Growth slowed but remained resilient at the end of 2024, leaving the U.S. economy on solid footing heading into a new year — and a new presidential administration — that is full of uncertainty.

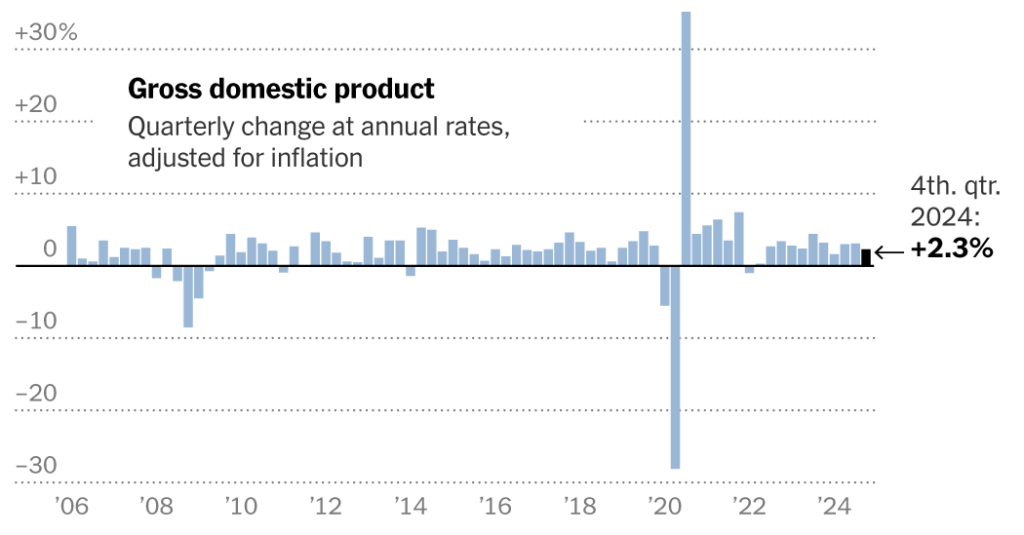

U.S. gross domestic product, adjusted for inflation, grew at a 2.3 percent annual rate in the fourth quarter of last year, the Commerce Department reported on Thursday. That was down from the 3.1 percent growth rate in the third quarter but nonetheless represented an encouraging end to a year in which the economy once again defied expectations.

The figures are preliminary and will be revised at least twice as more complete data becomes available.

For the year as a whole, measured from the end of 2023 to the end of 2024, G.D.P. increased 2.5 percent, far ahead of forecasters’ expectations when the year began. Robust consumer spending, underpinned by low unemployment and steady wage growth, helped keep the economy on track despite high interest rates, stubborn inflation and political turmoil at home and abroad.

“We ended on a pretty strong note,” said Diane Swonk, chief economist for the accounting firm KPMG. “It’s stunning how resilient and strong the economy has been.”

But the economy entered the new year facing a new set of challenges. The whirlwind start to President Trump’s second term — including sweeping changes to immigration policy, a spending freeze that was announced and then rescinded, and steep tariffs that could begin to take effect as early as this weekend — has increased uncertainty for both households and businesses. And while the full scope of Mr. Trump’s plans remains unclear, economists warn that his proposals on trade and immigration, in particular, could lead to faster inflation, slower growth, or both.

“You really have all the right ingredients to support sustainable growth, but the question is, where will it be in 12 months’ time?” said Gregory Daco, chief economist for the consulting firm EY-Parthenon. “The risk is you break the economy.”

Still, the economy entered 2025 with significant momentum, led by consumer spending, which grew at a 4.2 percent annual rate in the fourth quarter, ahead of forecasters’ expectations. Consumers have been buoyed by a strong job market, which has allowed pay to rise faster than prices in recent quarters: After-tax income, adjusted for inflation, increased at a 2.8 percent annual rate at the end of last year.

The housing market, too, showed signs of life at the end of the year, as a drop in mortgage rates spurred construction activity. Residential investment, which includes new home building and renovation, rose after two straight quarterly declines.

But there are also pockets of weakness. Businesses invested less in new buildings and equipment in the fourth quarter, and exports fell. The rebound in the housing market may prove short-lived: Mortgage rates have risen in recent months, and the market for existing homes remains frozen.

At the same time, consumer prices rose more quickly at the end of the year, the latest evidence that progress on inflation has stalled. That has complicated the job facing policymakers at the Federal Reserve, who until recently had been expecting to be cutting interest rates in order to shore up economic growth. Instead, the Fed on Wednesday held rates steady and signaled that the bar for future rate cuts will be high.

Still, economists have warned for years for years that growth is in danger of faltering, only to be proved wrong. And the momentum at the end of 2024 should help the economy withstand whatever new threats emerge in 2025.

“We’ve been able to take a lot and keep going,” Ms. Swonk said. “We can look at all the models, but the models haven’t been that valuable.”

https://www.nytimes.com/2025/01/30/business/economy/economy-gdp-q4.html