In Summary

- Approximately half of African currencies are experiencing volatility, with some depreciating significantly against the US dollar while others show signs of stability or appreciation.

- Factors contributing to volatile currency in Africa include global economic uncertainty, domestic economic pressures, and geopolitical tensions.

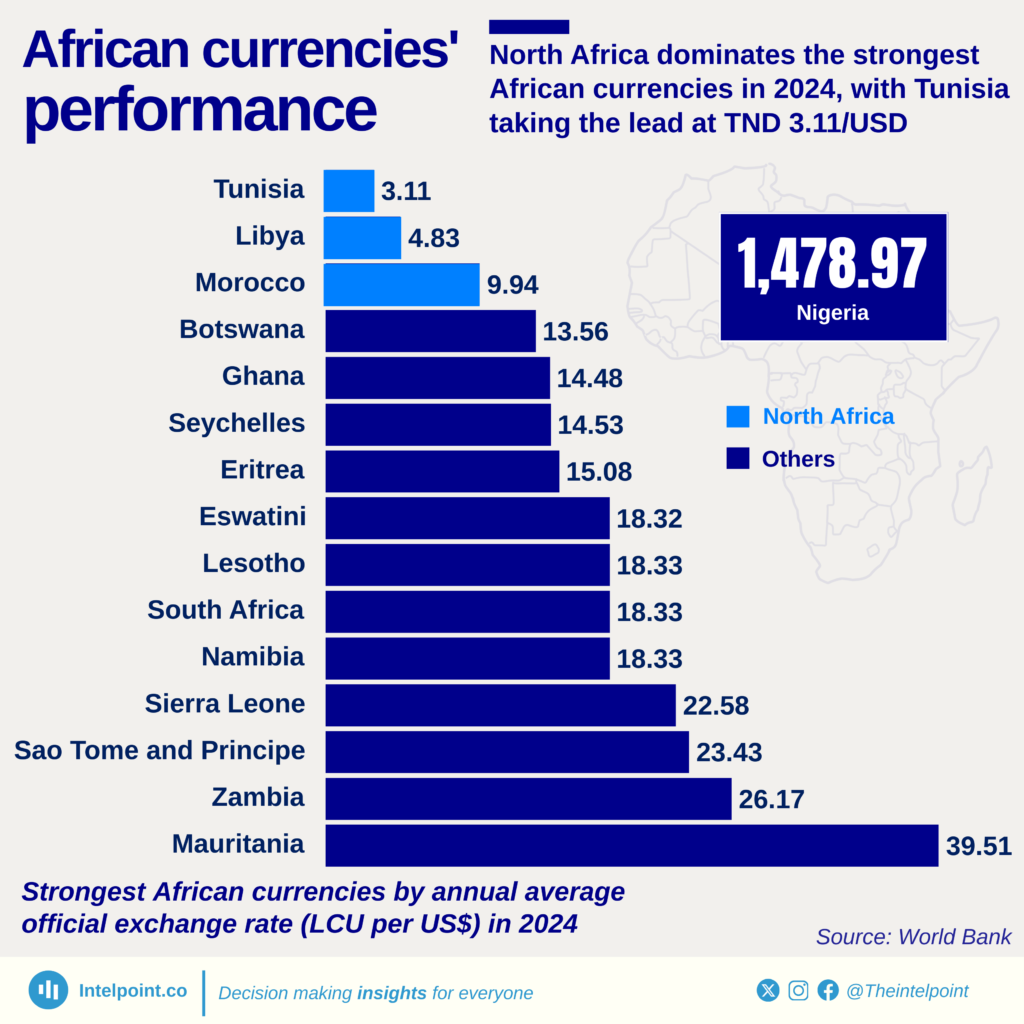

- A significant number of African currencies, including those of major economies such as Nigeria, Ghana, and South Africa, are facing high depreciation pressures, while the Ghanaian Cedi is also expected to weaken.

Deep Dive!!

Volatile currencies are more than just economic statistics and graphs, they disrupt lives and destabilize entire economies. In Africa, where many nations rely heavily on imports and external debt, currency depreciation means skyrocketing prices for food, fuel, and essential goods. It also erodes public trust, scares away investors, and makes long-term planning nearly impossible for businesses and households alike.

Last month, we reported on the Top 10 Most Traded Currencies in Africa in 2025, highlighting that Africa has an ever dynamic and evolving financial landscape, which is increasingly reflected in the performance and trading volume of its currencies. It has also been revealed over the years that without strong monetary policies and diversified economies, volatile currencies could remain one of the continent’s greatest obstacles to inclusive and sustainable growth.

According to experts, currency stability is a key indicator of a nation’s economic health, influencing everything from inflation and investment to public confidence and international trade. In 2025, several African countries are facing heightened currency volatility, driven by a combination of global economic pressures, domestic policy shifts, and structural challenges. For many nations, reliance on commodity exports, limited foreign exchange reserves, and rising debt levels have compounded the instability of their local currencies.

Here, we highlight the Top 10 Most Volatile African Currencies in 2025, offering a comprehensive look into how and why these currencies have depreciated, the macroeconomic implications for each country, and the broader impact on trade, consumer prices, and investor sentiment.

10. Ugandan Shilling (UGX) – Uganda

The Ugandan shilling rounds out the list with a modest but notable depreciation of ~2.2% in 2025. While relatively stable compared to others, the UGX has come under pressure due to global dollar demand, regional geopolitical tensions, and higher debt service costs. The exchange rate fluctuates around UGX3,700/USD.

Uganda’s economy is diversified with growing sectors in oil, agriculture, and tourism, but slow export growth and external borrowing have weighed on investor confidence. The central bank has tried to keep inflation in check through rate hikes and interventions, but the shilling’s gradual decline has still impacted fuel prices and cost of living.

9. Comorian Franc (KMF) – Comoros

The Comorian franc, while officially pegged to the euro through France’s monetary system, has still experienced about 4–5% devaluation in real terms due to declining remittances, trade imbalances, and slow growth. Comoros has one of the smallest economies in Africa, with limited export activity and heavy reliance on imports and aid.

Inflation in 2025 has been largely driven by transport and food prices. While the peg offers some stability, poor infrastructure, limited industrial activity, and climate vulnerability make the franc sensitive to external shocks. The country has been slow in implementing meaningful economic reforms to diversify income sources.

8. Burundian Franc (BIF) – Burundi

The Burundian franc has fallen by roughly 5–6% against the dollar in 2025, a consequence of limited foreign reserves, forex rationing, and sanctions that restrict external support. With an exchange rate above BIF2,900/USD, the currency has become increasingly volatile as the country grapples with rising debt and fiscal mismanagement.

Burundi, a small and aid-dependent nation, struggles with food insecurity, youth unemployment, and underdeveloped infrastructure. Currency depreciation has worsened access to imported medicines and fuel, while reforms remain minimal. The government’s closed-off economic stance has further alienated global partners.

7. Malagasy Ariary (MGA) – Madagascar

The Malagasy ariary depreciated by nearly 6% in 2025, primarily due to a widening trade deficit, inflation, and slow economic diversification. The currency now trades at around MGA4,700/USD. Madagascar’s economy is heavily reliant on vanilla, textiles, and agricultural exports, but global commodity prices and climate-related crop damage have reduced forex earnings.

Limited industrial capacity and high reliance on imports for fuel and machinery further expose the currency to external shocks. Despite some tourism recovery, the ariary’s weakness has led to a rise in living costs and uncertainty for investors, particularly in urban real estate and infrastructure development.

6. Sierra Leonean Leone (SLE) – Sierra Leone

The Sierra Leonean leone, after redenomination in 2022, continues to depreciate, with a decline of nearly 9% in 2025. The current exchange rate stands at over SLE20,000/USD, reflecting deep-rooted structural weaknesses in the economy. Political instability, limited export capacity, and dependency on imports have all contributed to currency pressures.

Sierra Leone’s economy, largely reliant on mining and agriculture, has struggled to stabilize after years of inflation and low foreign direct investment. Leone’s depreciation has had dire effects on food security and public sector salaries, while efforts to restore investor confidence remain in the early stages.

5. Angolan Kwanza (AOA) – Angola

The Angolan kwanza has depreciated by over 10% this year, driven largely by reduced oil revenues, inflation, and the central bank’s efforts to liberalize the currency. The exchange rate reached approximately AOA912/USD in mid-2025. Angola’s economy, which depends on oil for over 90% of exports, has been hit hard by price fluctuations and reduced demand from global markets.

While Angola has taken steps to diversify its economy and attract foreign investment, these reforms are slow to yield results. The depreciation of the kwanza has increased import costs, worsened public debt obligations, and made everyday essentials less affordable for citizens. Inflation remains a persistent concern, despite efforts to tighten monetary policy.

4. Congolese Franc (CDF) – Democratic Republic of Congo

The Congolese franc has seen about a 16–17% decline in value in 2025, affected by prolonged conflict in the eastern regions, weak governance, and volatility in the mining sector, which is DRC’s primary foreign exchange source. The exchange rate hovers near CDF2,800/USD, making it one of the weakest currencies in Central Africa.

Despite the country’s vast natural resource wealth, especially in cobalt and copper, poor infrastructure, political instability, and reliance on raw mineral exports have made the economy fragile. Currency volatility in the DRC has eroded savings, limited credit access, and inflated the cost of essential goods, compounding the struggles of a population already battling poverty and displacement.

3. Rwandan Franc (RWF) – Rwanda

Rwanda’s franc has depreciated by roughly 19% in 2025, driven by a growing import bill, a rising demand for the U.S. dollar, and persistent inflationary pressures. Though Rwanda’s economy is one of the fastest-growing in East Africa, with strong investment in infrastructure and ICT, its low export base makes it susceptible to currency instability.

The central bank has attempted to manage the depreciation through monetary tightening and forex interventions, but the demand for hard currency continues to outpace supply. The Rwandan franc’s weakness has led to increased prices of fuel, imported goods, and construction materials—impacting household consumption and slowing down key development projects.

2. Malawian Kwacha (MWK) – Malawi

The Malawian kwacha has experienced one of the steepest drops in Africa, losing nearly 40% of its value over 12 months. The exchange rate surpassed MWK1,700/USD in early 2025. Malawi, a landlocked and import-dependent economy, has faced severe forex shortages, high inflation, and a growing trade deficit, particularly due to rising global fuel and fertilizer prices.

The currency’s freefall has intensified economic hardship for households and small businesses. The government devalued the kwacha in hopes of securing an IMF bailout, but this move also raised the cost of essentials. Malawi’s economy, reliant on agriculture (notably tobacco), remains vulnerable to external shocks, poor harvests, and climate-related disruptions.

1. Nigerian Naira (NGN) – Nigeria

In 2025, the Nigerian naira has remained the most volatile currency on the continent, depreciating by over 30% since early 2024. Following the Central Bank’s decision to float the currency and remove fuel subsidies, the naira plummeted against the dollar, reaching over ₦1,500/USD. The move, while intended to attract foreign investment and unify multiple exchange rates, also led to a spike in inflation, rising import costs, and a decline in purchasing power across Nigeria’s 200+ million population.

The Nigerian economy which is heavily reliant on oil exports has struggled to maintain forex reserves amid declining oil revenues, foreign debt servicing, and low industrial productivity. Despite efforts to stabilize the currency through FX auctions and interest rate hikes, speculative trading, smuggling, and low investor confidence have continued to pressure the naira. This depreciation has ripple effects on everything from food prices to housing and energy.

https://www.africanexponent.com/top-10-most-volatile-african-currencies-in-2025/