One thing to start: Donald Trump signed an executive order targeting Jenner & Block, a law firm with ties to a former prosecutor who investigated allegations of collusion between Russia and his first presidential campaign, in the government’s latest broadside against the legal industry.

And another thing: Delaware is set to adopt sweeping changes to its governance laws making it more hospitable to billionaire-led companies as it faces growing competition from other states for corporate domiciles.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: [email protected]

In today’s newsletter:

The Rolls-Royce of CEOs?

Investors in Rolls-Royce finally have something to cheer about.

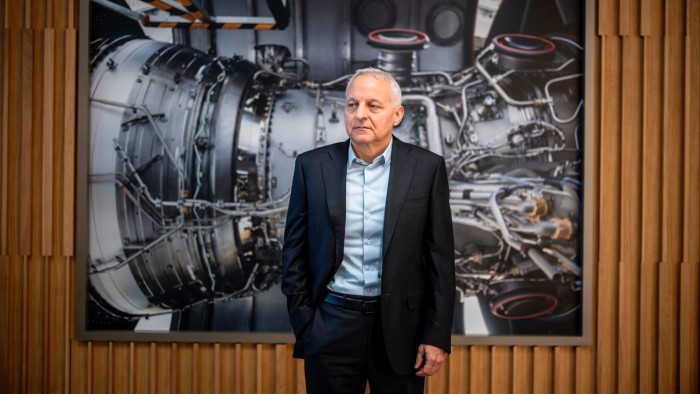

Shares in Britain’s blue-chip engineering group have risen almost eightfold since the arrival of new chief executive Tufan Erginbilgiç in January 2023.

It’s a dramatic change for a company that Erginbilgiç had told staff was a “burning platform” upon taking its reins.

That assessment shocked many inside the company of 42,000 people, especially since Erginbilgiç had arrived at headquarters with little name recognition.

But the former BP executive, who was passed up for the oil giant’s top job in 2020 after losing out to Bernard Looney, had done thorough work, reports the FT’s Sylvia Pfeifer in a profile of Erginbilgiç.

He had already spoken with shareholders, visited sites and even paid an external consultant to benchmark Rolls-Royce’s performance before entering the job. It prepared Erginbilgiç to make big changes at a company whose engines power many of the world’s largest civil aircraft.

The sheer size and speed of the turnaround of Rolls-Royce has prompted debate over whether Erginbilgiç is simply a lucky general riding the resurgence of the aviation industry or whether he has engineered a genuine reset.

It’s a debate that Erginbilgiç is keen to put to an end. Flying hours — a key metric for Rolls-Royce as its civil aerospace business makes most of its money when its engines are in the air — are only just back at pre-pandemic levels, he points out.

And yet financial results for last year showed operating profit margins almost tripled from 5.1 per cent in 2022 to 13.8 per cent in 2024. Dividend payouts have been restored. All the result of a carefully executed, four-point transformation plan, says the CEO.

Erginbilgiç’s can-do approach is en vogue in Europe as capitals across the continent ramp up defence spending in response to pressure from US President Donald Trump. The calls to action have lifted defence groups such as Rheinmetall and inspired animal spirits among “meme” traders that had abandoned European markets.

So where does Rolls-Royce go next? Notwithstanding any unforeseen events, Erginbilgiç says there is more to come.

The company’s defence business should benefit from higher military spending, while its power systems division, which makes gas and diesel engines for power generation, should similarly see demand from data centres.

Growth, too, should come in the civil aerospace business. Rolls-Royce is in the prime position of not having to spend any money right now on a new engine programme.

But what investors really want to see is whether Erginbilgiç can take the company back into the market for narrow-body jets. These typically fly short to medium-haul journeys and represent the biggest share of the market by volume.

If he can convince Airbus or Boeing to consider Rolls-Royce’s new engine still in development, the UltraFan, to power their next generation of narrow-body aircraft, even his current doubters will have little to complain about.

The allure of a Swiss bank account

Switzerland’s financial industry has come a long way from the velvet curtain-clad bank offices and whispered discretion made famous in James Bond films.

But for wealthy Americans, the Swiss bank account still holds enormous appeal — especially in uncertain times.

The election of Trump has prompted a rush by clients to move more assets to Switzerland, say wealth and asset managers. Many of these, they add, are anti-Maga Democrats.

Geneva-based private bank Pictet said its US entity, which is one of the biggest Swiss-domiciled wealth managers, has had a “significant uptick” from both new and existing American clients this year.

Josh Matthews, UK-based co-founder of Maseco, which provides wealth management services for Americans abroad, said the last time he had seen this type of interest was during the financial crisis.

A wealth manager involved with cross-border clients said they were helping a wealthy US family move between $5mn and $10mn to Switzerland.

The push factor is “fear” and Trump, says Pierre Gabris, founder and managing partner of Zurich-based Alpen Partners, which has an entity registered with the Securities Exchange Commission called Alpen International.

The appeal of Switzerland comes despite the introduction of regulations that put an end to sidestepping of tax authorities for Americans.

Swiss banks in 2013 adapted to US tax rules by increasing transparency, complying with the Foreign Account Tax Compliance Act, and sharing information on American account holders to avoid legal penalties.

Having some assets in a Swiss account adds a “layer of security and protection” in the minds of many wealthy clients, says one Zurich-based lawyer.

“This isn’t about avoiding taxes or making your money untouchable, it is about putting at least some of your assets somewhere stable, neutral and safe at a time when the US is looking increasingly unpredictable,” the person adds.

Job moves

-

CVC has appointed Jean-Pierre Saad as a managing partner, where he will lead private equity technology investments in Europe. He previously worked for KKR.

-

Robinhood has appointed John Hegeman to its board of directors. He currently works as chief revenue officer at Meta.

-

News Corp’s chief technology officer David Kline is stepping down from his role for a job outside the company. He’ll stay on until the end of June while the media group looks for his replacement.

-

Chad Williams, the founder of data centre giant QTS Data Centers, has stepped down as chief executive after two decades building the Blackstone-owned group into an industry giant. Longtime executives David Robey and Tag Greason have been named co-CEOs.

-

Aquarian Holdings has formed a new holding company called Aquarian Insurance Holdings, which includes Somerset Reinsurance, Investors Heritage and Hudson Life. The new entity will be led by John Frye and Jeff Burt.

Smart reads

Buy the dip Retail traders are barrelling into US stocks even as professional investors head for the exits, the FT writes.

401k chasers The world’s biggest private equity firms are pushing for a piece of Americans’ nest eggs, Bloomberg reports. It’s the final frontier in bringing private assets into the mainstream.

Hotshot to bankruptcy The biotech group 23andMe created a revolutionary technology that connected long-lost relatives and traced back generations, Lex writes. But it never nailed a sustainable business.

News round-up

PwC fined £2.9mn for audit failures at Sanjeev Gupta’s former bank (FT)

Tesla sales fall sharply in Europe despite upswing in electric vehicle market (FT)

Ticketmaster under fire from UK watchdog over Oasis ticket pricing (FT)

Tom Hayes asks UK Supreme Court to overturn Libor-rigging conviction (FT)

Standard Chartered fails to narrow £1.5bn lawsuit over Iran sanction breaches (FT)

Governments should nationalise smelters to compete with China, says Trafigura (FT)

Shell slashes costs in ‘relentless’ drive to close valuation gap with US rivals (FT)

Segro partners with Oaktree-owned Pure on £1bn data centre in London (FT)

Chinese developer Sunac unveils unprecedented second restructuring (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco. Please send feedback to [email protected]

Recommended newsletters for you

India Business Briefing — The Indian professional’s must-read on business and policy in the world’s fastest-growing large economy. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here

https://www.ft.com/content/5d8baa3c-b5e2-4b57-9d05-d83d29fa7cdf