The crypto market is up today, with more than 90 of the top 100 coins in green over the past 24 hours. In this time, the cryptocurrency market capitalization has increased by 2.3% to $4.12 trillion. At the same time, the total crypto trading volume is at $201 billion, the highest it’s been in days.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have increased over the past 24 hours.

Bitcoin (BTC) is largely unchanged as it’s up by 0.4% in a day, now trading at $119,052. This is the smallest decrease in this category.

At the same time, Ethereum (ETH) has increased by 8.3%, now trading at $4,634. It’s the category’s second-best performer.

Solana (SOL) is the highest gainer, having risen 12.3% to the price of $196.7.

As for the top 100 coins, four of them recorded double-digit increases. The highest among these is Binance Staked SOL (BNSOL), which appreciated 12.5% to $210.87.

It’s followed by Jito Staked SOL (JITOSOL)’s 12.3% to the price of $240.36. Solana and Pump.fun (PUMP) are next.

At the same time, six coins are down. Monero (XMR) fell the most, followed by Provenance Blockchain (HASH), having dropped 5.2% and 3.3% to $246.99 and $0.02858, respectively.

The market is still heavily influenced by the macroeconomic elements, particularly those US-related. While the concerns surrounding tariffs and economic health largely subsided, investors focused on economic data, particularly Tuesday’s Consumer Price Index (CPI) report.

Overall, it showed expected numbers, with annual inflation holding steady from the month prior. With this, expectations for rate cuts by the Federal Reserve in September persist.

‘Sentiment is a Significant Price Driver’

James Toledano, Chief Operating Officer at Unity Wallet, commented that currently, we’re seeing normal price fluctuations.

Bitcoin’s latest sideways price action was possibly a result of investor caution in the lead-up to US CPI inflation data release.

Additionally, Donald Trump’s meeting with Vladimir Putin this week may lead to heightened geopolitical tensions that could increase safe-haven demand for BTC. However, “there’s no clear evidence that it will meaningfully sway the BTC price in either direction,” Toledano argues.

He continued: “An increase in corporate treasury holdings in traditional finance, whether in cash, bonds, or other assets, won’t directly raise share prices in the same mechanical way that buying or buying back stock would. Bitcoin however might be different because sentiment is such a significant price driver and an increase in corporate treasury holdings in Bitcoin surely boosts sentiment for the digital asset as it speaks to broader adoption and acceptance within traditional finance.”

Additionally, Dom Harz, co-founder of BOB, commented on the crypto market cap surpassing Apple, saying that it’s “a clear reflection of strong sentiment.”

Bitcoin is trading around $120,000 and could reach another ATH in the near future, “with institutions and Bitcoin DeFi playing a large part in that rally,” Harz says.

Institutional inflows into the ETFs rise, resulting in Bitcoin “moving deeper into the financial mainstream.” Yes, besides the price, “the bigger transformation lies ahead,” with the rise of Bitcoin DeFi.

“As institutions grow their reserves, they’ll seek to put those holdings to work, driving innovation and accelerating development. This shift will cement Bitcoin’s role not just as a store of value, but as a fully functional layer in the global financial system,” Harz says.

Meanwhile, Glassnode noted bullish signals, finding that newer BTC buyers are paying a premium and that short-term demand remains strong.

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC trades at $119,052. Its lowest point of the day was $118,252, climbing above the $120,000 level to $120,203. Overall, BTC is up 4.4% in a week and down 2.6% in a month.

While it failed to maintain this level, it has attempted to retake it several times. Moving above $120,500 is likely to lead further to $122,000 and towards a new all-time high. For now, the signs point to a continued upward momentum. A break above $123,250 could open doors to $127,000.

In case of a bearish reversal, the price could dip to $113,650 and $110,675.

Bitunix analysts commented that BTC’s $120,000–$123,000 range is “a clear high-density supply zone with concentrated selling pressure.” Secondary supports lie at $116,000 and $112,000. “Without strong volume, an upside breakout is prone to rejection and pullback,” they said.

With the CPI data supporting rate-cut expectations, the analysts recommend investors to “monitor the USD and US Treasury trends – should BTC break the supply zone on strong daily volume, it could open a new leg upward.”

Ethereum is currently trading at $4,634. It started the day at the low of $4,265 and then steadily increased to the intraday high of $4,674.

Overall, ETH is still pushing towards its previous ATH of $4,878, seen in November 2021.

Over the past week, ETH appreciated 29.3%, as well as 52.3% in a month, still outperforming BTC.

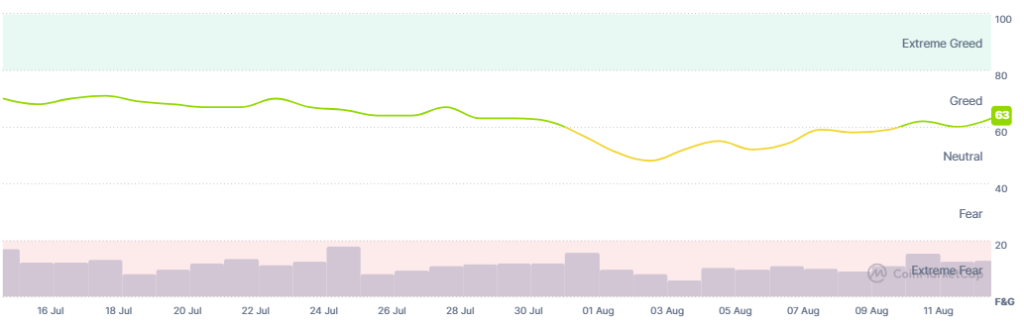

Meanwhile, the crypto market sentiment has increased slightly today within the greed zone. The crypto fear and greed index is up to 63 today from 60 yesterday.

Investors seem greedier upon the overall increase in the crypto market. Yet, the market doesn’t seem overheated at the moment, suggesting that a larger correction is likely not coming in the near term.

Furthermore, the US BTC spot exchange-traded funds (ETFs) continued the inflow streak. Tuesday saw positive flows of $65.95 million.

BlackRock is the only one with positive flows in this group, with $111.44 million. Grayscale and Ark$21Shares recorded outflows of $21.63 million and $23.86 million.

At the same time, the US ETH ETFs took in $523.92 million, following a record-breaking $1.02 billion recorded on Monday.

Six of the nine ETFs recorded flows, all of them positive. The highest among these is BlackRock’s $318.67 million, followed by Fidelity’s $144.93 million.

Meanwhile, Grayscale Investments registered two new statutory trusts in the US, listing the entities as the Grayscale Cardano Trust ETF and the Grayscale Hedera Trust ETF.

Also, Kazakhstan-based investment manager Fonte Capital will launch its BTC ETF on Wednesday on the Astana International Exchange (AIX). The fund will hold BTC directly.

US-regulated BitGo Trust will be the custodian, and the Astana International Financial Centre (AIFC) will regulate the fund. “The Fund is registered as non-exempt, making it accessible to a broad range of investors, including retail participants,” the announcement says.

It’s the latest of the country’s crypto-friendly developments.

Quick FAQ

- Why did crypto move with stocks today?

Both the crypto and stock markets recorded notable increases. At Tuesday’s closing time, the S&P 500 was up by 1.13%, the Nasdaq-100 increased by 1.33%, and the Dow Jones Industrial Average rose by 1.1%. The stock market surge followed the US CPI report, which showed expected inflation numbers, strengthening investor expectations that the Fed will cut interest rates in the near term.

- Is this rally sustainable?

Following yesterday’s expected pullback, crypto has continued an upward trajectory, with still more room to grow. That said, investors are keeping an eye on macroeconomic developments, which may pull the market to either direction.

The post Why Is Crypto Up Today? – August 13, 2025 appeared first on Cryptonews.

https://cryptonews.com/news/why-is-crypto-up-today-august-13-2025/

Kazakhstan is exploring the launch of crypto banks as part of its broader push to build a sustainable and regulated digital asset ecosystem.

Kazakhstan is exploring the launch of crypto banks as part of its broader push to build a sustainable and regulated digital asset ecosystem.