Bitmine, the crypto firm led by Wall Street veteran Tom Lee, has expanded its Ethereum treasury once again, purchasing another $69 million worth of ETH through Galaxy Digital’s over-the-counter (OTC) desk.

The latest acquisition brings Bitmine’s holdings to roughly 1.95 million ETH, valued at $8.66 billion, according to Arkham data.

Blockchain transaction records show a series of large transfers carried out between Galaxy Digital and Bitmine in recent hours.

The settlements included 3,247 ETH ($14.55 million), 3,258 ETH ($14.6 million), 4,494 ETH ($20.06 million), and 4,428 ETH ($19.77 million), totaling 15,427 ETH, about $69 million, in under an hour.

The structured timing suggests coordinated OTC settlements, which allow institutional buyers to accumulate large amounts without disrupting open market prices.

Bitmine Crosses 2M ETH, Controls Nearly 2% of Ethereum’s Supply

The purchase underlines Bitmine’s aggressive accumulation strategy. Data shows that Ethereum accounts for nearly the entirety of its $8.65 billion portfolio, positioning the firm as the largest corporate ETH treasury holder.

Other tokens in its portfolio are negligible by comparison, including minor holdings of MakerDAO’s MKR and a handful of experimental tokens with only a few thousand dollars in value.

Bitmine’s latest purchase follows a series of substantial buys over recent weeks. On September 11, the company received 46,255 ETH worth $201 million from a BitGo wallet across three addresses. A week earlier, on September 4, Bitmine acquired 80,325 ETH valued at $358 million from Galaxy Digital and FalconX.

These acquisitions have lifted its total stash well above 2 million ETH in circulation, equivalent to about 1.8% of Ethereum’s entire supply.

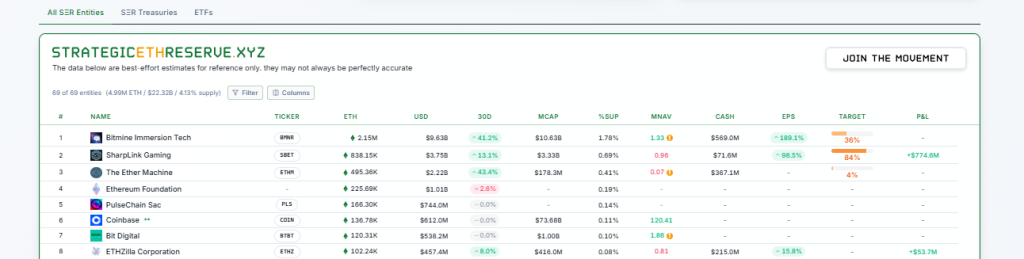

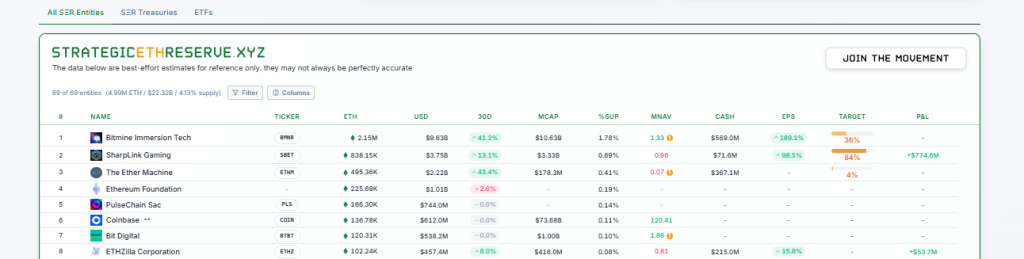

According to treasury reserve data, corporate and institutional entities now collectively hold about 4.99 million ETH worth $22.2 billion, representing 4.13% of the token’s circulating supply.

Bitmine leads this group with 2.15 million ETH, valued at $9.59 billion at peak pricing, followed by SharpLink Gaming with 838,000 ETH ($3.74 billion) and The Ether Machine with 495,000 ETH ($2.2 billion).

The Ethereum Foundation, by comparison, holds about 225,000 ETH, while Coinbase’s treasury sits at 136,800 ETH.

The scale of Bitmine’s holdings has drawn comparisons to Strategy’s long-standing bitcoin strategy under Michael Saylor, where large corporate accumulation became a cornerstone narrative for BTC’s institutional adoption.

Bitmine appears to be positioning itself as Ethereum’s equivalent, building a multi-billion-dollar ETH balance sheet as a long-term treasury reserve.

Ethereum itself has been trading under pressure despite the accumulation. At the time of writing, ETH is changing hands at $4,465, down 2.8% in the past 24 hours and 4.2% over the week.

Ethereum Treasury Firms Expand Holdings Amid SPAC Deals and Buybacks

The competition among Ethereum treasuries is heating up as corporate strategies evolve under market pressure.

On September 17, The Ether Machine, an Ethereum-focused treasury firm, filed a draft registration statement with the SEC to go public via a merger with Nasdaq-listed SPAC Dynamix Corporation.

The deal, first announced in July, is expected to close in the fourth quarter, pending shareholder approval. The company has built a sizable position of 495,362 ETH after adding 150,000 ETH in August.

Meanwhile, SharpLink Gaming announced the repurchase of 1 million shares at an average price of $16.67, part of its ongoing buyback program.

Since late August, the firm has repurchased nearly 1.94 million shares, citing undervaluation as the driver. SharpLink reported a net asset value of $3.86 billion, or $18.55 per share, and confirmed it carries no outstanding debt.

Analysts say Ethereum is emerging as the key beneficiary of the digital asset treasury (DAT) boom.

In a report this week, Standard Chartered’s global head of digital assets research, Geoffrey Kendrick, argued that ETH-focused treasuries are better positioned than their Bitcoin and Solana counterparts.

Unlike Bitcoin, Ethereum and Solana generate staking yield, which supports higher valuations and long-term sustainability.

Since June, Ethereum treasuries have accumulated about 3.1% of the token’s circulating supply. With valuations for many DATs under pressure, consolidation is expected, but Ethereum-focused firms appear to be gaining ground.

The post Tom Lee’s Bitmine Buys Another $69M ETH, Holds Massive $8.66B Stack appeared first on Cryptonews.

https://cryptonews.com/news/tom-lees-bitmine-buys-another-69m-eth-holds-massive-8-66b-stack/

Standard Chartered said Ethereum has benefited more than Bitcoin or Solana from digital asset treasury buying, citing stronger staking yields.

Standard Chartered said Ethereum has benefited more than Bitcoin or Solana from digital asset treasury buying, citing stronger staking yields.