In Summary

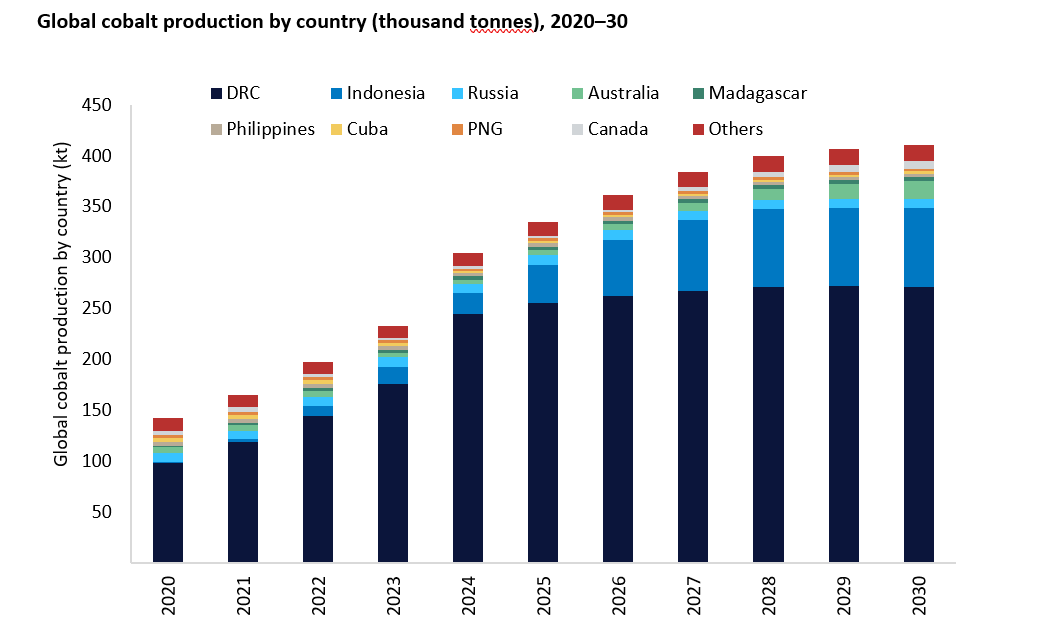

- The Democratic Republic of Congo (DRC) is the undisputed global leader in cobalt production, supplying an estimated 75-80% of the world’s supply. Its output, a mix of large-scale industrial mines and vast artisanal mining, is so substantial that it dwarfs all other African nations combined.

- Beneath the DRC, a second tier of established and rapidly growing producers exists, including Madagascar, Zimbabwe, and Rwanda. A third wave of new entrants like Uganda, Tanzania, and Botswana are leveraging new projects to establish themselves as future suppliers, signaling a trend towards a more diversified African supply chain.

- African cobalt production is not monolithic. It is derived from primary cobalt mines (Morocco), as a by-product of Platinum Group Metals (South Africa) or copper/nickel mining (Zambia, DRC), and through formalized regional trading hubs (Rwanda). This diversity creates different economic impacts and strategic roles within the global battery market.

Deep Dive!!

The global transition to a green energy future is fundamentally underpinned by a class of critical minerals, and few are as strategically significant as cobalt. This silvery-blue metal is an indispensable component in the lithium-ion batteries that power electric vehicles (EVs) and store renewable energy, making it a cornerstone of modern technology and climate policy. As demand surges, driven by national pledges to achieve net-zero emissions and the rapid electrification of the global auto fleet, the security and diversification of the cobalt supply chain have become paramount concerns for governments and industries worldwide. This intense focus invariably turns to a single continent that dominates the global production landscape: Africa.

Within Africa, the narrative of cobalt is one of both overwhelming concentration and dynamic emergence. The Democratic Republic of Congo (DRC) stands as an undisputed colossus, accounting for an estimated 70-80% of global output, a level of dominance unmatched for any critical mineral by a single country. However, beneath this towering presence, a cohort of other African nations is rapidly advancing, leveraging their own geological endowments to carve out roles in this high-stakes market. From established producers like Morocco and South Africa to ambitious new entrants like Uganda and Madagascar, these countries represent a compelling story of economic diversification and the quest to build a more polycentric and resilient global supply chain.

This article provides a comprehensive analysis of the top 10 cobalt producers in Africa for 2025. Moving beyond simple production figures, we delve into the unique drivers, challenges, and future trajectories of each nation. We will explore the industrial mega-projects and artisanal mining sectors that define the market, examine the geopolitical and economic impacts on host countries and their people, and assess how these key players are shaping, and are shaped by, the relentless demands of the global energy transition.

10. Botswana

Estimated 2025 Production: Approximately 1,000 tonnes.

Botswana, a nation synonymous with diamond wealth, is strategically pivoting to secure its place in the battery metals market. The primary catalyst for its entry onto the cobalt production stage is the advanced development of the Tshukudu Metals’ T3 Project. While starting from a low base, the project is notable for its high-grade copper-cobalt ore and its location within Botswana’s stable and mining-friendly jurisdiction, which is a significant draw for cautious investors. The government’s recent revisions to the mining code, designed to incentivize value-added mineral processing, are creating a conducive environment for such strategic projects. As the CEO of Tshukudu Metals noted in a Q4 2024 investor update, “Botswana offers a unique proposition: a first-world regulatory framework paired with world-class mineral potential. Our T3 project is not just a mine; it’s a foundational asset for a new, critical minerals hub in Southern Africa.”

The economic implications of this nascent sector are profound for Botswana, representing a crucial step in its long-term strategy to diversify its economy beyond diamonds. For the local population, the development promises skilled employment opportunities and the growth of ancillary industries in the Kalahari Copper Belt region. However, the journey is not without its challenges; Botswana must compete for capital and attention against more established mining jurisdictions and must build its cobalt-specific infrastructure and expertise from the ground up. While a modest figure, it marks the beginning of a strategic journey that could see Botswana become a reliable, albeit niche, supplier of high-grade cobalt to the market.

9. Zambia

Estimated 2025 Production: Approximately 2,500 tonnes.

Zambia, a historic cornerstone of the Central African Copperbelt, is on a determined path to revive its cobalt fortunes after years of operational and fiscal challenges. The country’s cobalt is exclusively a by-product of its massive copper mining industry, with key contributions from legacy operations like Mopani Copper Mines and First Quantum Minerals’ Kansanshi mine. The year 2025 is poised to be a pivotal period of stabilization and strategic repositioning following the government’s successful debt restructuring and the acquisition of Mopani by a new consortium promising fresh investment. A Lusaka-based mining analyst recently commented, “Zambia’s cobalt story is one of untapped potential. With the right policy consistency and investment in modern processing, it could easily double its output by 2030.”

The impact of a resurgent mining sector on Zambia’s economy cannot be overstated. Increased cobalt and copper production directly translates to higher foreign exchange earnings, government revenue, and formal employment in the Copperbelt province. For the people of Zambia, a thriving mining sector funds essential public services and infrastructure projects. The government’s ambition is clear, focusing on initiatives to attract foreign direct investment into mineral processing to capture more of the value chain domestically. This figure represents a cautious recovery, with the potential for significant growth hinging on the successful execution of its revitalization strategy and favorable commodity prices.

8. South Africa

Estimated 2025 Production: Approximately 3,000 tonnes.

South Africa’s cobalt production profile is unique, as it is almost entirely derived as a by-product from the vast platinum group metal (PGM) mines of the Bushveld Igneous Complex. Mining giants like Sibanye-Stillwater and Impala Platinum recover cobalt from their smelting and refining streams, meaning South Africa’s output is intrinsically linked to the health and operational stability of the PGM market. In 2025, with PGM demand expected to remain steady amid a complex automotive sector transition, cobalt production is forecast to be consistent. A Sibanye-Stillwater sustainability report highlighted this synergy, stating, “Our cobalt recovery initiatives are a core part of our resource stewardship strategy, ensuring we maximize the value and minimize the waste from every tonne of ore we mine.”

From an economic standpoint, cobalt provides a valuable revenue stream diversification for South Africa’s PGM miners, improving the overall viability of their operations in a fluctuating market. For the nation, it represents an additional, though secondary, source of export earnings from its well-established mining sector. The communities around the Bushveld Complex benefit from the sustained economic activity that this multi-commodity mining supports. South Africa’s role is that of a reliable, steady supplier, whose output is less about explosive growth and more about the efficient and sustainable co-production of critical minerals.

7. Uganda

Estimated 2025 Production: Approximately 4,000 tonnes.

Uganda is poised to make its formal debut on the global cobalt production map in 2025, a landmark achievement for its nascent mining industry. The primary driver is the commissioning of the Kilembe Mines tailings project, an innovative venture focused on reprocessing historical copper-cobalt tailings left from past mining operations. This approach not only unlocks value from waste but also minimizes the environmental footprint associated with greenfield mining. The project has attracted significant interest from international investors seeking exposure to new sources of cobalt outside the DRC. The Ugandan Minister for Energy and Mineral Development proclaimed at the project’s ground-breaking, “Kilembe marks a new dawn for Uganda’s mineral sector. We are open for business and ready to become a responsible and transparent supplier of the critical minerals the world needs.”

The economic and social impact for Uganda is transformative. The development of a formal, modern mining sector creates high-skilled jobs, fosters technical training, and generates substantial government royalties. For the local population in the Kilembe region, it promises revitalized infrastructure and economic opportunity. The success of this flagship project is crucial, as it is expected to serve as a catalyst for further investment in Uganda’s underexplored mineral wealth. As a new entrant, Uganda’s initial contribution may be modest, but it signals the opening of a new, prospective frontier for cobalt in East Africa.

6. Morocco

Estimated 2025 Production: Approximately 4,500 tonnes.

Morocco carves out a distinctive niche in the African cobalt landscape as the home of the continent’s only primary cobalt mine, the long-operating Bou Azzer mine, managed by the industrial conglomerate Managem Group. This unique status means its production is not subject to the ebbs and flows of copper or nickel prices, providing a rare and consistent stream of cobalt to the market. In 2025, Managem continues to focus on operational efficiencies and deeper exploration to steadily increase output from this strategic asset. The company has secured its market position through long-term off-take agreements directly with European automotive manufacturers, a testament to the high value placed on traceable and non-DRC associated supply. A Managem spokesperson stated, “Bou Azzer is a strategic asset for Europe’s battery ecosystem. We provide a transparent, ESG-compliant, and reliable source of cobalt, which is increasingly the premium that OEMs are willing to pay for.”

This strategic positioning provides Morocco with stable export revenues and cements its role as a key partner in Europe’s green transition plans. For the local economy around Bou Azzer, the mine is a cornerstone of industrial activity and employment. The Moroccan government supports this sector as part of its broader industrial strategy, seeing critical minerals as a gateway to higher-value manufacturing and international partnerships. While not the largest producer, Morocco’s consistent, primary production and its strategic alignment with Western markets make it an disproportionately influential player in the global cobalt narrative.

5. Tanzania

Estimated 2025 Production: Approximately 5,500 tonnes.

Tanzania is rapidly emerging as a significant new source of cobalt, with its output primarily emerging as a valuable by-product from its burgeoning gold and nickel sectors. The most significant contributor in 2025 is the advanced Kabanga Nickel Project, one of the world’s largest and highest-grade undeveloped nickel sulphide deposits, which contains substantial cobalt credits. After successful project financing and development throughout 2024, Kabanga is set for its first full year of meaningful production, marking a pivotal moment for the country. A project director at Kabanga noted, “We are not just building a nickel mine; we are building a battery-grade metals facility. The cobalt recovered here will be a key component in making Tanzania a hub for the EV supply chain.”

The economic windfall for Tanzania is substantial, adding a high-value battery metal to its traditional export portfolio of gold and diamonds. This diversification strengthens the national economy and increases government revenue. For the local population, the development of a large-scale, modern project like Kabanga brings infrastructure investment, job creation, and skills transfer in a region previously underdeveloped from a mining perspective. Tanzania’s entry into the top five signifies a major shift, highlighting its potential to become a long-term, multi-commodity supplier to the global battery industry.

4. Madagascar

Estimated 2025 Production: Approximately 7,000 tonnes.

Madagascar is on the cusp of a dramatic transformation into a major cobalt producer, driven by the resurrection of the massive Ambatovy nickel-cobalt mine. After a period of care and maintenance, the mine has been acquired by a new consortium and is undergoing a meticulous ramp-up towards its full design capacity. Ambatovy is a technological marvel, utilizing high-pressure acid leach (HPAL) technology to process lateritic ore, making it one of the most complex and significant battery metal projects globally. A statement from the new owners confirmed, “Our phased plan for Ambatovy is on track. We are committed to not only restoring production but also setting new benchmarks for environmental and social governance in Madagascar’s mining sector.”

The impact of Ambatovy’s full-scale return cannot be overstated for the Malagasy economy. It is projected to become the largest single contributor to the nation’s GDP and export earnings, providing a transformative influx of capital. For the people, it represents thousands of direct and indirect jobs and an unprecedented opportunity for industrial skill development. However, the project also carries the weight of immense responsibility to operate sustainably and share benefits equitably with local communities. Madagascar’s position as the #4 producer is a testament to its vast potential, positioning it as a future cornerstone of the global nickel and cobalt supply.

3. Zimbabwe

Estimated 2025 Production: Approximately 8,000 tonnes.

Zimbabwe has rapidly cemented its status as a formidable force in the cobalt market, with production surging from its rich geological endowments. Output is sourced from two primary streams: as a by-product of platinum mining along the Great Dyke from operations like Karoo Resources’ Selkirk Mine, and increasingly, from cobalt contained in hard-rock lithium deposits, where Zimbabwe is also becoming a major player. The government’s “use-it-or-lose-it” policy on mineral claims and its general openness to foreign investment have accelerated project development. A Harare-based mining consultant observed, “Zimbabwe is witnessing a mining boom, and cobalt is a key beneficiary. The geology is world-class, and the political will to develop it has never been stronger.”

This mining-led growth is providing a vital stimulus to the Zimbabwean economy, generating crucial foreign currency and creating employment in a country that desperately needs both. For communities, new mining projects bring roads, schools, and clinics, though this is often accompanied by social displacement and environmental concerns that require careful management. Zimbabwe’s trajectory is sharply upward, and with its extensive mineral reserves, it has the clear potential to challenge for a higher position on this list in the near future.

2. Rwanda

Estimated 2025 Production: Approximately 9,000 tonnes.

Rwanda’s remarkably high ranking is a function of geography, logistics, and governance rather than large-scale primary mining. The country has established itself as the preeminent regional hub for the formalization and export of artisanal and small-scale mining (ASM) cobalt, a significant portion of which originates from the neighboring DRC. By providing a stable, efficient, and transparent trading environment, Rwanda attracts a volume of cobalt that, when combined with its own small but growing domestic production, places it second only to the DRC itself. A report from the International Energy Agency (IEA) on critical minerals noted, “Rwanda’s Kigali has become a crucial node in the African cobalt trade, demonstrating how governance and infrastructure can create a strategic commercial gateway.”

This role as a trading hub provides immense economic benefits for Rwanda, generating substantial service-based revenues, creating jobs in logistics and compliance, and bolstering its position as a center for business in East-Central Africa. For the people, it fosters a skilled services sector. However, this model is not without controversy, as it raises complex questions about the formalization and traceability of ASM materials and their origins. This figure underscores Rwanda’s immense influence on the market, acting as a critical conduit for cobalt units that might otherwise enter informal or opaque supply chains.

1. Democratic Republic of Congo (DRC)

Estimated 2025 Production: Approximately 170,000 – 190,000 tonnes.

The Democratic Republic of Congo stands in a league of its own, a colossus whose dominance over the global cobalt market is projected to remain absolute in 2025. The nation is expected to supply an astonishing 75-80% of the world’s cobalt, a figure that underscores the strategic dependency of the global energy transition on its geological wealth. This output is a dual-stream phenomenon: the vast, industrial-scale mines operated by international giants like Glencore (Kamoto Copper Company) and CMOC (Tenke Fungurume Mine) form the backbone, while the extensive, informal artisanal and small-scale mining (ASM) sector collectively contributes a volume larger than any other single African nation. A Glencore operational update succinctly stated, “The scale and grade of the DRC’s copper-cobalt deposits are unparalleled. Our investments in Katanga are long-term commitments to sourcing the critical minerals essential for decarbonization.”

The economic impact of cobalt in the DRC is profound, representing a primary source of national export earnings and formal employment. However, this wealth has historically been marred by governance challenges, corruption, and a tragic failure to translate mineral riches into broad-based development for the Congolese people. The ASM sector, which employs hundreds of thousands, is characterized by perilous working conditions and human rights concerns, driving intense global efforts to establish ethical and traceable supply chains. The DRC’s position is unassailable; its geological endowment and established production base ensure it will remain the cornerstone of the global cobalt supply for decades, making its stability and responsible management a concern of global significance.

https://www.africanexponent.com/top-10-cobalt-producers-in-africa-in-2025/