There was nervousness within the skinny mountain air when the planet’s financial leaders gathered in January at Davos for the 54th assembly of the World Economic Forum. Donald Trump had simply trounced Nikki Haley within the Iowa caucuses, all however securing the Republican nomination for president. Haley was dependable, a identified amount. A resurgent Trump, alternatively, was extra worrying.

The Davos attendees wanted reassurance, and Jamie Dimon, the chairman and chief govt of JPMorgan Chase, had some to supply. In an interview with CNBC that made headlines around the globe, Dimon praised Trump’s financial insurance policies as president. “Be honest,” Dimon stated, sitting towards a backdrop of snow-dusted evergreens, dressed casually in a darkish blazer and polo shirt. “He was kind of right about NATO, kind of right on immigration. He grew the economy quite well. Trade. Tax reform worked. He was right about some of China.” Asked which of the possible presidential candidates could be higher for enterprise, he opted to not choose a facet.

“I will be prepared for both,” he stated. “We will deal with both.”

Dimon presides over the most important and most worthwhile financial institution within the United States and has achieved so for almost 20 years. Maybe greater than any single particular person, he stands in for the Wall Street institution and, by extension, company America. With his feedback at Davos, he appeared to be sending a message of fine will to Trump on their behalf. But he additionally gave the impression to be attempting to place his fellow globalists comfy, reassuring them that America, lengthy a haven for traders fleeing danger in less-stable democracies, would stay a protected vacation spot for his or her cash in a second Trump administration.

But wouldn’t it? As Dimon famous, for all Trump’s excessive rhetoric within the 2016 marketing campaign — his threats to tear up America’s worldwide commerce agreements and his assaults on “globalization” and the “financial elite” — his presidency, like most presidencies, proved to be business-friendly. Corporate America wound up with loads of allies within the administration, from Secretary of the Treasury Steven Mnuchin, a former Goldman Sachs govt; to Secretary of Commerce Wilbur Ross, a Harvard Business School-educated chapter guru; to Trump’s son-in-law Jared Kushner, an aspiring Wall Street participant. And the Trump administration’s financial agenda of lowered taxes and deregulation largely suited company America’s pursuits; JPMorgan saved billions of {dollars} a yr because of Trump’s company tax cuts.

But Trump and people round him are signaling {that a} second Trump administration could be very completely different. They promise a extra populist financial agenda and a extra populist governing fashion to match, with steep tariffs on imported items and punitive measures towards corporations that do enterprise with China. And his staff has been clear about the truth that Trump is able to transfer forward with out the blessing of the enterprise neighborhood. “You’ll see loyalists,” says Brian Ballard, a fund-raiser and former lobbyist for Trump. “Wall Street’s supermen who thought they were the smartest guys in the room? That sort of stuff he won’t tolerate.”

Scholars who’ve spent their careers learning populist actions aren’t confused about what to anticipate. They have seen this sequence of occasions play out earlier than, to disastrous impact not simply on democracies however on companies — and enterprise leaders. If historical past presents any information, they are saying, it’s that the Davos crowd needs to be so much extra involved a few second Trump time period.

For all of the free-floating nervousness at Davos, America’s govt class appears to be sustaining a base-line religion that its pursuits aren’t actually on the poll in November — that regardless of who occupies the White House, the circumstances which have stored it on the middle of the worldwide economic system for a century aren’t in any actual hazard. But these circumstances might simply change, and considerably.

There could also be nothing executives can say or do that may make a distinction at this level. But they could wish to start thinking about their choices. “There has been this sense among business leaders that we can work with these people even if they sound kind of revolutionary because they will give us some things that are useful,” says Rawi Abdelal, a political economist and professor at Harvard Business School. “They are missing that this is a moment of systemic danger for capitalist systems as we know them, and globalization as we know it.”

The End of (Economic) History

For many years, America’s enterprise leaders bought roughly what they needed from the White House, no matter who occupied it. Communism had fallen, the Cold War had ended and nations around the globe have been opening up and integrating. The battle of concepts was over, presumably perpetually; capitalism had received. “At the end of history, there are no serious ideological competitors left to liberal democracy,” the American political scientist Francis Fukuyama wrote in his 1992 e book, “The End of History and the Last Man.”

History had ended earlier than. The Gilded Age of the late nineteenth century marked the final, climactic chapter of many years of largely unconstrained company progress and ostentatious shows of personal wealth. Then, as now, populists protested. Depression and warfare got here subsequent, accompanied by a brand new regulatory regime — the New Deal. Years of fast progress and lowered revenue inequality adopted, however they got here to an abrupt halt with the oil disaster and recession of the mid-Seventies. Free-market orthodoxy, now within the title of “neoliberalism,” started one other ascent underneath the Democratic regime of Jimmy Carter and reached its full flower underneath Ronald Reagan’s presidency within the Nineteen Eighties.

The Democrats who adopted Reagan largely hewed to the identical pro-business handbook, limiting authorities interference within the economic system. Corporate America, and Wall Street specifically, hardly ever shy of their efforts to seize the federal government and deploy regulatory powers to their very own ends, discovered an more and more heat welcome in Washington. They despatched a gentle stream of individuals into positions of energy in every successive administration, whereas on the similar time hiring armies of lobbyists and donating generously to political campaigns and political motion committees to protect the established order.

‘The business community here doesn’t perceive what’s about to hit them.’

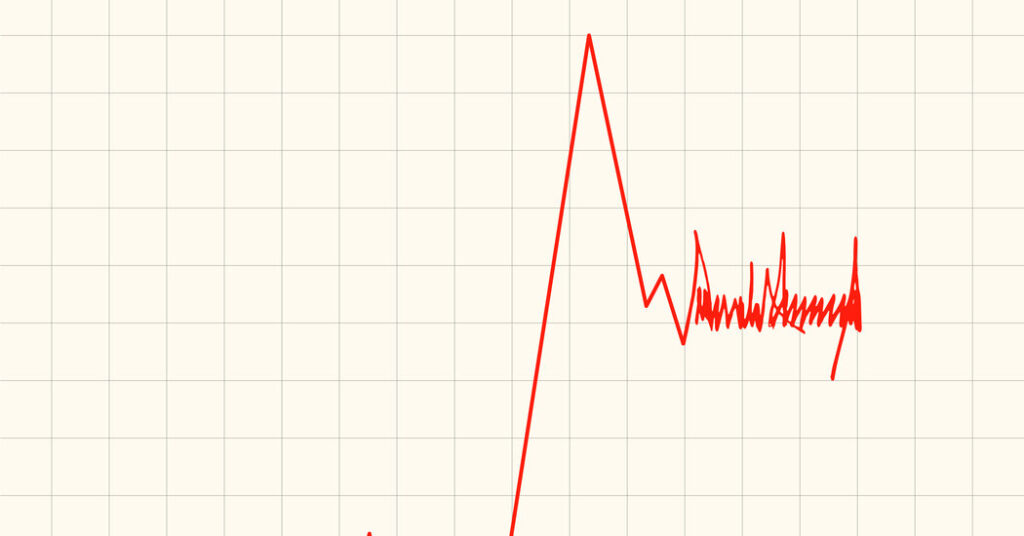

After Brexit — the United Kingdom’s withdrawal from the European Union in 2016 — there could possibly be little question that historical past had began once more. A brand new populist wave had already been swelling for years, however the world’s enterprise leaders have been however blindsided by the referendum’s passage, having vastly underestimated the rising backlash towards globalization. Stock markets around the globe tanked as traders apprehensive about what this wave of nationalism may imply for Europe and the broader economic system. For many British companies, the results of Brexit have been devastating, lowering investments, growing prices and creating each labor and provide shortages. Populism has continued its march ever since, with residents around the globe seemingly desperate to burn down the neoliberal world financial order.

Trump’s rise appeared to mark the arrival of this wave on America’s shores, however his antiglobalist rhetoric on the stump didn’t quantity to a lot as soon as he was in workplace. The enterprise neighborhood bought the tax cuts and deregulation that it needed, even when Trump’s public picture created issues for executives who needed to reply to shareholders or staff. After Trump’s feedback defending white supremacists on the protest in Charlottesville, Va., in 2017, a variety of distinguished executives resigned from two presidential enterprise advisory councils, forcing him to disband the teams. Then, when Trump refused to just accept the outcomes of the 2020 election, and once more within the aftermath of the assault on the Capitol on Jan. 6, 2021, almost 50 chief executives, together with the heads of Johnson & Johnson and Walmart, got here collectively to rally behind America’s democratic establishments. Still, when all was stated and achieved, the Trump presidency was good for enterprise leaders, driving up inventory costs and spurring a rise in mergers and acquisitions and preliminary public choices.

Their recollections of that period have absolutely been made rosier by their frustrations with President Biden, who has been a way more proactive regulator. His Securities and Exchange Commission has issued a raft of guidelines constraining the conduct of economic establishments; his Federal Trade Commission and Justice Department have begun an aggressive antitrust campaign; and his National Labor Relations Board has pursued an unambiguously pro-union agenda.

The Biden administration can be notably gentle on former company executives. “Nobody there is wired into the business world, even in seats where you would normally find them, like Treasury or commerce,” says Lloyd Blankfein, the previous chairman and chief govt of Goldman Sachs. “And they don’t seem to want any.”

But students of populism warn {that a} second Trump administration could possibly be way more destabilizing to America’s enterprise leaders and to the bigger world financial order. Rachel Kleinfeld, a senior fellow on the Carnegie Endowment for International Peace, detailed the various potential risks forward in a report final yr, “How Does Business Fare Under Populism?” Examining the latest financial histories of Hungary, Brazil and India, she discovered that populist governments considerably improve volatility and danger by utilizing their regulatory energy to tilt markets or outright take management of companies. The report makes for ominous studying for these accustomed to the consolation and stability of the neoliberal orthodoxy. “The business community here doesn’t understand what is about to hit them,” Kleinfeld informed me.

‘Massive Economic Shock Waves’

Trump has made no secret of his intentions. Over the course of his marketing campaign, he has outlined a radical program of protectionism, calling for a phaseout of all “essential goods” from China, in addition to a ban on investments in China and on federal contracts for any firm that outsources labor to China. All of this is able to be regarding sufficient for American enterprise. But Trump has additionally proposed a ten p.c tariff on all imported items, which might quantity to the declaration of a worldwide commerce warfare, with different international locations virtually definitely retaliating with their very own tariffs.

Together, these protectionist insurance policies would drive up the price of items, create sweeping supply-chain points and fairly probably trigger hyperinflation. “We’re talking about massive economic shock waves,” says Lisa Graves, govt director of True North Research, a nationwide watchdog group that research authorities oversight of enterprise. And tariffs are only the start. Trump’s promise to provoke what he calls “the largest deportation operation in American history” could possibly be catastrophic for employers already going through a decent labor market.

Trump’s evolving coverage views are consistent with the broader populist migration of the conservative motion. Last yr, Project 2025, an effort of greater than 100 conservative organizations led by the Heritage Foundation, printed a 900-page report known as “Mandate for Leadership: The Conservative Promise,” which is actually a blueprint for a second Trump administration. In addition to embracing radical protectionism, it requires the following president to scale back the facility of the Federal Reserve, limiting its potential to function a so-called lender of final resort for banks and different monetary establishments going through money crunches. This would improve the danger of economic crises, undermining confidence within the U.S. banking system and its monetary markets. “The power of the Federal Reserve to step in and provide economic relief to stop the spread of economic chaos is what saved us in 2009,” Graves says. To restrict any inside opposition to his agenda, the report additionally requires Trump to reimpose an govt order that Biden revoked, enabling him to fireplace 1000’s of civil servants throughout his administration and change them with political appointees.

There are different, extra existential causes for concern, too. A trademark of populist leaders is to tighten the state’s grip on the enterprise sector — a phenomenon that Ian Bassin, a lawyer and pro-democracy activist, calls “autocratic capture.” To get a way of how this works, contemplate Hungary underneath Prime Minister Viktor Orban, a detailed Trump ally.

Like Trump, Orban ruled as a conventional, pro-business conservative throughout his first time period as prime minister between 1998 and 2002, slicing taxes and decreasing authorities spending, partly to arrange Hungary to affix the European Union. But he has been a really completely different chief since returning to workplace in 2010. In order to consolidate and keep his energy, he has nationalized components of the non-public sector, pressured banks to reissue mortgages at extra favorable charges, ordered utilities to decrease costs, levied “crisis taxes” on varied industries and imposed worth caps on foreign-owned supermarkets. “Anything you were counting on by way of predictability just disappears,” Kim Lane Scheppele, a professor of sociology and worldwide affairs at Princeton University and an knowledgeable on Hungarian politics and regulation, informed me. Along the way in which, Orban has made his family and friends wealthy, beginning investigations, blocking mergers and directing the passage of laws to devalue some companies, which has made them weak to takeovers by his allies or the federal government.

During a latest go to to the United States, Orban was shunned by the Biden administration however welcomed to Mar-a-Lago by Trump. He additionally spoke on the Heritage Foundation, which has a proper cooperation settlement with a assume tank that has shut ties to Orban’s authorities, the Danube Institute. “It’s clear that Project 2025 is a direct copy of what Orban did in 2010,” Scheppele says. “The parallels are very deep between these guys.”

Fear of Backlash

Privately, some enterprise leaders and company executives have begun to specific concern about not less than a few of what they’re listening to from Trump. “They are ready to be galvanized into collective action if need be,” says Jeffrey Sonnenfeld, the founder and chief govt of the Chief Executive Leadership Institute at Yale. “But they aren’t going to speak out if it’s not necessary.”

It’s straightforward to know their hesitation. A variety of companies have already confronted punishing backlashes from conservatives for embracing social causes like L.G.B.T.Q. rights. And Trump would virtually definitely not hesitate to make use of the levers of presidency towards anybody who opposed him. In truth, he already seems to have achieved so. During his presidency, his in any other case merger-friendly administration sued to dam AT&T’s buy of CNN’s mum or dad firm, Time Warner, inflicting months of pricey delays. The Justice Department has denied that Trump’s hostility to the information outfit influenced its resolution. Either method, he’s extensively understood to be a vindictive man. “I am your retribution,” is how he put it to supporters on the marketing campaign path.

Speaking out could possibly be scary. And but your complete world financial order is perhaps in danger. Enlightened self-interest sometimes requires companies to remain on good phrases with these in energy, however for Dimon and the Davos set at the moment, that will change into a fatally short-term view. “The only thing we know for sure about globalization,” Harvard’s Abdelal says, “is that it’s desperately fragile and can easily be broken.”