Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

UniCredit and Commerzbank are launching competing campaigns to win over Germany’s Mittelstand, turning a cross-border takeover battle into a fight for the backbone of the country’s economy.

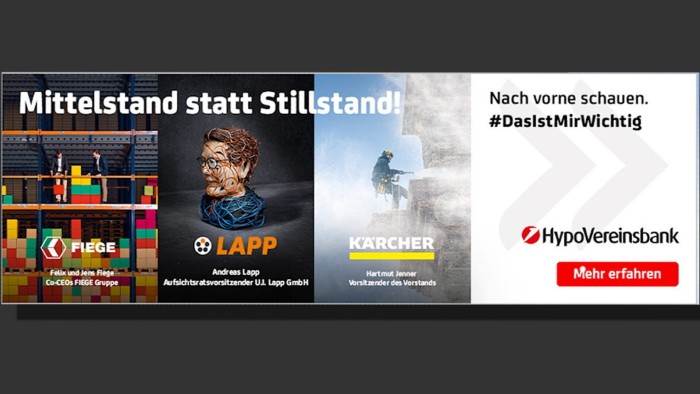

UniCredit’s German subsidiary HypoVereinsbank (HVB) has enlisted high profile corporate clients such as cleaning equipment maker Kärcher and cable company Lapp for a newspaper advertising blitz under the slogan “Mittelstand statt Stillstand” (Mittelstand instead of Standstill).

Commerzbank is due to launch its own campaign spanning ads, events and newsletters in the coming months, arguing that it is much better known among the Mittelstand than “foreign competitors”.

Both banks have said that the campaigns were part of long-running marketing efforts and would not constitute a tit-for-tat.

But who can claim to represent the financial interests of Germany’s 3mn small and medium-sized enterprises has taken on outsized importance in the politically-charged tussle for control of Commerzbank.

Commerzbank’s dedication to the Mittelstand has become key to the bank’s defence against UniCredit’s unwanted advances, as management prepare to present the bank’s standalone case to investors at a capital markets day on Thursday.

Both HVB and Commerzbank have traditionally been important lenders to the Mittelstand, often family-run, risk-averse businesses with long-standing commercial relationships, making them attractive borrowers. UniCredit chief executive Andrea Orcel on Tuesday put the combined share “in the low teens”.

Commerzbank claims that it is already the “market leader” with almost 10 per cent market share in Mittelstand lending.

It has sounded the alarm about a potential exodus of corporate clients should the two banks combine, with a survey of business customers last year finding that 70 per cent of respondents rated its independence as important.

In a recent message to HVB employees, Orcel tried to dispel such concerns, stating that Commerzbank would make necessary adjustments “independently” according to UniCredit’s “blue print” and that even after a merger “decision-making [would be] kept in Germany”.

Despite emphasising HVB’s century-long commitment to the Mittelstand, UniCredit misspelled the German word as “Mittlestand” several times in its third-quarter results presentation. The Italian group corrected the error after being approached by the FT. Its latest annual results presentation included the correct spelling.

Alongside its commitment to Germany’s small and medium-sized businesses, Commerzbank chief executive Bettina Orlopp is expected to lay out plans to cut costs and boost returns to shareholders when she makes her case for independence later this week.

The bank has been exploring making thousands of job cuts as it seeks to improve profitability, even as Commerzbank unions had used the threat of job losses as an argument against a takeover by UniCredit. Orlopp has already raised targets for the bank since the Italian lender first made its approach in September.

Additional reporting by Alexander Vladkov

https://www.ft.com/content/2668979e-5aae-41d9-86f3-31ec2ec615fe