In crypto news today:

- Crypto market is green today

- Major Mining Companies Surpass the 101,000 BTC Mark

- RAAC Launches Testnet for $235M Gold-Backed RWA Platform

- Bybit Introduces Margin Staked SOL

__________

Crypto market is green today

The crypto market has turned green in the past day.

The global cryptocurrency market capitalization fell 0.7% over the past 24 hours, currently standing at $2.82 trillion.

At the time of writing, the daily crypto trading volume is $85 billion, significantly lower than what we’ve been seeing these past few weeks.

Most of the top 100 coins per market cap are green today. Among the green ones, the best performer is Cronos (CRO). It’s up 7% to the price of $0.08685. The rest appreciated up to 6%.

On the other hand, Pi Network (PI) fell the most: 4.1% to $1.35. The other coins decreased by up to 3.5% each.

As for the top 10 coins, two are red today. Solana (SOL) fell the most. It’s down 1.2%, now trading at $126.6.

Bitcoin (BTC) is also red, but it’s down only 0.1%, meaning it’s unchanged over the past day. It’s currently trading at $82,637.

At the same time, Binance Coin (BNB) appreciated the most – 4.47% to the price of $624.

Ethereum (ETH) increased the least, having risen 0.5%, currently changing hands at $1,892.

Major Mining Companies Surpass the 101,000 BTC Mark

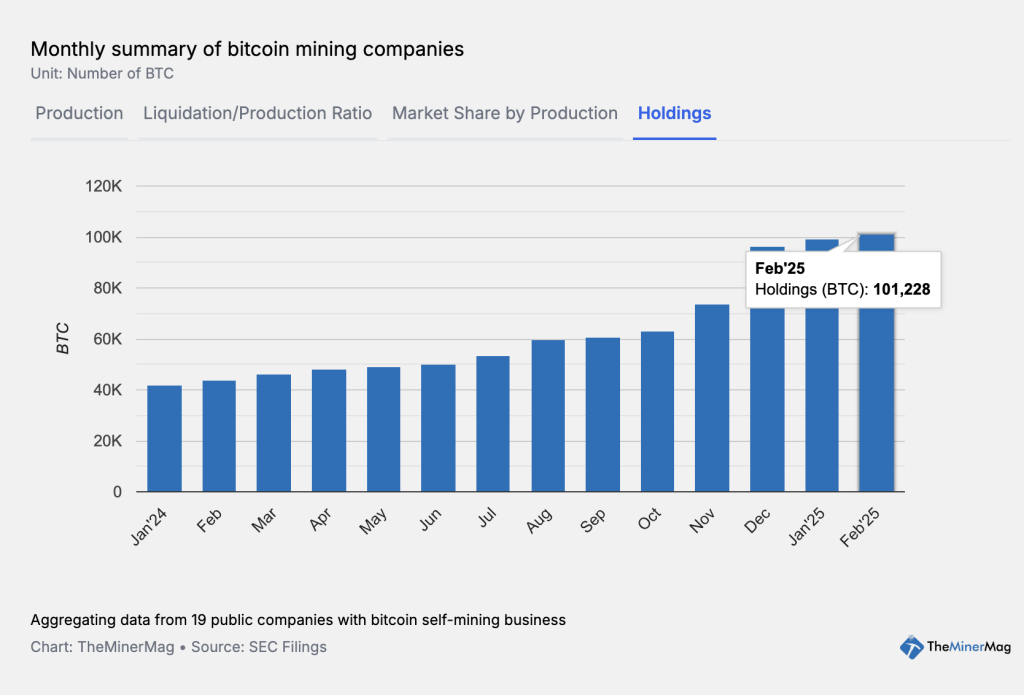

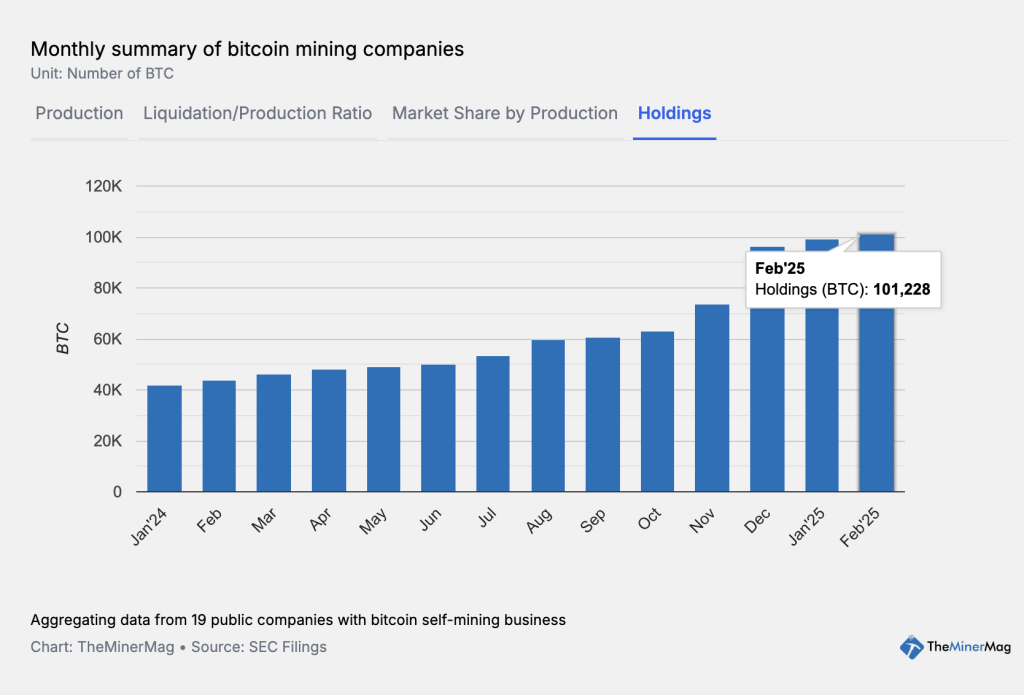

The total Bitcoin (BTC) held by 14 private and public mining companies with a BTC reserve strategy surpassed the 101,000 BTC mark for the first time at the end of February, according to the latest Miner Weekly report by BlocksBridge consulting. This happened despite last month’s market sell-off, the report highlighted.

The reason behind this growth is large mining and data center operators – such as MARA, Riot, Hut 8, CleanSpark, Core Scientific, and Cango – either purchasing BTC from the market using funds they had raised through debt and equity, or continuing to hodl a significant portion (or all) of their monthly BTC production.

Furthermore, major public mining companies raised $6.37 billion in the last quarter, according to data by TheMinerMag.

Notably, $1.6 billion of that number came from stock offerings, while the companies raised the remaining $4.6 billion through debt financing. They did this through the issuance of convertible bonds with zero coupon rates, the researchers said.

In Q3, mining companies raised just $1.7 billion, the report highlighted. Of this, $1.2 billion was from stock offerings and only $500 million from debt financing.

“While they raised a similar amount from shareholder dilution in Q4, they took on significantly more debt,” it states. “In total, they secured $5.27 billion in debt financing in 2024, with 87% of that occurring in the last quarter.”

RAAC Launches Testnet for $235M Gold-Backed RWA Platform

RAAC, a decentralized Real World Asset (RWA) lending and borrowing ecosystem, has launched its testnet for non-US persons. A closed beta will follow the testnet, while the Ethereum mainnet launch and Token Generation Event are scheduled for Q2.

Per the press release, the project has secured $235 million in gold-backed deposits at launch from one of the largest gold reserves in North America. Also, it is seeking “opportunities in US rental property and more,” the team said.

RAAC is a member of the Chainlink Build program and has been incubated by The LLamas, a DeFi community that supports, builds, and promotes Curve ecosystem growth.

Initially, RAAC will develop protocols integrating gold-backed and real estate-backed tokens from asset owners through the institutional tokenization provider Instruxi. The asset owners include Pretio DeFi Solutions, which has acquired 1 million troy ounces of proven gold reserves for tokenization.

At the time of tokenization, these reserves are valued at approximately $400 million, or 20% of a discounted spot price of $2,000 per troy ounce. Once the gold is extracted, refined, and stored, the tokenized asset’s total estimated value could reach up to $3 billion over a 10 to 15-year production cycle.

Meanwhile, the tokenization process will transform these gold reserves into fractional digital assets, which will be deposited into the Pretio Foundation DAO. This ecosystem will operate via stablecoins minted by the Pretio Treasury, initially backed by the gold reserves, and later by other precious metals.

Bybit Introduces Margin Staked SOL

Crypto exchange Bybit has announced the launch of Margin Staked SOL. According to the press release, the move is meant to help users optimize their SOL earnings through leveraged borrowing and staking.

Users have the ability to leverage up to a level of 2x, and the potential to grow SOL holdings by leveraged borrowing and staking, to significantly enhance on-chain rewards through bbSOL, the team claims.

Also, the platform allows easy borrowing, staking, and earning in one place, removing the complexities associated with managing multiple accounts or services.

Furthermore, users have the flexibility to redeem bbSOL for SOL at any time. They may opt for Instant Redemption where users can receive their SOL immediately with no gas fee, or for Postponed Redemption for “a better exchange rate” with a gas fee.

“Both redemption mechanisms ensure user control over their assets and allow them to adapt their strategies as needed,” the exchange said.

__________

Bookmark this page and subscribe to our newsletter for the latest crypto news updates!

The post What’s Happening in Crypto Today? Daily Crypto News Digest appeared first on Cryptonews.

https://cryptonews.com/news/whats-happening-in-crypto-today-daily-crypto-news-digest/

Boost Your SOL Earnings with Margin Staking!

Boost Your SOL Earnings with Margin Staking! Learn more: https://t.co/2JDJLypluR

Learn more: https://t.co/2JDJLypluR Stake now: https://t.co/9Ra3KgDhDR

Stake now: https://t.co/9Ra3KgDhDR