In Summary

- Africa’s AI market is rapidly expanding, led by Egypt, South Africa, Kenya, and Nigeria, with rising investment, startups, and national strategies driving growth.

- Emerging players like Mauritius, Rwanda, Tunisia, Morocco, and Senegal are gaining traction through policy innovation, skills development, and localized AI solutions.

- AI adoption promises economic diversification, up to $1.5 trillion in value by 2030, and 230 million new digital jobs, positioning Africa competitively in the global tech landscape.

Deep Dive!!

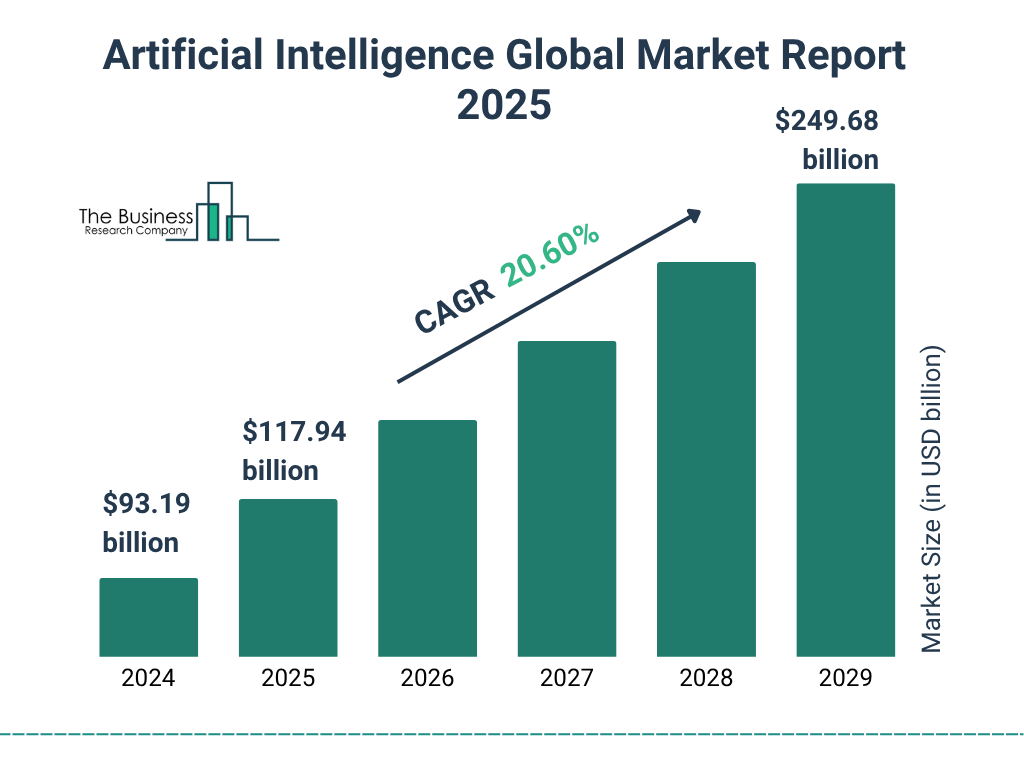

Monday, 10 November 2025– A critical starting point for assessing which African nations are leading the AI race lies in quantitative metrics, from market size and funding volumes to adoption rates and government readiness. Recent research places the size of Africa’s AI market at approximately $4.92 billion by the end of 2025, representing about 2.5 % of the global AI industry. This figure signals both progress and the potential for much greater growth across the continent. Equally telling are data on startup ecosystems: one report lists over 2,400 AI focused companies across Africa, with South Africa (~726), Nigeria (~456) and Kenya (~204) accounting for the bulk of these. Meanwhile, private capital remains concentrated, according to the World Economic Forum in 2025, Africa accounted for just 0.3% of projected global AI investments, underscoring the gap between ambition and resources.

Beyond funding and market size, government readiness is another vital indicator of where countries stand. The Oxford Insights Government AI Readiness Index 2024 evaluates 188 countries across pillars such as strategy, infrastructure and innovation capability. Although the full report shows wide regional variation, key African performers in the Sub Saharan region include Mauritius (53.94), South Africa (52.91) and Rwanda (51.25) out of 100, illustrating meaningful but still modest readiness. Egypt, in the MENA region, has also shown marked improvement in AI governance and strategy implementation. These indicators suggest that while some countries are forging ahead, many face foundational gaps in policy, regulation and digital infrastructure.

Finally, adoption and usage metrics provide a window into how entrenched AI technologies are in everyday life and business. Data from Africa hint at strong pockets of usage—for example, Kenya is reported to be among the leading African markets in AI driven applications, although a reliable figure of ~42% of internet users aged 16+ using platforms like ChatGPT has circulated in tech media (though full verification remains elusive). In any case, adoption in sectors such as agriculture, healthcare, finance and public services is accelerating rapidly, supported by reports estimating that generative AI alone could unlock up to $103 billion in annual value for Africa. Together, these data points, market size, funding concentration, readiness scores and adoption indicators, form the foundation for analysing which nations are truly leading Africa’s AI boom.

Front Runners and Emerging Players in Africa

Africa’s AI landscape in 2024 and 2025 is increasingly defined by a handful of front-runner nations that are setting the pace in innovation, policy, and investment. Egypt leads the continent with its comprehensive AI Strategy 2025 2030, which emphasizes governance, infrastructure, skills development, and sectoral adoption, aiming to make AI a core contributor to national GDP. South Africa follows closely, hosting around 726 AI-focused companies, supported by strong infrastructure, global partnerships, and active talent development programs. Meanwhile, Kenya has emerged as East Africa’s tech powerhouse, attracting $1.05 billion in AI-related investments in 2024, fueled by a thriving startup ecosystem and rapid adoption of AI tools across fintech, agriculture, and public services. Nigeria, with approximately 456 AI firms, combines a large domestic market with a dynamic entrepreneurial culture, bolstered by institutions such as the National Centre for Artificial Intelligence and Robotics (NCAIR). Smaller but agile nations like Mauritius and Rwanda demonstrate high readiness scores, leveraging focused policy frameworks, data-driven governance, and digital infrastructure to attract both investment and talent.

Beyond these leaders, several emerging players are making noteworthy strides in the AI race. Tunisia, Morocco, and Senegal are improving rapidly thanks to progressive AI policies, increased investment in local talent, and enhanced regulatory frameworks. Tunisia, for example, has invested heavily in AI training and incubators, positioning itself as a regional hub for innovation in North Africa. Morocco’s AI initiatives focus on integrating digital tools into public administration and private sector applications, while Senegal is fostering startup growth and digital adoption through public-private partnerships. Collectively, these rising stars demonstrate that Africa’s AI progress is not limited to a few countries but is spreading across regions, creating a more diversified and competitive ecosystem.

The combination of national strategies, investment influx, and adoption momentum defines the current hierarchy of African AI leadership. Countries like Egypt, South Africa, Kenya, and Nigeria dominate in scale and readiness, while Mauritius and Rwanda excel in governance and strategic execution. Meanwhile, emerging nations are leveraging targeted policies to gain ground rapidly. This dynamic landscape underscores that Africa’s AI boom is both concentrated and expansive: concentrated in the top-performing countries driving innovation and investment, yet expansive in its potential for emerging economies to join the race. As infrastructure improves, skills development accelerates, and investment flows grow, the continent is poised to become a significant player in the global AI arena.

What’s Fueling or Holding Back the AI Race in Africa

The rapid growth of AI across Africa is supported by a mix of enabling factors that provide fertile ground for innovation and adoption. Chief among these is the development of digital infrastructure, including data centers, high-speed fiber networks, andemerging 5G coverage in urban hubs, which facilitate the deployment of AI applications across sectors. Skills development is another key driver, with countries like Egypt, South Africa, and Kenya establishing AI training programs in universities, tech hubs, and through partnerships with global tech firms. Regulatory frameworks are also evolving, as governments increasingly recognize the need for clear AI governance, ethical standards, and data protection policies to build investor and public confidence. Despite these advances, Africa currently holds only ~3 % of global AI talent, highlighting both the opportunity and the challenge in scaling expertise across the continent.

Despite these positive drivers, significant barriers continue to constrain AI growth in Africa. Internet penetration remains limited, with only ~37 % of Africans online in 2023, restricting access to AI tools and digital platforms. Funding gaps exacerbate the problem, as venture capital and public investment are heavily concentrated in a few leading nations, leaving emerging economies with insufficient resources to build AI startups or scale existing projects. Regulatory inconsistencies also pose challenges, with many countries lacking comprehensive AI policies, data governance frameworks, or ethical guidelines, which can hinder both domestic innovation and international collaboration. These constraints collectively slow the diffusion of AI technologies, particularly in rural or underserved regions, and highlight the need for coordinated continental strategies.

Several African nations and regional bodies are actively addressing these barriers through strategic initiatives and policy frameworks. The African Union’s Continental AI Strategy, adopted in 2024, seeks to harmonize AI governance, develop regulatory frameworks, and support cross-border knowledge transfer to boost AI adoption continent-wide. Countries like Rwanda and Mauritius are leading by example, combining investments in digital infrastructure with targeted AI skills programs and regulatory experimentation to attract startups and foreign investors. Similarly, Kenya and South Africa are leveraging public-private partnerships to expand internet access, build AI labs, and strengthen talent pipelines. These initiatives demonstrate a growing recognition that overcoming infrastructure, funding, and regulatory challenges is essential not only for maintaining competitiveness but also for ensuring that Africa’s AI revolution is inclusive, sustainable, and capable of delivering transformative economic and social benefits.

Sectoral Use Cases and Innovation Highlights

Across Africa, artificial intelligence is increasingly reshaping key sectors, driving efficiency, innovation, and new business models. In agriculture, AI-powered solutions are helping farmers optimize crop yields, predict weather patterns, and access real-time market information; for example,Malawi has deployed localized AI chatbotsthat provide smallholder farmers with tailored agronomic advice. In healthcare, AI tools assist with diagnostics, patient monitoring, and telemedicine, bridging gaps in regions with limited medical infrastructure. Fintech is another prominent arena, with AI enabling risk assessment, fraud detection, and personalized financial services, particularly in Kenya and Nigeria, where mobile money ecosystems are already sophisticated. Governments are also leveraging AI to improve service delivery, data management, and citizen engagement, reflecting a growing integration of AI into public administration and policy-making.

Some African nations are emerging as innovation hotspots, demonstrating both adoption and creative deployment of AI technologies. Kenya has seen rapid uptake of platforms like ChatGPT, with startups integrating generative AI into education, customer service, and business analytics. Nigeria’s AI ecosystem continues to expand, boasting hundreds of startups across sectors from fintech to health tech, supported by accelerators and innovation hubs. Egypt is rolling out multi-sector AI initiatives under its national AI strategy, applying machine learning in finance, logistics, smart cities, and healthcare, positioning itself as a continental leader in applied AI. These examples illustrate not just adoption but practical impact, showing how AI is solving local problems while creating economic and social value.

The role of global partnerships and international investment is critical to scaling these innovations. Leading technology firms such as Microsoft, Google, and IBM are actively training thousands of African AI professionals, funding startup accelerators, and providing cloud and AI platforms to local enterprises. Such collaborations enhance local capacity, introduce advanced technologies, and accelerate deployment of AI solutions in key sectors. With continued support from global investors and development agencies, Africa’s AI ecosystem is poised to expand rapidly, enabling nations to harness AI not only for competitive advantage but also for inclusive economic growth and sustainable development.

Future Outlook: What Comes Next and Why It Matters

Africa’s AI sector is poised for explosive growth over the next decade, with projections suggesting that capturing just 10 % of the global AI market could add up to $1.5 trillion to the continent’s economy by 2030. This growth potential is underpinned by expanding digital infrastructure, rising internet penetration, and increasing AI adoption across key sectors such as agriculture, healthcare, finance, and public services. Countries with established ecosystems, Egypt, South Africa, Kenya, and Nigeria, are particularly well-positioned to lead, leveraging their existing startup base, skilled talent pools, and supportive policy frameworks to capture a significant share of this economic value.

Looking ahead, the AI landscape in Africa is likely to see dynamic shifts, with newer entrants and smaller nations gaining traction through niche specialization, language and data localization, and innovative regulatory approaches. For instance, countries like Tunisia, Morocco, and Rwanda are investing in localized AI solutions that address language diversity and sector-specific needs, from fintech to public health. Ethical AI deployment and robust regulatory frameworks will increasingly differentiate successful AI hubs, ensuring responsible innovation while mitigating risks such as bias, data misuse, and cybersecurity threats. These strategic moves could rebalance the competitive landscape, allowing emerging players to compete alongside established frontrunners.

The broader significance of Africa’s AI boom extends far beyond market growth. By 2030, AI is expected to generate up to 230 million new digital jobs, supporting economic diversification and reducing reliance on traditional resource-dependent sectors. This surge in AI-driven employment and innovation will strengthen Africa’s position in the global knowledge economy, fostering competitiveness and resilience in a rapidly changing technological landscape. Moreover, effective AI adoption can enhance public service delivery, improve productivity, and create sustainable development opportunities, making AI a cornerstone of Africa’s socioeconomic transformation.

We welcome your feedback. Kindly direct any comments or observations regarding this article to our Editor-in-Chief at [email protected], with a copy to [email protected].

https://www.africanexponent.com/africas-ai-boom-which-nations-are-leading-the-artificial-intelligence-race/