesterday. Crypto Fear and Greed Index stands at 65 today, indicating increasingly bullish sentiment and investors continuing to buy in.

Meanwhile, US BTC spot exchange-traded funds (ETFs) saw a net inflow of $431.12 million on Tuesday. BlackRock’s $336.74 million contributed the most to this amount. The total net inflow so far stands at $45.06 billion.

At the same time, US ETH spot ETFs have recorded seventeen consecutive days of inflows, adding another $124.93 million. BlackRock leads this list again with $80.59 million on 10 June. Overall, Ethereum investment products have seen a cumulative total net inflow of $3.5 billion.

Meanwhile, Bitcoin is continually seeing a rising investor interest, with over 80 publicly traded companies now holding BTC. However, some have raised red flags.

According to the latest report by the global digital asset bank Sygnum, “large concentrated holdings are a risk for any asset.” At this point, Strategy’s holdings are “approaching a point where they become problematic, with the company holding close 3% of the total Bitcoin ever issued, but a much higher share of the actual liquid supply.”

The company aims to acquire 5% of the total issued BTC. This “raises concerns.” Firstly, these vehicles amassing too much of the supply undermine Bitcoin’s safe haven properties. Secondly, private corporations controlling a large portion of the existing supply would make BTC inappropriate for central banks to hold as a reserve asset, Sygnum warns. Finally, a plunge in the liquid supply will also deter large institutions.

Quick FAQ

- Why did crypto move with stocks today?

Both the crypto and stock markets have increased in the last day, though crypto’s increase is notably higher. For example, the S&P 500 has increased by 0.55%, the Nasdaq-100 is up 0.66%, and the Dow Jones Industrial Average rose by 0.25%. Stocks are up for three days straight, and today, they’re expected to react to the agreement reached during the US-China trade talks.

- Is this rally sustainable?

The positive market sentiment keeps powering the current two-day rally. Analysts see the market moving higher, but they do warn traders and investors to keep an eye on macroeconomic and geopolitical events.

The post Why Is Crypto Up Today? – June 11, 2025 appeared first on Cryptonews.

https://cryptonews.com/news/why-is-crypto-up-today-june-11-2025/