The U.S. financial system remained resilient early this yr, with a powerful job market fueling strong client spending. The hassle is that inflation was resilient, too.

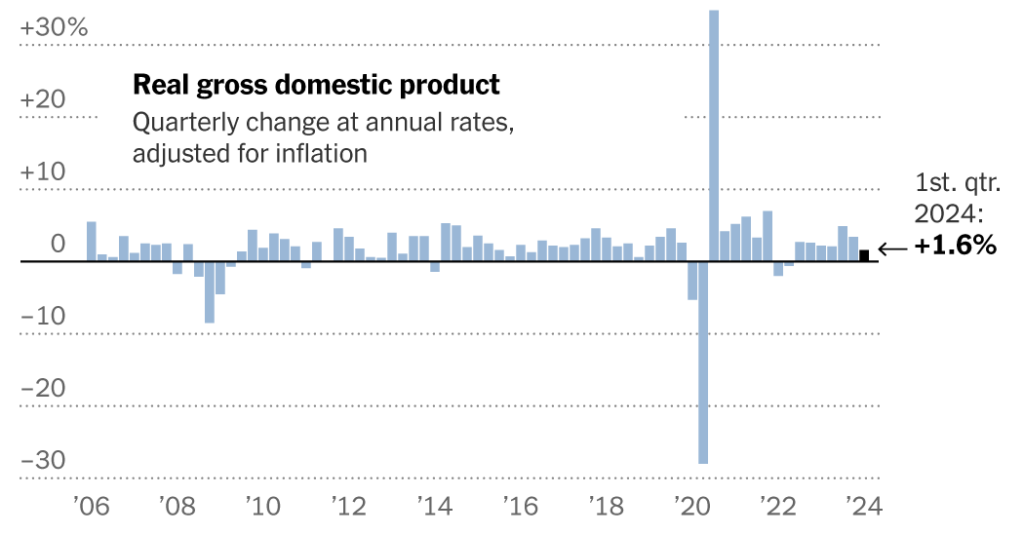

Gross home product, adjusted for inflation, elevated at a 1.6 p.c annual charge within the first three months of the yr, the Commerce Department mentioned on Thursday. That was down sharply from the three.4 p.c development charge on the finish of 2023 and fell effectively in need of forecasters’ expectations.

Economists have been largely unconcerned by the slowdown, which stemmed largely from massive shifts in enterprise inventories and worldwide commerce, parts that always swing wildly from one quarter to the subsequent. Measures of underlying demand have been considerably stronger, providing no trace of the recession that forecasters spent a lot of final yr warning was on the way in which.

“It would suggest some moderation in growth but still a solid economy,” mentioned Michael Gapen, chief U.S. economist at Bank of America. He mentioned the report contained “few signs of weakness overall.”

But the stable development figures have been accompanied by an unexpectedly speedy acceleration in inflation. Consumer costs rose at a 3.4 p.c annual charge within the first quarter, up from 1.8 p.c within the last quarter of final yr. Excluding the unstable meals and vitality classes, costs rose at a 3.7 p.c annual charge.

Taken collectively, the first-quarter knowledge was the newest proof that the Federal Reserve’s efforts to tame inflation have stalled — and that the celebration in monetary markets over an obvious “soft landing” or mild slowdown for the financial system had been untimely.

“It increases the chances of a harder landing,” mentioned Constance L. Hunter, an economist at MacroPolicy Perspectives, a forecasting agency. “The inflation data was the surprise.”

At a minimal, cussed inflation is prone to imply that the Fed will wait no less than till fall to start reducing rates of interest. Some forecasters suppose it’s potential that policymakers gained’t simply maintain charges “higher for longer,” as buyers have been anticipating for a number of weeks now, however would possibly really increase them additional.

“It is a huge shift because all of a sudden ‘higher for longer’ could mean another hike,” mentioned Diane Swonk, chief economist at KPMG. For now, she mentioned, the Fed is caught in “monetary policy purgatory.”

Financial markets fell on the information. The S&P 500 index was down about 1 p.c at noon, and yields on authorities bonds have been up as buyers anticipated that borrowing prices will stay excessive.

Investors aren’t the one ones who may endure if rates of interest stay excessive. There are mounting indicators that top borrowing prices are weighing on Americans’ monetary well-being. Consumers saved simply 3.6 p.c of their after-tax revenue within the first quarter, down from 4 p.c on the finish of final yr and greater than 5 p.c earlier than the pandemic.

The indicators of pressure are notably acute for lower-income households. They have more and more turned to bank cards to afford their spending, and with rates of interest excessive, extra of them are falling behind on their funds.

“There is a sense that lower-end households are increasingly stretched right now,” mentioned Andrew Husby, senior U.S. economist at BNP Paribas.

Yet regardless of these strains, client spending, within the mixture, reveals little signal of cooling down. Spending rose at a 2.5 p.c annual charge within the first quarter, solely modestly slower than in late 2023, and spending on providers like journey and leisure really accelerated.

Spending has been pushed notably by wealthier shoppers, whose low debt and fixed-rate mortgages have insulated them from the results of upper rates of interest, and who’ve benefited from a inventory market that was till not too long ago setting data.

“Higher income households feel very flush,” mentioned Brian Rose, senior economist at UBS. “They’ve seen such a huge run-up in the value of their house and the value of their portfolios that they feel like they can keep spending.”

That presents a conundrum for the policymakers on the Fed: Their principal instrument for combating inflation, excessive charges, is doing little to tamp down spending by the rich whereas hurting poorer households. And but in the event that they reduce these charges, inflation may speed up once more.

Even so, forecasters mentioned the general financial image stays surprisingly rosy, particularly when put next with the glum predictions of a yr in the past. Unemployment has remained low, job development has stayed robust and wages have continued to rise, all of which helped after-tax revenue to outpace inflation within the first quarter.

Businesses stepped up their funding in tools and software program within the first quarter, a vote of confidence within the financial system. The housing market additionally rebounded, though that was due partly to a dip in mortgage charges that has since reversed.

Even one of many drags on development within the first quarter — a swelling commerce deficit — largely mirrored demand from the United States. Imports rose as Americans purchased extra items from abroad, whereas exports rose extra modestly.