In Summary

- African economies face a complex web of structural constraints, including a persistent continent-wide trade finance gap estimated at about US$100 billion.

- South Africa stands at the forefront, with the Public Investment Corporation (PIC) managing approximately ZAR 2.693 trillion (USD 142 billion) in assets as of March 2024, making it Africa’s largest asset manager.

- Uganda’s institutional investment sector is emerging, with entities like the National Social Security Fund (NSSF) playing a pivotal role.

Deep Dive!!

Institutional Investors are organizations or entities that invest large sums of money in financial markets on behalf of their members, clients, or stakeholders. These investors typically include pension funds, insurance companies, mutual funds, hedge funds, sovereign wealth funds, endowments, and other large entities that pool capital for the purpose of generating returns.

They play a crucial role in financial markets due to their substantial capital, expertise, and long-term investment horizons, which enable them to influence market dynamics, improve liquidity, and support the funding of large-scale projects. Their investments typically span across various asset classes, including stocks, bonds, real estate, and alternative investments.

Within the last decade, the institutional investment sector in Africa has continued to evolve, with certain countries emerging as leaders in institutional capital mobilization. These investors, including pension funds, insurance companies, sovereign wealth funds, and other large financial entities, are increasingly shaping the future of Africa’s capital markets.

Here, we explore the top 10 African countries with the largest proportion of institutional investors in 2025, examining the factors contributing to their dominance in this space, their growth projections, and how they continue to influence both regional and global investment trends.

10. Mozambique

Mozambique is increasingly becoming an attractive destination for institutional investors, particularly in the energy and infrastructure sectors. The country’s significant natural resource reserves, including natural gas, coal, and minerals, are drawing attention from both local and international institutional investors. The Mozambique Stock Exchange (BVM) has also seen gradual growth, with increasing institutional interest in its public offerings and government bonds. Additionally, the government’s infrastructure development projects, such as the construction of roads, bridges, and ports, present lucrative opportunities for long-term investors.

As Mozambique continues its economic expansion, institutional investors are expected to focus on capitalizing on opportunities in energy, mining, and infrastructure development. With government initiatives aimed at improving the ease of doing business and attracting foreign investment, Mozambique’s institutional investment sector is poised for growth in the coming years.

9. Ethiopia

Ethiopia’s institutional investment landscape is still in its early stages but holds considerable promise due to the launch of the Ethiopian Securities Exchange (ESX) in January 2025.

The government’s economic reforms and market liberalization efforts are expected to attract institutional investors seeking exposure to the country’s rapidly developing markets. The launch of the ESX provides a platform for institutional investors to participate in the country’s economic growth, especially in sectors such as agriculture, infrastructure, and manufacturing.

As Ethiopia continues its modernization efforts, the country’s institutional investors are expected to focus on long-term investment opportunities in infrastructure and industrial projects. The government’s ongoing commitment to financial sector development and the establishment of a robust regulatory environment will play a critical role in attracting institutional capital. With projections for steady economic growth, Ethiopia’s market will likely become increasingly attractive to institutional investors looking for new frontiers in Africa.

8. Tanzania

Tanzania’s capital markets have witnessed gradual growth, particularly in the government debt market, where institutional investors play a dominant role. The Dar es Salaam Stock Exchange (DSE) has been expanding, with institutional investors taking a more active role in government bonds and other fixed-income instruments. The Tanzanian government’s push to improve the investment climate through initiatives like infrastructure bonds has attracted institutional investors looking for stable, long-term returns.

In the future, Tanzania’s institutional investors are expected to focus more on infrastructure and industrial growth, particularly in the energy, transportation, and telecommunications sectors. The government’s strategic initiatives aimed at improving the capital markets and facilitating foreign investment will continue to strengthen institutional investor participation. Tanzania’s growth potential in sectors such as renewable energy and manufacturing positions the country as an attractive investment destination for institutional players.

7. Uganda

Uganda’s institutional investment sector is emerging, with major entities like the National Social Security Fund (NSSF) playing a pivotal role. The NSSF is one of the largest institutional investors in the country and has been instrumental in driving growth in Uganda’s capital markets. The listing of companies such as MTN Uganda on the Uganda Securities Exchange has provided new investment opportunities for institutional investors. Uganda’s institutional investors are also focusing on the growing real estate market, with increasing interest in infrastructure projects driven by government investments.

As the country’s financial market continues to mature, institutional investors are likely to focus on opportunities in agriculture, infrastructure, and energy. The government’s commitment to improving the business environment through economic reforms and liberalization is expected to attract more institutional capital in the coming years. Uganda’s emerging financial sector has significant potential for growth, making it an attractive option for institutional investors seeking long-term returns.

6. Zambia

Zambia’s Lusaka Securities Exchange (LuSE) has experienced notable growth, with increasing participation from institutional investors. Government-led initiatives to promote capital market development, such as the introduction of green bonds and the GEM Portal for small and medium-sized enterprises, have contributed to this expansion. Zambia’s institutional investors, including pension funds and insurance companies, have become more active in the market, seeking long-term investment opportunities in sectors like infrastructure, mining, and energy.

Looking forward, Zambia’s institutional investment sector is expected to benefit from the government’s focus on infrastructure development and resource extraction. Additionally, the country’s efforts to promote financial market transparency and strengthen regulatory frameworks will likely attract more institutional investors. The growing interest in sustainable investments, particularly in renewable energy and mining, will further diversify Zambia’s institutional investment base.

5. Morocco

Morocco has a strong institutional investment sector, with pension funds, insurance companies, and sovereign wealth funds playing a key role in the country’s financial markets. The Casablanca Stock Exchange (CSE) is one of the largest in Africa by market capitalization, and institutional investors have shown growing interest in the market’s opportunities. The CSE has experienced significant growth, with a 70% increase in daily trading volume to $37.5 million in 2024 and a 20% rise in total market capitalization to $77.6 billion.

Morocco has also benefited from its proximity to European markets, which has attracted foreign institutional investors seeking exposure to African markets. The country’s institutional investors are increasingly looking to diversify their portfolios by investing in sectors such as infrastructure, renewable energy, and consumer goods.

Going forward, Morocco is expected to maintain its leadership in institutional investment in North Africa. The financial sector is undergoing regulatory reforms aimed at further boosting institutional participation, particularly in green financing and sustainable development. With a well-developed infrastructure and a growing middle class, Morocco’s institutional investors are well-positioned to expand their portfolios across the African continent.

4. Kenya

Kenya’s institutional investment sector has seen steady growth in recent years, with increasing participation from pension funds and insurance companies. The Nairobi Securities Exchange (NSE) has taken several initiatives to attract institutional investors, including the introduction of Real Estate Investment Trusts (REITs) and infrastructure bonds. These efforts have proven effective, as institutional investors now constitute a more significant portion of the market, contributing to its depth and liquidity.

Kenya’s financial markets are also benefiting from the growing interest in renewable energy, infrastructure, and real estate. In addition, Kenya’s pension industry has shown remarkable growth, with assets under management reaching KSh 2.25 trillion (approximately USD 18 billion) by December 2024, marking a 14% increase from the previous year.

As Kenya continues to develop as an emerging market, the country’s institutional investors are likely to focus more on government-backed infrastructure projects and green investment funds. The ongoing economic reforms, coupled with a more stable macroeconomic environment, will continue to provide institutional investors with new avenues for growth. The introduction of more advanced financial products and the expansion of capital markets will ensure that Kenya’s institutional investment sector becomes increasingly attractive to both local and international players.

3. Egypt

Egypt has made strides in enhancing its institutional investment sector, supported by entities such as the National Investment Bank and various pension funds. The Egyptian Exchange (EGX) reached its highest-ever market capitalization of LE 2.29 trillion (approximately USD 74 billion) in December 2024. Additionally, Egypt attracted a landmark investment deal in February 2024, with the Abu Dhabi sovereign wealth fund ADQ committing $35 billion to purchase development assets, signaling strong institutional investor confidence.

These reforms, including the flotation of the Egyptian pound and improvements in fiscal policies, have opened up the market to foreign investors, making Egypt an increasingly attractive destination for institutional capital. The Egyptian government has also pursued privatization programs, which have further spurred institutional investment in sectors such as energy, construction, and telecommunications.

Moving forward, Egypt’s institutional investors are expected to focus on high-growth sectors, especially those benefiting from government infrastructure projects and the expansion of the Suez Canal Economic Zone. The introduction of new financial instruments like Real Estate Investment Trusts (REITs) and green bonds will likely provide institutional investors with additional opportunities. With the ongoing reform agenda, Egypt’s institutional investors are poised to play a significant role in the country’s economic transformation.

2. Nigeria

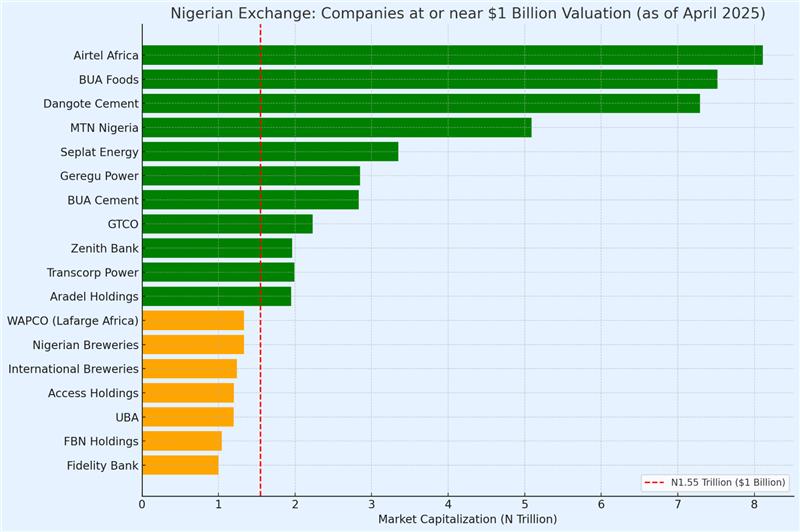

Nigeria’s institutional investment sector has grown significantly over the past decade, with the Nigerian Exchange Group (NGX) seeing increased participation from local institutional investors, including pension funds, insurance companies, and the Sovereign Wealth Fund. The Nigeria Sovereign Investment Authority (NSIA) manages assets aimed at long-term development projects, reflecting Nigeria’s increasing focus on utilizing its financial sector for national development. Pension funds in Nigeria have grown to manage assets worth over USD 20 billion, and these funds play an essential role in both public and private sector investments. The Nigerian capital market has become a vital component of the economy, enhancing market liquidity and depth, which, in turn, fosters more robust economic growth.

In the near future, Nigeria’s institutional investors are expected to focus on infrastructure and real estate investments, with increasing interest in sectors such as fintech, agriculture, and energy. The ongoing market reforms by the Central Bank of Nigeria (CBN) and Securities and Exchange Commission (SEC) to deepen the capital market and ensure better regulatory oversight will continue to attract institutional investors. The Nigerian financial market is also poised to benefit from technological innovations such as fintech and blockchain, which may further improve market efficiency and expand the institutional investment base.

1. South Africa

South Africa remains the continent’s leader in institutional investment, driven by its well-established financial infrastructure and regulatory environment. The Public Investment Corporation (PIC), which manages approximately ZAR 2.693 trillion (USD 142 billion) in assets as of March 2024, is one of Africa’s largest institutional investors.

The Johannesburg Stock Exchange (JSE) continues to be Africa’s largest stock exchange by market capitalization, with a substantial portion of its trading volume influenced by institutional investors. This dynamic has led South Africa to be a hub for both local and international investors seeking diverse investment opportunities in equity, fixed income, and alternative assets. The country’s financial sector benefits from strong regulation and transparency, which supports long-term investor confidence and helps mitigate risks.

Looking forward, South Africa’s institutional investors are expected to focus more on sustainable and impact investing, which aligns with global investment trends. The introduction of green bonds and other sustainable financial products is likely to boost institutional participation in sectors such as renewable energy and infrastructure, further diversifying their portfolios. The South African market also stands to benefit from stronger investor relations and deeper integration with global capital markets, attracting even more institutional players in the coming years.

https://www.africanexponent.com/top-10-african-countries-with-the-largest-institutional-investors-proportion-in-2025/