Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

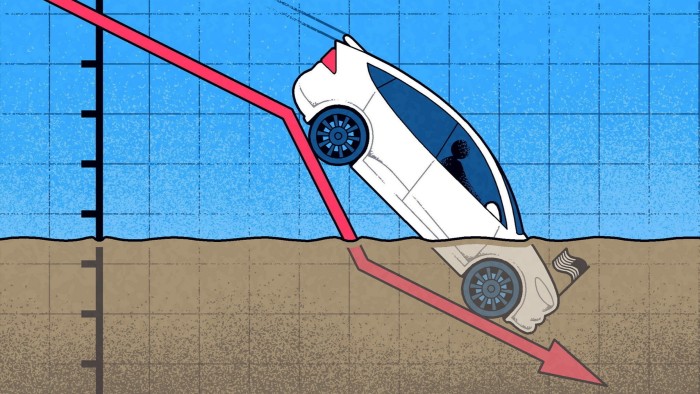

Of all the Trump trades to hit the skids, Tesla stands out. The share price of Elon Musk’s electric vehicle company has plummeted from a post-election high of nearly $480 to less than $282 last week. The fall has been so precipitous that last Thursday, the American Federation of Teachers, a US union representing members with $4tn in retirement investments, called on six large money managers — BlackRock, Vanguard, State Street, T Rowe Price, Fidelity and TIAA — to reconsider their position in the company.

As AFT president Randi Weingarten put it, Tesla stock has been sinking “faster than a Cybertruck in quicksand”, with European sales in particular falling off a cliff. The company’s latest financial statements show a 23 per cent year on year decrease in operating income, with gross profit margins slipping 138 basis points in the fourth quarter.

Sales in California — a key market for electric vehicles — fell 8 per cent in the fourth quarter of 2024, according to vehicle registrations released by the California New Car Dealers Association. Of course, that’s nothing compared with the near 60 per cent January year-on-year sales dip reported in Germany.

Some of the backlash is political. Gestures that look like Nazi salutes don’t go down well with Europeans, nor do calls to dismantle the Department of Education resonate with teachers. But even if Musk himself were not so polarising, the company’s share price has become “completely divorced from the fundamentals”, as a JPMorgan analysis put it barely a month ago. What’s more, the reasons that Tesla’s brand has become so tarnished overlap with the larger decline of America Inc.

Just as Trump overpromises and underdelivers (remember the line about prices falling his first month in office?) so has Musk. Start with the fact that Chinese electric vehicle maker BYD outperformed 2024 sales estimates by nearly 20 per cent, even as Tesla reported its first full year of decline in vehicle deliveries since 2011. This is the result of BYD dramatically lowering its costs compared with rivals by leveraging vertical integration, ownership of supply chains (BYD makes its own batteries) and economies of scale.

That is the magic formula for Chinese industrial policy — constant iteration at scale keeps productivity up and costs down. State subsidies in areas such as electric vehicles support expansion. But post-Biden, the US has no industrial policy in clean technology. Trump is ending federal support to build charging stations, something that massively benefited Tesla, and will probably cut tax incentives for electric vehicles as well. Musk may be able to attend cabinet meetings, but at the end of the day, Big Oil runs the Republican party and Trump has no interest in supporting the clean energy transition. That doesn’t bode well for an American company trying to outcompete a Chinese national champion.

Tesla has focused not on price, but on being a premium brand. That’s the Apple strategy. But to charge a premium, you have to be seen as having a certain lustre and cachet in the marketplace. Musk’s political antics have devalued his brand in many parts of the world. Sales in Europe crashed after he announced support for Germany’s far-right AfD party.

A Dutch pension fund divested from Tesla in protest early in January. Tesla owners in France, Norway and the UK are snapping up bumper stickers that read: “I bought this before we knew Elon was crazy.” In Germany, public protests at Tesla factories are commonplace (I recently received an invitation for one in Brooklyn too). All of this has eroded Tesla’s pricing power and the value of its high tech, sustainable brand. According to Stifel analyst Stephen Gengaro, Tesla’s net favourability rating, which measures consumer perception of a brand, is close to an all-time low.

Tesla’s fall mirrors a larger sense that US equity exceptionalism, especially in technology, may be at an end. Some of this is down to stiffer competition from China (the DeepSeek surprise led to a sharp correction in US artificial intelligence stocks) and the reality that technology decoupling will inevitably shut US companies out of large markets. Tesla sales lag behind overall market growth in China, where regulators have been slow to approve Musk’s self-driving software. Given the politics of the US-China relationship, it’s hard to imagine that Tesla will be able to move ahead of competitors such as Waymo in areas like autonomous cars.

Meanwhile, competitors at home and abroad are coming together to threaten Tesla’s leadership in EV infrastructure. Mercedes-Benz, BMW, GM, Stellantis, Honda, Hyundai, Kia and Toyota have launched Ionna, a rival charging station initiative in the US that plans to deploy 30,000 stations by 2030. That, says the AFT, “poses a direct challenge to Tesla’s dominance”.

Will money managers listen to union calls to review their position in Tesla? I hope so. Musk’s frequent announcements about ambitious projects that will supposedly transform the company (I’m not betting on the success of humanoid robots outside Japan) have an air of recklessness. His contested pay package is both obscene and unwarranted. As AFT points out, one JPMorgan analyst has a $135 target for Tesla. If the share price were to decline to this, the year-to-date price drop would reach 64 per cent.

That would be a serious hit for investors. I’d rank Tesla, like the US itself these days, as a sell.

https://www.ft.com/content/809cd697-8f3e-459a-bb2f-82754282ace5