Stay informed with free updates

Simply sign up to the Media myFT Digest — delivered directly to your inbox.

Springer Nature, one of the world’s biggest academic publishers, has announced plans for a long-delayed initial public offering, in a major test of appetite for fundraising on Europe’s public markets.

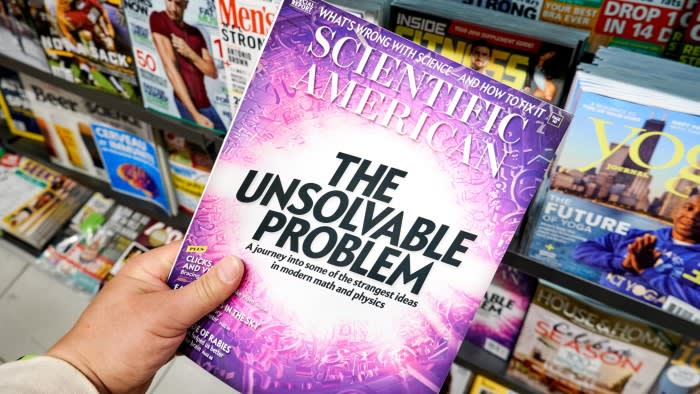

The Berlin-based company, which is partly owned by private equity group BC Partners and publishes journals including Nature and Scientific American, said on Thursday that it planned to raise €200mn in a listing in Frankfurt before the end of the year.

A flotation would be among the largest in Europe this year and could value the publisher at roughly €7bn, including debt, according to people familiar with the matter.

BC Partners first bought into the publisher in 2013 and now owns a 47 per cent stake. The listing would allow the group to sell shares.

Holtzbrinck Publishing Group, a privately owned company that owns the remaining 53 per cent, does not intend to sell shares.

Springer Nature last year posted revenues of €1.9bn, up 5.2 per cent, and adjusted operating profit of €511mn, an increase of 7 per cent.

The IPO, which could be completed in the second half of 2024, has been long delayed; an initial attempt was halted in 2020 during the Covid-19 pandemic.

It would be Europe’s first big market debut for the second half of the year. The continent saw several IPOs go through successfully earlier in 2024, including Swiss skincare company Galderma.

Before this year, Europe had been enduring a slowdown in IPOs as rising interest rates and choppy markets deterred companies from seeking listings given uncertain investor appetite.

However, a stabilising economic outlook, lower rates and a desire by private equity groups to cash out from some of their investments has led to more deals this year.

While large offerings such as Galderma and private equity group CVC have gained in trading since their IPOs, others have fared less well.

The March listing of German perfume retailer Douglas flopped, while Spanish beauty group Puig has also fallen since its May debut.

Springer Nature, which competes with UK-listed rival Relx, estimated that the size of the global research publishing market in 2023 was €10.2bn. The group sees the use of artificial intelligence and other technology as a big driver of future growth in its trade publications and data.

Frank Vrancken Peeters, its chief executive, said: “Springer Nature is well positioned to continue to deliver in a resilient and growing research market by employing technology to generate real benefits for the academic community.”

https://www.ft.com/content/a8beb1ed-9958-4e82-ad38-696a36804b7e