Polymarket has opened a new prediction market centered on Pump.fun, the Solana-based meme coin launchpad that has rapidly become one of the most active platforms in the crypto ecosystem.

The market lets users wager on whether Pump.fun’s token, PUMP, will reach a new all-time high by December 31, 2025.

At present, the betting odds are split evenly, with “Yes” and “No” outcomes each priced at 50%. The balance reflects uncertainty among traders, who are weighing Pump.fun’s rapid growth against questions about its long-term sustainability.

Pump.fun Drives Nearly 13M Token Launches on Solana, $500M in Fees Collected

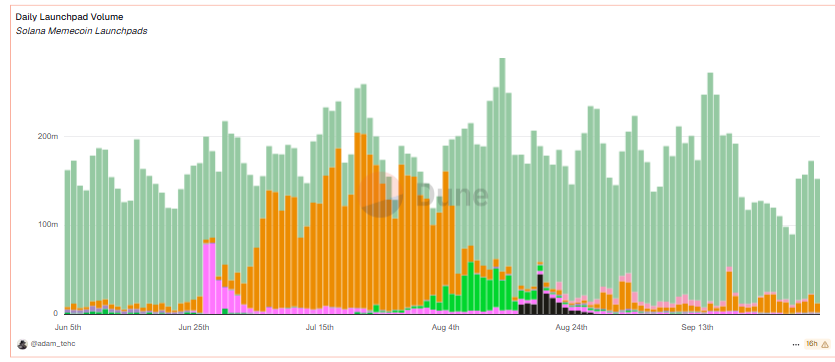

Since launching in early 2024, Pump.fun has facilitated the creation of more than 7 million tokens, according to Galaxy Research. Nearly 13 million of the 32 million tokens on Solana have been launched through Pump.fun, marking a near 300% increase in under two years.

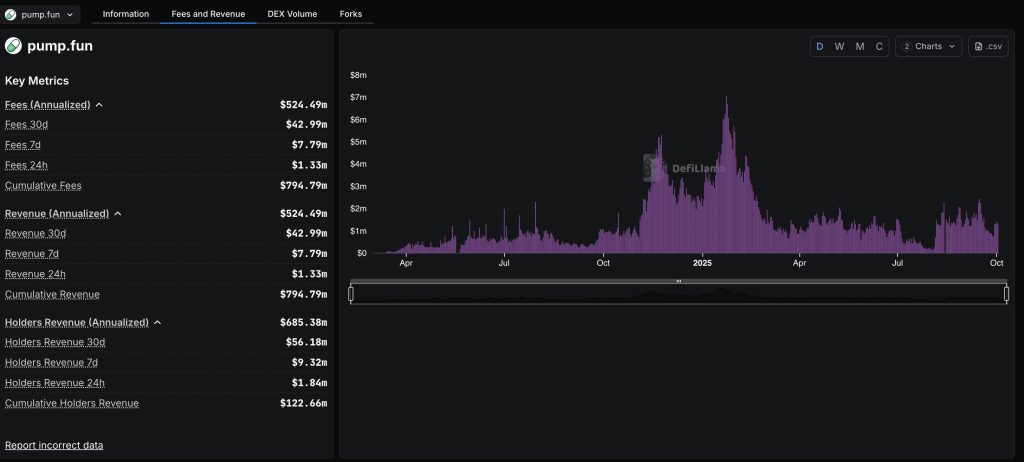

Tokens on the platform represent $4.8 billion in fully diluted market value, while Pump.fun itself has generated close to $500 million in fees.

The platform’s expansion has had a direct impact on the wider Solana ecosystem. High trading volumes on Pump.fun have funneled liquidity into Solana, at times supporting gains in SOL’s price.

At its peak, Pump.fun revenue reached $13.48 million in a single week between August 11 and August 17, its strongest performance since February. Over the past 30 days, the launchpad has generated around $120 million in fees, according to DefiLlama.

Daily activity remains high. In the last 24 hours, Pump.fun recorded $134.3 million in trading volume and 114,457 active addresses. More than 20,000 new tokens were deployed on the platform, while 95 “graduates” advanced beyond the bonding curve stage. Fees collected over the same period totaled $1.29 million.

Despite these milestones, concerns linger. Data shows that 98.6% of Pump.fun tokens are classified as scams or pump-and-dump projects, raising questions about sustainability.

Median holding times for Solana meme coins have also collapsed to about 100 seconds, down from 300 seconds a year earlier, showing the dominance of bots and scalpers in trading activity.

Pump.fun launched its own token, PUMP, in July through an initial coin offering that raised $500 million in under 12 minutes. The token has since seen sharp moves.

It reached an all-time high of $0.008819 but now trades at $0.007028, about 20% below that peak but still up 75% in the past 30 days. Its market capitalization stands at $2.48 billion, ranking it 66th on CoinGecko.

The introduction of Polymarket’s new betting market adds another dimension to the story, giving investors a structured way to quantify sentiment.

With odds currently split, the market highlights both confidence in Pump.fun’s explosive growth and caution over the volatility of meme coin-driven ecosystems.

Pump.fun Token Gains Momentum Amid Ecosystem Upgrades and Institutional Interest

Pump.fun has continued to draw attention with a mix of ecosystem updates, exchange listings, and corporate adoption, fueling bullish sentiment for its native token, PUMP.

The platform’s major upgrade, Project Ascend, announced on September 2, introduced a new creator fee structure aimed at improving token sustainability. The system, called Dynamic Fees V1, lowers fees as market capitalization rises, encouraging long-term projects rather than short-lived speculative launches.

The move, coupled with faster approvals for community-led token takeovers, helped PUMP rally more than 10% on the day of the reveal.

Expansion efforts have followed swiftly. In mid-September, Binance added PUMP to its spot market, offering traders a chance to share in a 350 million token reward pool.

On October 1, Pump.fun announced new payment integrations with Apple Pay, Robinhood, Phantom, and others, streamlining onramps for users with low fees and instant trading access

Institutional interest has also emerged. On October 2, Australia’s Fitell Corporation disclosed a purchase of 216.8 million PUMP tokens worth $1.5 million, adding them to its treasury as part of a broader Solana-focused investment strategy.

The firm, rebranding as Solana Australia Corporation, recently secured a $100 million credit line to deepen its crypto exposure.

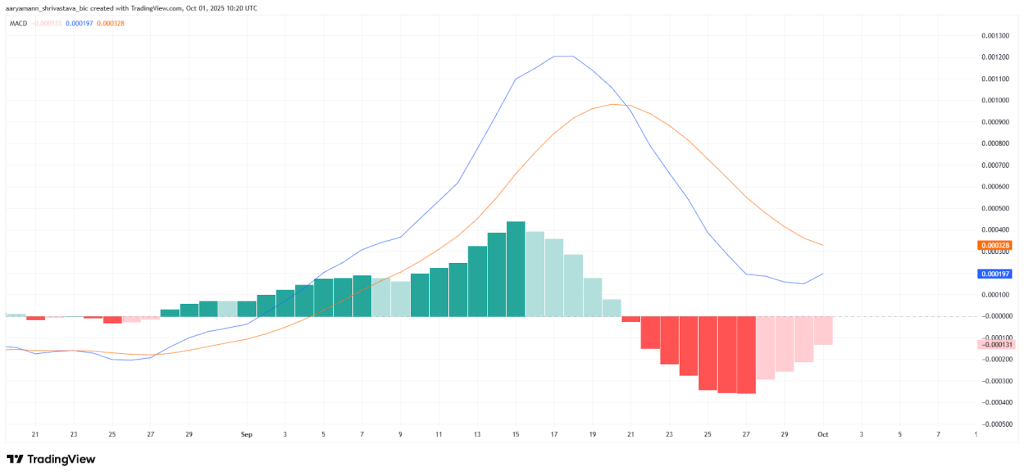

Technical indicators suggest momentum may be building. Analysts point to a potential bullish crossover on the MACD and rising capital inflows shown by the Chaikin Money Flow, both signaling stronger investor demand.

PUMP, trading near $0.0066, is attempting to hold $0.0062 as support, with targets of $0.0077 and $0.0090 if buying pressure continues.

https://cryptonews.com/news/pump-fun-ath-this-year-polymarket-split-50-50-as-500m-meme-coin-factory-faces-crash-fears/