In Summary

- Africa’s pineapple production is expected to reach about 20 million metric tonsby the end of 2025, with Nigeria, Angola, and Ghana being the largest producers.

- Nigeria alone is projected to produce 1.91 million metric tons by 2026, making it a major player in the global market.

- The continent’s strong production capacity and proximity to key markets like the Middle East make it an attractive location for pineapple processing and export.

- Nigeria, Africa’s largest pineapple producer ranks eighth on the top 10 global production list, with Indonesia leading the world pineapple production with 3.2 million Tons.

Deep Dive!!

The pineapple industry in Africa has witnessed significant growth over the past few years, with several countries emerging as key players in global production. As of 2025, Africa remains one of the largest producers of pineapples worldwide, with a diverse range of countries contributing to the continent’s strong agricultural sector.

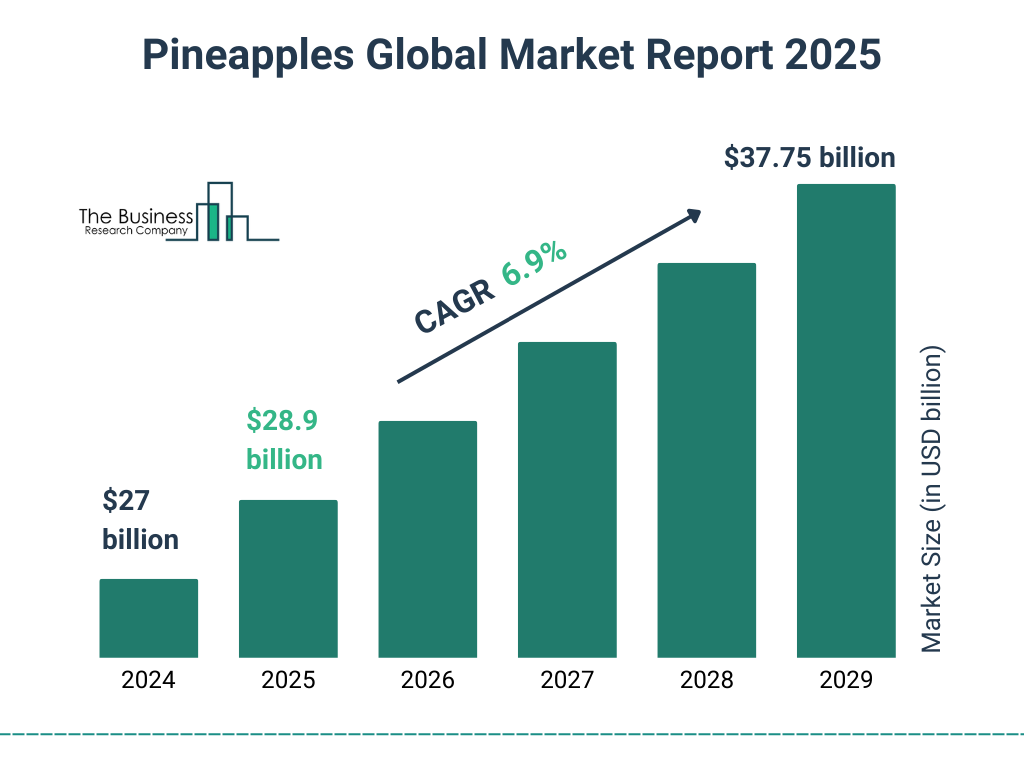

The global demand for pineapples, particularly in Europe and the Middle East, has fueled an increase in production, cultivation, and export, benefiting both large-scale commercial farms and smallholder farmers. The top producers in Africa not only meet the growing demand for fresh and processed pineapples but also play a vital role in boosting their respective economies through job creation, export revenues, and agricultural development.

At the forefront of this growth are countries like Nigeria, Ghana, and Angola, which dominate the African market with their impressive production volumes and export potential. Nigeria, the continent’s largest producer, leads the way with an estimated 1.5 million tonnes annually and a projection of 1.91 million metric tons by the end of 2026. Ghana, renowned for its high-quality pineapples, follows closely behind. In addition to these leading nations, countries such as South Africa, Kenya, and Cameroon have also carved out important niches in the pineapple industry, driven by favorable climate conditions, investment in agricultural infrastructure, and expanding export opportunities.

As pineapple production continues to rise, the industry presents substantial economic benefits, particularly in the form of foreign exchange earnings, rural employment, and enhanced agricultural diversification. In this article, we delve into the top 10 pineapple producers in Africa in 2025, offering a comprehensive overview of each country’s production capacity, economic impact, and future potential within the global pineapple market.

10. South Africa

South Africa ranks tenth in Africa’s pineapple production, with an estimated annual output of 128,623 tonnes. The country’s climate, characterized by mild winters and warm summers, makes it ideal for year-round pineapple cultivation. The main pineapple-growing regions include Limpopo and Mpumalanga, which benefit from fertile soils and favorable weather conditions.

Pineapple farming in South Africa is a vital part of the agricultural sector, contributing not only to local consumption but also to export markets, particularly in Europe and the Middle East. In recent years, the industry has been bolstered by increased investments in agricultural technology and sustainable farming practices. South Africa’s proximity to major shipping routes, particularly its ports in Durban and Cape Town, has made it a key player in the global fruit trade.

However, the country faces challenges, such as land distribution and water management, which need to be addressed to ensure the continued growth of the pineapple industry. With efforts to expand processing capabilities and improve supply chain infrastructure, South Africa’s pineapple sector is positioned for growth in both domestic and international markets.

9. Democratic Republic of the Congo (DRC)

The Democratic Republic of the Congo (DRC) is ranked ninth in Africa’s pineapple production, with an estimated output of 190,969 tonnes. The country’s vast arable land and favorable tropical climate are ideal for pineapple cultivation, especially in provinces such as Bas-Congo and Kongo-Central. Despite its potential, DRC’s pineapple industry faces significant infrastructural challenges, which hinder the ability to increase export volumes.

While pineapple production is largely directed towards local consumption, the country has considerable room to grow as a key exporter. The government and local producers are working to enhance the efficiency of supply chains, invest in processing facilities, and improve market access, particularly within the African region. DRC’s pineapple industry holds immense promise, especially if it can overcome logistical barriers. Increased focus on agricultural development, coupled with better access to global markets, could see DRC emerge as a leading pineapple exporter in the future, boosting the country’s agricultural sector and economy.

8. Kenya

Kenya ranks eighth in Africa’s pineapple production, with an output of approximately 282,655 tonnes annually. Pineapple farming in Kenya is highly developed, with significant contributions from large commercial farms like Del Monte Kenya, which operates extensive plantations in regions such as Thika and Murang’a. The country’s favorable climate, combined with advanced farming techniques, has positioned Kenya as a major player in the pineapple industry. Kenyan pineapples are particularly valued for their quality and are predominantly exported to European markets.

Kenya’s pineapple sector is a vital part of its agricultural export economy, contributing significantly to foreign exchange earnings. However, Kenya’s pineapple farmers face challenges such as fluctuating market prices, inadequate processing facilities, and dependency on a few export markets. Despite these obstacles, the sector has great potential, with ongoing initiatives to expand domestic processing capacity, which could open new opportunities for regional and international trade.

7. Cameroon

With an annual production of approximately 312,192 tonnes, Cameroon ranks seventh in Africa for pineapple production. The country’s pineapple industry is primarily concentrated in the Central and Littoral provinces, where favorable climatic conditions and fertile soils support large-scale cultivation. Cameroon’s pineapple sector is a vital part of its agricultural economy, supporting both local consumption and export to neighboring countries.

However, the country faces challenges related to infrastructure, particularly in terms of logistics and processing capacity, which limits its ability to fully capitalize on its pineapple production. Cameroon is working towards improving its infrastructure, especially in transportation and storage, to reduce post-harvest losses and increase exports. The government’s support for the agricultural sector, including pineapple farming, could foster significant growth, and with a more robust value chain, Cameroon could boost its share of the global pineapple market.

6. Malawi

Malawi, with a production volume of approximately 334,071 tonnes, holds the sixth position in Africa’s pineapple production rankings. The majority of Malawi’s pineapple farming is carried out by smallholder farmers, many of whom rely on this crop as an important source of income. The country’s favorable climate and fertile soil in regions like the Southern and Central regions make it ideal for pineapple cultivation.

Malawi’s pineapple sector is growing steadily, with a rising focus on processing and regional exports. As demand for processed pineapple products increases, there is an increasing push to invest in better processing infrastructure and market access. The government’s efforts to improve agricultural policies, along with the introduction of cooperative farming practices, have enhanced productivity and efficiency in the sector. The growing popularity of Malawian pineapples in regional markets could help the country further establish itself as a key player in Africa’s pineapple trade.

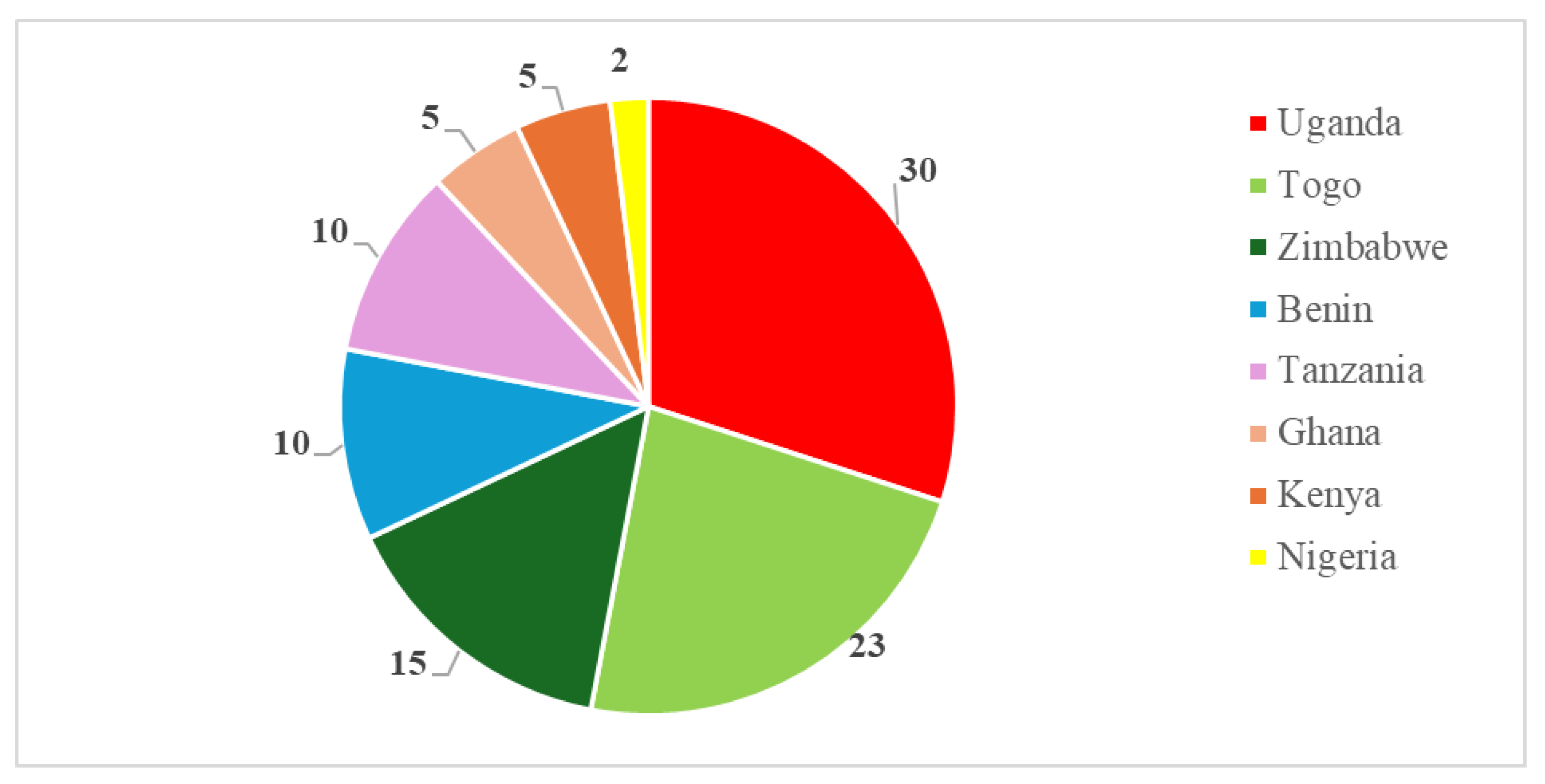

5. Tanzania

Tanzania produced about 372,179 tonnes of pineapples in 2025, ranking fifth in Africa’s pineapple production. The country’s tropical climate and fertile soils provide optimal conditions for pineapple farming, particularly in regions like Tanga, Morogoro, and the coastal belt. Pineapple farming is a significant part of Tanzania’s agricultural landscape, with smallholder farmers contributing substantially to production. The country’s pineapples are primarily grown for domestic consumption, but there is increasing potential for exports, particularly to regional markets such as East Africa.

The Tanzanian government has recognized the value of the pineapple sector and is investing in infrastructure improvements, particularly in transportation and processing. Additionally, there is growing interest from foreign investors seeking to expand pineapple cultivation and processing in the country. With improved supply chain efficiency and investment in value-added products, Tanzania is poised to increase its share in the global pineapple market.

4. Benin

Benin ranks fourth in pineapple production in Africa, with an estimated output of 406,220 tonnes. The country’s pineapple sector is primarily composed of smallholder farmers, who grow the fruit in regions like Ouémé and Mono. Benin’s pineapples are well-regarded for their quality, and a significant portion of production is directed towards local consumption. However, there is increasing focus on enhancing processing capabilities and expanding export opportunities, particularly within the West African region.

The government has supported the sector through various agricultural development programs, aiming to improve farming practices, infrastructure, and access to markets. As demand for fresh and processed pineapples grows in both local and international markets, Benin is poised to increase its exports, boosting its position as a key player in Africa’s pineapple trade.

3. Angola

Angola’s pineapple production reached 663,263 tonnes, making it the third-largest producer of pineapples in Africa. The country’s pineapple farming is concentrated in provinces such as Kwanza Sul and Bengo, where the fertile land and favorable climate support large-scale cultivation. Angola’s pineapple sector is growing rapidly, with increasing production geared towards both local markets and regional exports.

The country’s pineapple industry has been bolstered by foreign investments, which have helped modernize farming practices and expand processing capabilities. Angola’s increasing share of the pineapple market reflects the growing diversification of its agricultural sector, which is traditionally focused on oil and mining. As Angola continues to enhance its agricultural infrastructure and export capabilities, the pineapple industry is expected to play an increasingly important role in the country’s economic development.

2. Ghana

Ghana, with a pineapple production volume of approximately 668,093 tonnes, is ranked second in Africa. The country is renowned for its high-quality pineapples, particularly the “Queen” variety, which is highly sought after in international markets. Ghana’s pineapple industry is largely driven by smallholder farmers, who cultivate the fruit in regions such as the Volta and Western regions. Pineapple farming has become a vital source of income for many rural families.

Ghana’s pineapples are primarily exported to Europe and the Middle East, contributing significantly to the country’s agricultural export earnings. The industry benefits from a growing focus on value-added products, including canned pineapples and juices, which are increasingly popular in international markets. The Ghanaian government has supported the sector through infrastructure development and agricultural programs aimed at improving the quality and efficiency of pineapple production, making the country a key player in the global pineapple market.

1. Nigeria

Nigeria is the largest producer of pineapples in Africa, with an estimated output exceeding 1.5 million tonnes annually. The country’s vast agricultural landscape and favorable climate conditions make it ideal for large-scale pineapple farming, primarily carried out by smallholder farmers. Nigeria’s pineapples are consumed both domestically and in neighboring countries, with increasing interest in processing and export markets.

The growing demand for Nigerian pineapples, both fresh and processed, has led to increased investments in agricultural infrastructure, including processing plants and storage facilities. As the largest producer in Africa, Nigeria is well-positioned to meet the rising demand for pineapples in international markets, particularly in Europe and the Middle East. The country’s pineapple industry is a key contributor to its agricultural sector and plays a significant role in the diversification of its economy. With continued investments in infrastructure, processing, and export logistics, Nigeria is poised to maintain its position as the continent’s leading pineapple producer in the years to come.

https://www.africanexponent.com/top-10-pineapple-producers-in-africa-2025/