In Summary

- Africa experienced a 75% surge in foreign direct investment (FDI) in 2024, reaching a historic $97 billion, marking a significant rebound from previous years.

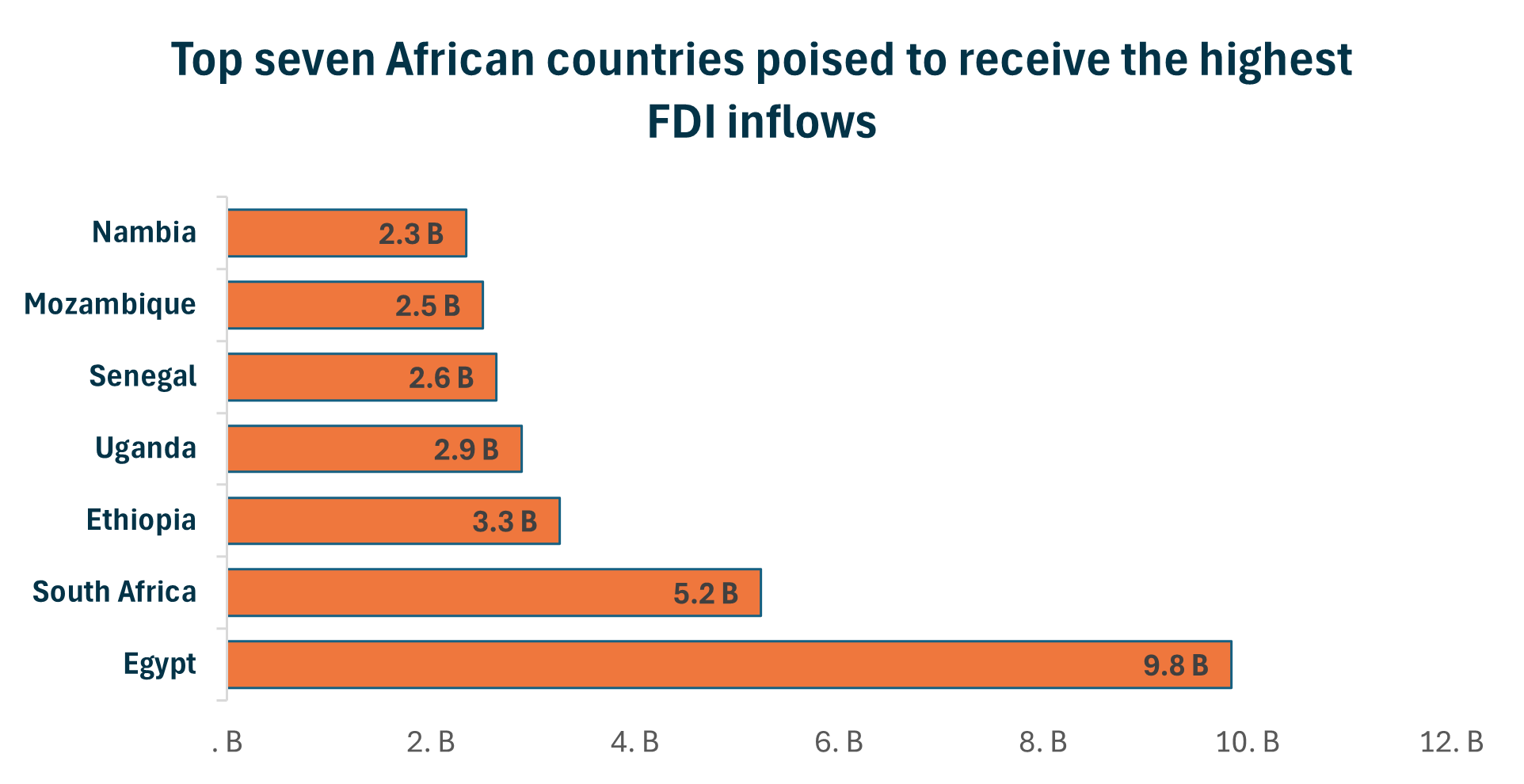

- Egypt attracted $46.58 billion in FDI in 2024, accounting for nearly half of Africa’s total FDI inflows, driven by major infrastructure projects and strategic economic reforms.

- The surge in FDI was notably concentrated in sectors such as energy, infrastructure, and digital services, reflecting investor confidence in Africa’s evolving economic landscape.

Deep Dive!!

In 2025, Africa has witnessed a remarkable surge in foreign capital inflows, with total foreign direct investment (FDI) reaching unprecedented levels across the continent, as highlighted in out report “Top 10 African Countries Poised to Receive Highest Foreign Direct Investment (FDI) in 2025”.

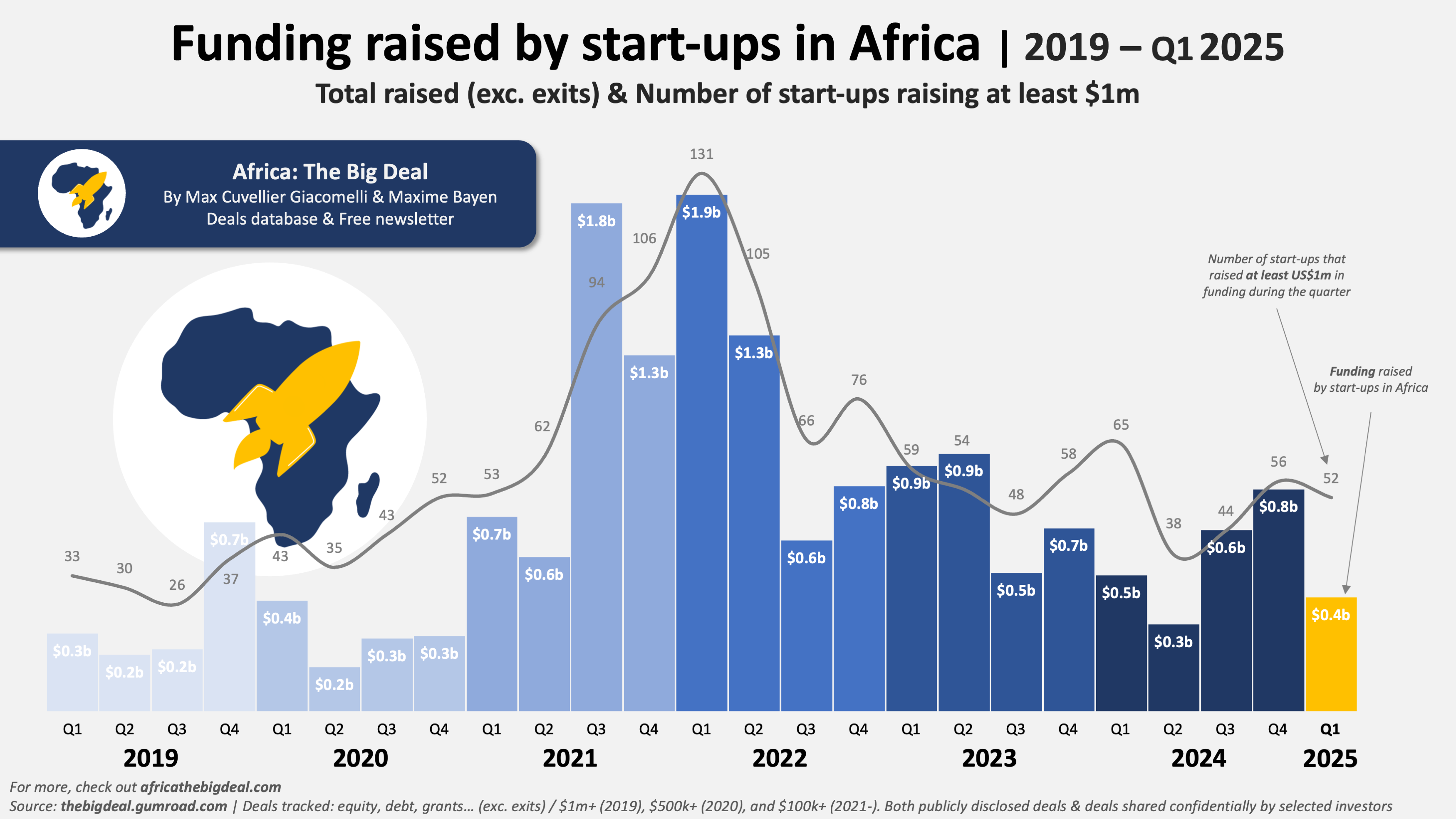

Recent data from the United Nations Trade and Development highlights a staggering 75% year-over-year growth, surpassing the $97 billion mark, a clear testament to Africa’s growing attractiveness as an investment destination. This growth can be attributed to a combination of factors including vast natural resources, strategic economic reforms, and a rapidly expanding middle class.

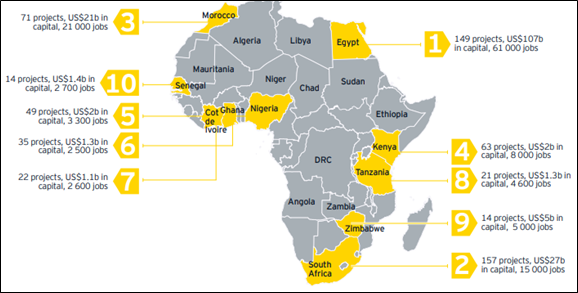

Among the top ten recipients of FDI, countries such as Egypt, Ethiopia, and Côte d’Ivoire have demonstrated resilience and forward-thinking policies that continue to draw investors from around the globe. These nations are capitalizing on sectors like infrastructure development, energy, and agriculture, while simultaneously addressing challenges like political instability and regulatory frameworks to improve their investment climates.

As we delve into the specifics of each country’s FDI inflows in 2025, it becomes evident that Africa’s investment landscape is not only dynamic but also reflective of the continent’s increasing integration into the global economy. This article provides an in-depth analysis of the top 10 African countries attracting the largest foreign capital inflows, offering valuable insights into the driving forces behind their economic growth.

10. Democratic Republic of the Congo (DRC)

The DRC remains one of the top recipients of foreign capital, mainly due to its wealth in natural resources, especially minerals like cobalt, copper, and diamonds. These resources are essential in global supply chains, particularly in the tech and energy industries. The DRC’s mining sector continues to draw significant foreign investments, especially in the context of the increasing demand for cobalt in the electric vehicle industry.

However, the country faces several challenges, including political instability and infrastructural deficits, which can sometimes deter foreign investors. Still, ongoing efforts to improve the investment climate, including governance reforms, have provided a more conducive environment for investors.

9. Guinea

Guinea has steadily increased its foreign direct investment inflows due to its vast bauxite reserves, the largest in the world, and its emerging oil and gas sector. The country’s strategic location and active participation in regional trade agreements have also enhanced its attractiveness.

The government has made strides in improving its business environment by focusing on infrastructure development, fiscal reforms, and attracting foreign partnerships. Despite this, Guinea’s heavy reliance on mining and its political challenges can still pose risks to investors. The government is focused on balancing development with social and environmental concerns.

8. South Africa

South Africa has long been a key investment hub in Africa due to its diversified economy and advanced infrastructure. In 2025, the country continues to attract significant foreign capital, especially in sectors such as financial services, technology, and manufacturing.

The country’s sophisticated financial market, strong regulatory framework, and established corporate governance make it an appealing destination for international investors. However, South Africa faces challenges like high unemployment, energy crises, and slow economic growth, which have impacted FDI inflows in recent years. Despite these obstacles, the country remains one of Africa’s largest economies and a major FDI player.

7. Namibia

Namibia, though a smaller economy in Southern Africa, has seen growing foreign investment due to its stable political environment, strong mineral resources, and focus on sustainable development.

The country is a major producer of uranium, diamonds, and other minerals, making it an attractive destination for mining-related investments. Namibia has also been focusing on renewable energy projects and green hydrogen production, which is expected to further boost FDI in the coming years. Despite a decline in FDI inflows in 2025, Namibia’s investment prospects remain positive, particularly with government-led efforts to diversify the economy.

6. Senegal

Senegal has become an increasingly attractive destination for FDI, driven by its strong political stability, strategic location along the West African coast, and rapidly developing infrastructure.

The government has focused on sectors like energy, infrastructure, and mining, and has launched initiatives such as the Plan Senegal Emergent, which aims to transform the economy by focusing on industrialization and improving competitiveness. Senegal’s commitment to regional integration through ECOWAS (Economic Community of West African States) has further enhanced its appeal. Despite a decrease in FDI growth in 2025, Senegal remains a solid investment destination due to its growing role in Africa’s economic integration.

5. Uganda

Uganda has seen a surge in FDI, particularly following the discovery of oil reserves and the development of related infrastructure. In addition to oil, the country’s agricultural sector is a key driver of foreign investments, with a growing focus on agro-processing industries.

The government has also prioritized improving the business climate, which includes measures such as tax reforms and the establishment of special economic zones. Uganda’s geographic position in East Africa, along with its favorable trade agreements within the East African Community, makes it an appealing destination for regional investors. The country’s economic potential is tempered by challenges such as high corruption levels and infrastructure bottlenecks, which can affect the ease of doing business.

4. Mozambique

Mozambique has emerged as one of Africa’s top FDI recipients due to its vast natural gas resources and strategic location along the Indian Ocean. The country has attracted substantial investments in the energy sector, particularly from international oil and gas companies.

Mozambique’s recent focus on large infrastructure projects, including roads, ports, and industrial parks, has made it an increasingly attractive investment destination. Additionally, the country’s efforts to improve its regulatory environment have supported its growing investment profile. Despite this, Mozambique’s security challenges, particularly in the northern region, have posed risks to potential investors, though the country’s potential as an energy hub remains strong.

3. Côte d’Ivoire

Côte d’Ivoire continues to lead West Africa in attracting FDI, driven by its diversified economy. The country has seen investments in agriculture, energy, and infrastructure, with the cocoa sector playing a particularly prominent role due to Côte d’Ivoire being the world’s largest cocoa producer. The government has implemented significant reforms to improve the business climate, reduce red tape, and increase transparency.

Côte d’Ivoire’s active participation in regional economic initiatives such as the African Continental Free Trade Area (AfCFTA) has positioned it as a key gateway to the West African market. The country’s growing infrastructure projects and economic stability make it an attractive destination for investors.

2. Ethiopia

Ethiopia has become a major FDI destination in East Africa, attracting significant foreign capital in manufacturing, infrastructure, and energy. The government’s focus on industrialization through the creation of industrial parks has contributed to rapid economic growth and job creation. In addition, Ethiopia’s strategic location in the Horn of Africa, along with its large market size, has made it a regional hub for trade and investment.

The country has also focused on improving its regulatory environment, making it easier for foreign investors to set up businesses. Ethiopia’s commitment to infrastructure development and its strong growth trajectory makes it one of the fastest-growing economies in Africa, despite challenges like political instability and insecurity in certain regions.

1. Egypt

Egypt stands out as the leading recipient of FDI in Africa, with significant capital inflows driven by large-scale infrastructure projects and strategic economic reforms. The country’s Suez Canal Economic Zone, new urban developments like the New Administrative Capital, and mega-projects in energy have attracted billions of dollars in foreign investment; attracting $46.58 billion in FDI in 2024, and accounting for nearly half of Africa’s total FDI inflows, driven by major infrastructure projects and strategic economic reforms.

Egypt’s strategic location at the crossroads of Africa, Asia, and Europe further enhances its position as a global logistics hub. In addition, Egypt’s government has pursued policies aimed at improving its business environment, reducing inflation, and stabilizing the economy. The country’s investments in renewable energy, natural gas, and tourism continue to provide strong growth prospects, making it an enduring investment magnet for foreign capital.

https://www.africanexponent.com/top-10-countries-in-africa-with-the-largest-foreign-capital-inflows-in-2025/