Ethereum (ETH) has gained another 8% overnight, while Bitcoin (BTC), although it breached past $120,000, ticked 1.6% over the same period.

Part of ETH’s rise stems from the passing of the GENIUS Act – legislation that offers long-awaited clarity for stablecoins, which are heavily built on Ethereum. The rally is also backed by fresh institutional accumulation, with ETH gaining strength as the utility layer of Web3.

Meanwhile, Bitcoin, after recently setting a new local high, appears to have paused in its ascent. But the real surprise is what’s happening beneath the surface. Its fastest Layer-2 solution to date Bitcoin Hyper (HYPER) has raised over $300,000 in the past 48 hours alone, pushing its total funding to over $3.31 million.

It seems early investors are positioning themselves not just on Bitcoin the asset but on Bitcoin’s future. One that looks more dynamic, usable, and programmable.

HYPER tokens are currently priced at $0.0123, with less than 14 hours remaining before the next presale stage triggers a price increase.

Ethereum Extends Its Climb While Bitcoin Stalls – But Heavy Bets Are Now Flowing Into BTC’s Fastest Layer-2

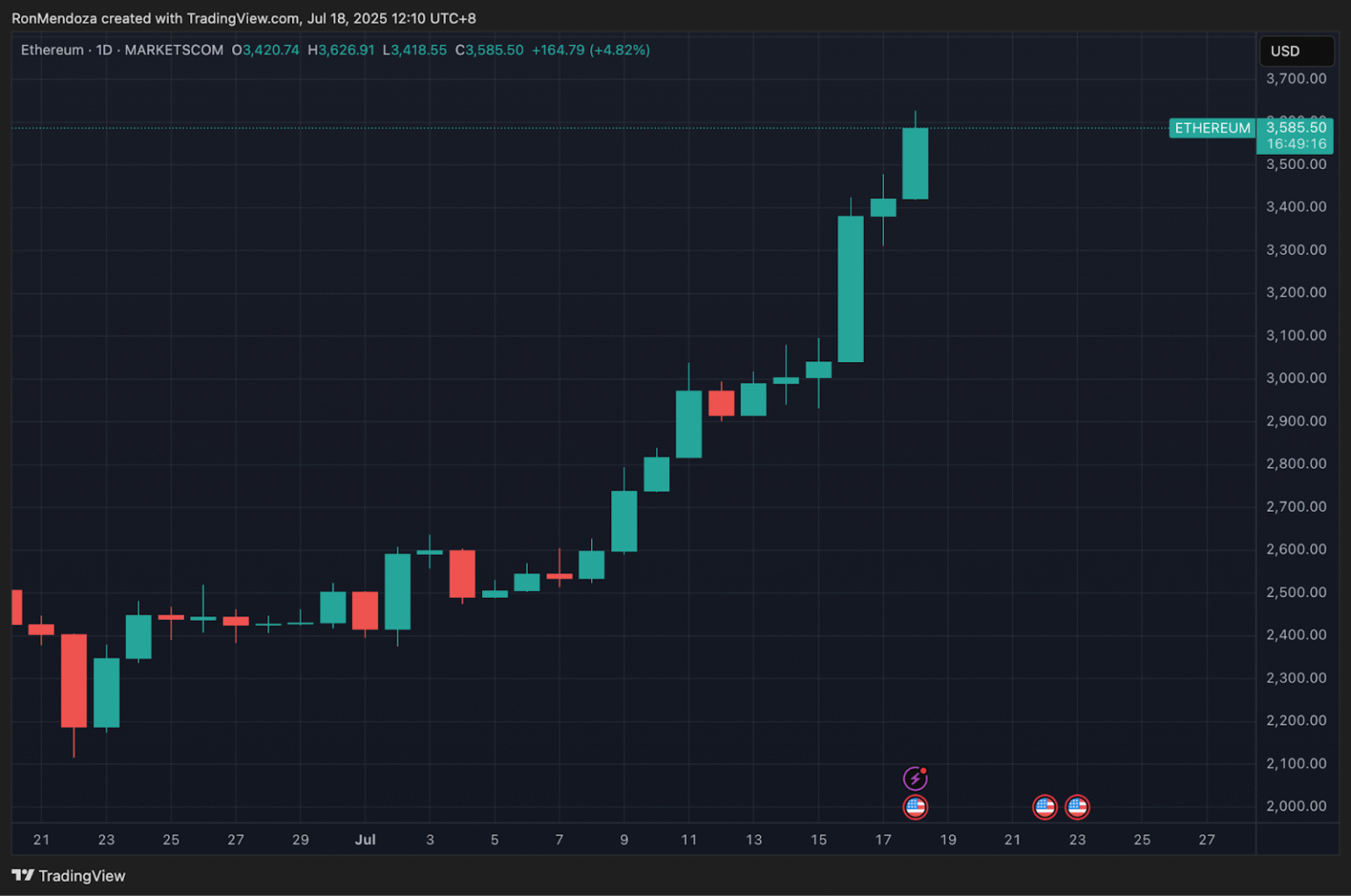

Ethereum (ETH) has climbed steadily this week, touching a local high of $3,626 on Friday before easing slightly to around $3,585.50 as of writing. The rally comes on the back of renewed institutional interest and growing political tailwinds.

Source: TradingView

The GENIUS Act – a landmark bill that cleared the Senate in June – was officially passed by the House on Thursday, paving the way for federal-level stablecoin regulation.

Designed to bring regulatory clarity to stablecoins and tokenized assets, the legislation is seen as a major win for Ethereum’s core infrastructure.

With the vast majority of stablecoins, DeFi protocols, and tokenized platforms built on Ethereum, the market interpreted the latest developments as a bullish signal for further institutional adoption.

Ethereum spot ETFs also saw fresh inflows this week – over $726 million – reinforcing the narrative that institutions are doubling down on ETH exposure ahead of regulatory certainty.

Bitcoin (BTC), by contrast, has lost steam. After reaching a high of $122,838, it even slipped to $116,000 earlier in the week before settling to its current price.

Without a strong narrative or upgrade cycle to drive it forward, Bitcoin’s price appears to be consolidating, as traders look elsewhere for growth.

But while BTC trades flat, trust in its long-term potential hasn’t gone away – it’s just shifting to a different kind of bet.

One of the most talked-about moves this week is the rapid rise of Bitcoin Hyper, a high-speed Layer-2 built on the Solana Virtual Machine (SVM). The presale’s been moving so fast, it’s almost hard to believe it only launched a little over a month ago.

It’s clear that while Bitcoin may be stalling on the charts, those who still believe in its future are backing Bitcoin’s transition from a settlement layer to a programmable network.

This Is What Bitcoin Scaling Was Meant to Look Like

As mentioned, Bitcoin Hyper is built on the SVM, and it works like this: BTC is locked on-chain using a non-custodial, zero-knowledge bridge, and a wrapped version is minted on the Bitcoin Hyper Layer-2.

From there, it becomes usable across a high-speed network that combines the execution speed of Solana with the value base of Bitcoin without compromising either.

Instead of sitting idle in cold wallets or static ETF holdings, BTC can now move freely across applications that were previously out of reach. Trading with near-zero fees, deploying DeFi protocols with native BTC liquidity, or launching NFT drops that are settled on Bitcoin.

And while all of that runs on Layer-2, the Bitcoin itself stays locked on the base chain secured by Bitcoin’s own consensus. The bridge uses zero-knowledge proofs for verification, so users can move BTC in and out without middlemen, while keeping full trust in the original network.

And for users who simply want to retrieve their BTC, the process is just as seamless: burn the wrapped version on Layer-2, and the original Bitcoin is released from the bridge.

Source: https://bitcoinhyper.com/

Bitcoin Hyper is primed for rapid development, with SDKs and APIs already live and full support for Rust – the go-to language across Solana and Web3.

Builders can start immediately, without learning obscure frameworks or custom languages. And unlike past attempts like Stacks or Rootstock, there’s no added friction or fragmentation – Bitcoin Hyper preserves the BTC base while unlocking real programmability.

This Is Where the Next Bitcoin Breakout Is Being Built

While Ethereum rallies on utility and clarity, Bitcoin drifts currently without direction – and that’s why capital is shifting toward what Bitcoin could become. Bitcoin Hyper is getting funding not for what BTC is today, but what it can be tomorrow.

If you’re seeing the same trend unfold – where Bitcoin benefits from speed, programmability, and more real use cases – now’s the time to move.

Again, over $3.31 million has already been raised in the Bitcoin Hyper presale, with 191 million HYPER tokens staked on its native protocol offering a dynamic 274% APY. This shows early believers are truly in it for the long haul.

Head to the Bitcoin Hyper website to secure your HYPER tokens before the next price increase. You can buy with SOL, ETH, USDT, BNB, or even a credit card.

For a smoother experience, consider using Best Wallet – HYPER, which is already listed under Upcoming Tokens, making it easy to track, manage, and claim.

Join the conversation on Telegram and X.

The post Why Ethereum Is Rising Faster as BTC Stalls – And the Biggest Bet on a Bitcoin Layer-2 Draws Over 300K in 2 Days appeared first on Cryptonews.

https://cryptonews.com/news/bitcoin-hyper-why-ethereum-rising-faster-btc-stalls-biggest-bet-layer-2-draws-300k-2-days/