In Summary

- Africa’s food imports are projected to reach $110 billion per year by the end of 2025.

- The Maputo Declaration in 2003 called for increased public investment in agriculture and higher agricultural productivity growth.

- Crop production in Africa is projected to increase from 1.007 billion metric tons in 2019 to 1.213 billion metric tons by 2030 and 1.473 billion by 2043.

Deep Dive!!

Agriculture remains a cornerstone of Africa’s economic development, contributing to the livelihoods of over 60% of the population across the continent. For example, in 2023, Niger’s agricultural sector contributed over 47% to the GDP, while Comoros and Ethiopia saw contributions of approximately 37% and 36% respectively.

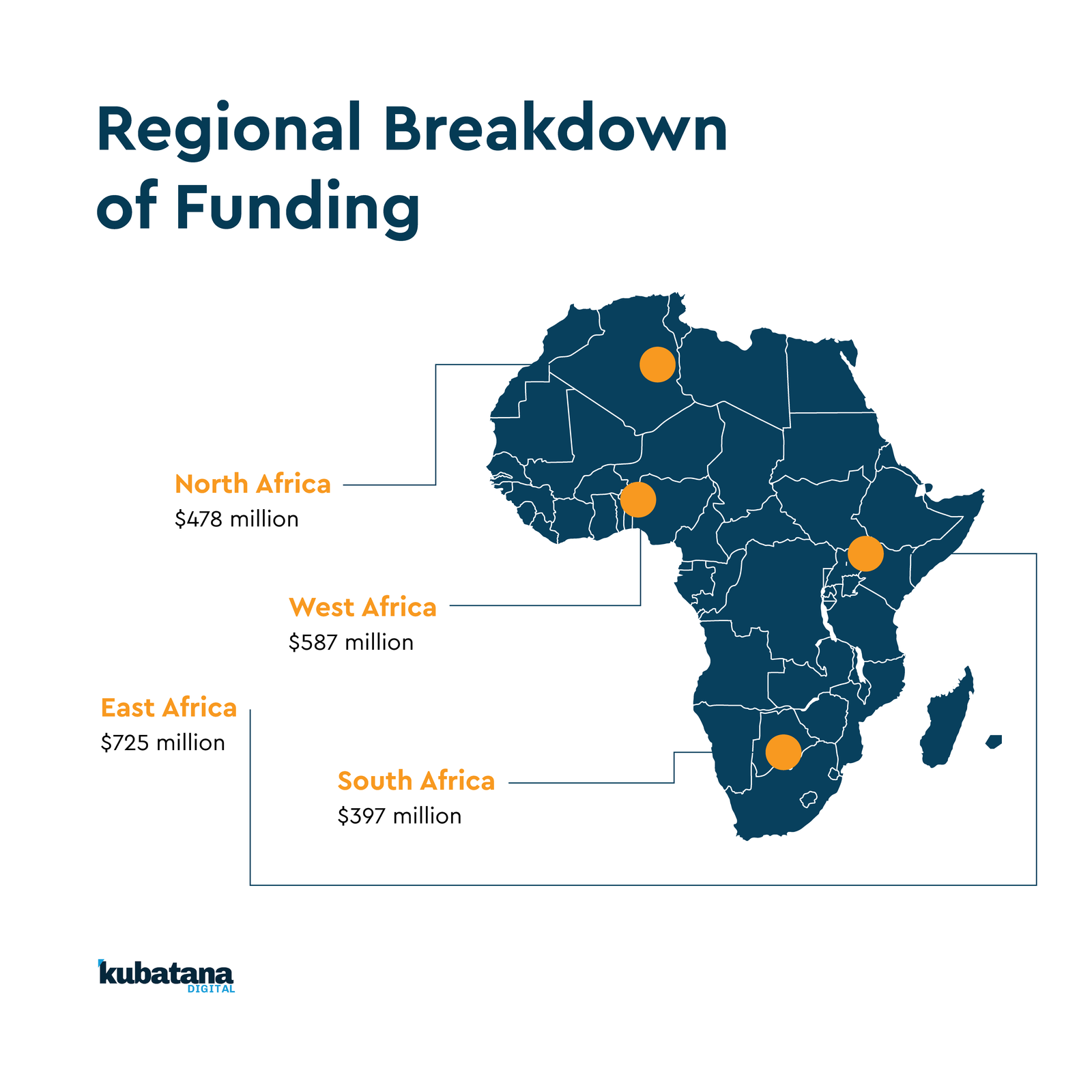

However, despite its importance, Africa’s agricultural sector faces numerous challenges, including limited access to financing, inadequate infrastructure, and climate change. According to reports, by the end of 2025, Africa is expected to import $110 billion worth of food annually. The continent’s agriculture sector is significantly impacted by cheap commodity imports, making it challenging for smallholder farmers to compete. To address this, the Maputo Declaration in 2003 called for increased public investment in agriculture and higher agricultural productivity growth.

Following the declaration, governments, international organizations, and private investors are increasingly focusing on creating incentives to attract investment in the sector; one of the ways of achieving this is through agricultural investment incentive programs. These programs are designed to support agribusinesses, promote sustainable farming practices, and improve food security across the continent. They aim to create an enabling environment where farmers, agribusinesses, and entrepreneurs can access the necessary resources, technical expertise, and market opportunities to thrive.

Since their introduction, there have been remarkable improvements. Crop production in Africa has been steadily increasing. In 2019, 1.007 billion metric tons of crops were produced, a significant increase from 365 million metric tons in 1990. Forecasts suggest a further increase to 1.213 billion metric tons by 2030 and 1.473 billion by 2043.

This article highlights the Top 10 Agriculture Investment Incentive Programs in Africa for 2025, providing an in-depth look at the key initiatives that are helping to transform the agricultural landscape.

Here are the Top 10 Agriculture Investment Incentive Programs in Africa in 2025. Check them out!

[Note: The list is in no particular order]

1. Comprehensive Africa Agriculture Development Programme (CAADP)

- Overview: CAADP is an African Union-led initiative aimed at boosting agricultural productivity and investment across the continent.

- Key Features:

- Targets raising agricultural productivity by at least 6% per annum.

- Encourages countries to allocate at least 10% of their national budgets to agriculture.

- Focuses on improving food security and reducing poverty.

- Impact: CAADP has been instrumental in shaping agricultural policies and attracting investments in numerous African countries.

2. Green Investment Program for Africa (GIPA)

- Overview: GIPA, managed by the African Development Bank, aims to scale climate finance and green technologies in Africa.

- Key Features:

- Supports projects that promote sustainable agriculture and renewable energy.

- Provides funding and technical assistance to green initiatives.

- Impact: GIPA has facilitated the development of several climate-smart agricultural projects across the continent.

3. Financing for Agri-SMEs in Africa (FASA)

- Overview: FASA is a fund of funds that unlocks financing for agricultural SMEs by supporting investment vehicles active in the sector.

- Key Features:

- Provides capital to SMEs involved in agriculture.

- Focuses on enhancing access to finance for small and medium enterprises.

- Impact: FASA has been pivotal in improving the financial inclusion of agri-SMEs, thereby fostering growth in the agricultural sector.

4. Aceli Africa

- Overview: Aceli Africa aims to unlock the growth and impact of agricultural SMEs by bridging the gap between capital supply and demand.

- Key Features:

- Provides financial products tailored to the needs of agri-SMEs.

- Focuses on enhancing the capacity of financial institutions to lend to the agricultural sector.

- Impact: Aceli Africa has facilitated increased investment in the agricultural sector, leading to enhanced productivity and sustainability.

5. SAIS Investment Readiness Programme

- Overview: The SAIS Investment Readiness Programme offers a year-long, customized development plan for African tech start-ups in agriculture, livestock, food, and climate sectors.

- Key Features:

- Provides mentorship and capacity-building support.

- Aims to prepare startups for investment opportunities.

- Impact: The program has helped numerous startups scale their operations and attract investment.

6. Market Access Africa 2025

- Overview: Market Access Africa 2025 focuses on agro-processing, regional trade integration, and innovation to set the stage for long-term economic growth in Africa’s agricultural sector.

- Key Features:

- Promotes regional trade and integration.

- Encourages innovation in agro-processing.

- Impact: The initiative has contributed to the development of robust agricultural value chains across the continent.

7. BRICS+ Agriculture Investment & Trade Summit 2025

- Overview: The BRICS+ Agriculture Investment & Trade Summit aims to unleash global opportunities in Africa through women agripreneurs.

- Key Features:

- Focuses on empowering women in agriculture.

- Provides a platform for networking and investment opportunities.

- Impact: The summit has facilitated increased investment in women-led agricultural enterprises.

8. AgDevCo Funding Initiative

- Overview: AgDevCo is a specialist investor in African agribusinesses, providing funding to scale operations and enhance productivity.

- Key Features:

- Offers long-term, patient capital to agribusinesses.

- Focuses on sustainable and inclusive growth.

- Impact: AgDevCo’s investments have led to the establishment of several successful agribusinesses across Africa.

9. African Development Bank’s Agro-Processing Zones Initiative

- Overview: The African Development Bank is mobilizing $2.2 billion to develop agricultural processing zones in 28 states in Nigeria to boost food security and create jobs.

- Key Features:

- Establishes processing facilities closer to farmers.

- Aims to reduce post-harvest losses and strengthen value chains.

- Impact: The initiative is expected to enhance food security and generate employment opportunities in Nigeria.

10. Helios Africa Climate Fund

- Overview: Helios Investment Partners has raised an initial $200 million for its Africa-focused climate fund, aiming to support green transitions in Africa.

- Key Features:

- Invests in low-carbon energy, climate-smart agriculture, and other sustainable sectors.

- Provides financial opportunities for climate entrepreneurs.

- Impact: The fund aims to become the largest Africa-focused climate fund, supporting sustainable development across the continent.

Conclusion:

Each program not only aims to enhance agricultural productivity and sustainability but also seeks to address critical challenges such as food insecurity, rural poverty, and the environmental impact of traditional farming practices. Whether it’s through direct funding, capacity building, or creating partnerships for international trade, these programs are crucial for fostering long-term growth and resilience in the sector.

These programs represent a concerted effort by governments, development institutions, and the private sector to transform Africa’s agricultural landscape. By providing financial support, technical assistance, and market access, they aim to enhance productivity, sustainability, and resilience in the agricultural sector. For investors and entrepreneurs, these initiatives offer valuable opportunities to engage in Africa’s burgeoning agribusiness sector.

https://www.africanexponent.com/top-10-agriculture-investment-incentive-programs-in-africa-2025/