The very first US spot Ethereum exchange-traded funds (ETFs) launched on this day one year ago and have come a long way. With over $8 billion in total net inflow, rising investor momentum, and potential staking on the way, the future seems bright for this vehicle, analysts argue.

ETFs are considered a highly useful vehicle for both adoption and investment as they open doors to a diverse range of investors who otherwise may not consider entering the space.

After finally receiving a final approval from the US Securities and Exchange Commission (SEC), the nine spot Ethereum ETFs began trading on 23 July 2024. On that day, they netted a combined trading volume of more than $1 billion.

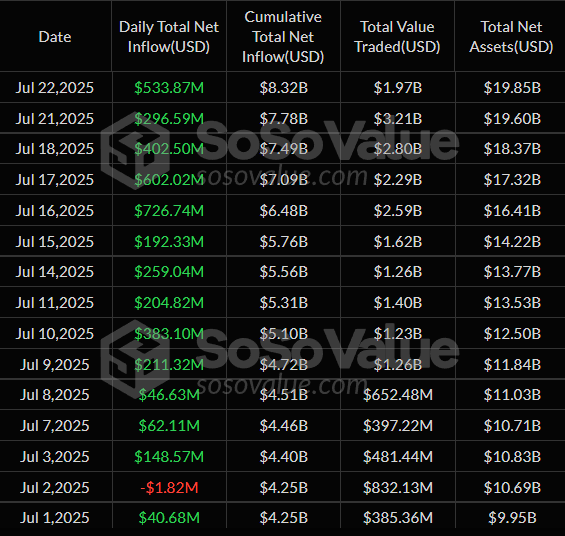

On 23 July 2025, closing with the trading on 22 July, the total net inflow into these funds has reached $8.32 billion.

This is substantially lower than their Bitcoin counterparts’ total of $54.55 billion. However, spot Ethereum ETFs have been gaining momentum recently. This is also evident in the number of consecutive days of positive flows, as well as the daily inflows hitting all-time highs.

Ethereum ETFs: Reaching the Third-Highest Daily High

On Tuesday, the funds recorded inflows of $533.87 million – the third highest ever.

The current ATH is $726.74 million, seen on 16 July, followed by $602.02 million the very next day.

Additionally, Tuesday marked the thirteenth consecutive day of positive flows for the funds combined.

The streak follows a day of minor outflows: $1.82 million on 2 July.

Moreover, as the chart above shows, the value of total net assets continued to rise in July. It hit an all-time high on Tuesday at $19.85 billion.

Meanwhile, not every one of the nine trades the same, or sees any flows at all, depending on the day. BlackRock commonly leads the list with the highest flows, be they positive or negative.

On Tuesday, three funds saw positive flows, while the others recorded no flows at all. BlackRock took in $426.22 million. It’s followed by Grayscale’s $72.64 million and Fidelity’s $35.01 million.

In comparison, on 16 July, when the ETFs hit their ATH, BlackRock recorded $499.25 million. Fidelity took in $113.31 million. Six other funds saw inflows.

Katherine Wu, the COO of ENS Labs, the organization behind the open-source blockchain naming protocol, Ethereum Name Service (ENS), commented that “these are massive numbers that speak volumes: institutions aren’t just paying attention, they’re allocating.”

This surge represents the highest single-day inflows for Ethereum ETFs in four months. It coincides with ETH’s climb above $2,800 for the first time since February, pushing the asset to a 12-day high.

The remarkable momentum began building in…

What’s Next: Price

Sean Dawson, Head of Research at onchain options platform Derive.xyz, recently commented on Ethereum’s price surge, after it had surpassed $3,500.

“BTC is participating,” Dawson said, “but this rally belongs to ETH.” There is actually a structural shift in positioning underway, highlighted by the technical setup, option flows, and liquidations.

What’s more, ETF momentum, rising institutional inflows, bullish macro tailwinds, falling rates, and “an overwhelming shift in sentiment” may turn the second half of 2025 Ethereum’s strongest in years.

“This isn’t just a spike, it’s a regime change. We’re seeing explosive upside bets and a wave of short liquidations. The market may finally be waking up to ETH’s asymmetric upside,” Dawson concluded.

At the time of writing, Ethereum trades at $3,677. It’s down 0.7% in a day, 16.7% in a week, 63.2% in a month, and 4.6% in a year.

It recorded its ATH of $4,878 in November 2021, decreasing 24.6% since.

That said, many analysts and researchers argue that we may see its price finally reclaim the $4,000 level relatively soon.

Meanwhile, Wu stated that the approval of the Ethereum ETF was a watershed moment for the crypto industry. This move has legitimized ETH for both mainstream investors and institutions.

“For years, crypto has pushed to build infrastructure that traditional finance would take seriously,” Wu writes in an email. “With the Bitcoin ETFs, institutions got access to a scarce, sovereign store of value. With the Ethereum ETFs, they’re getting something different: a productive, programmable asset that underpins stablecoins, tokenization, real-world assets, and more. The ETH ETF didn’t just validate an asset class — it validated an ecosystem.”

Market sentiment is firmly in greed territory, reflecting bullish investor psychology.

Soaring Institutional Demand and Record Network Growth on the Ethereum…

What’s Next: Staking ETFs

A more crypto-friendly situation in the US has led to companies seeking a wider range of ETFs, beyond BTC and ETH. They’re looking at altcoins, memecoins, and NFTs. These may take time, though.

Moreover, the US SEC is wary of allowing the spot Ether ETFs to stake the ETH they hold.

Katherine Wu of ENS Labs argues that we’re now entering a new phase of ETFs. “BlackRock’s recent filing to enable staking within its ETH ETF marks a shift in how Ethereum is viewed,” she says. It’s no longer about only holding ETH, but also utilizing those funds to earn yield.

“In-kind creations, staking exposure, and deeper ETF liquidity could reshape how traditional finance interacts with Ethereum. While this proposal is still pending, it underscores the growing institutional appetite for ETH and the expanding vision for what these products can offer.”

Additionally, Alon Muroch, co-founder of SSV Labs and Core Contributor to the SSV Network, also commented on this. The SEC said that staking is not a securities activity under specified circumstances. So “the next step is to push for the approval of staking ETFs before the end of 2025.”

The SEC is likely to improve the activity if institutions and industry work together to show that Ethereum staking is operational infrastructure and not a securities offering, Muroch says.

“Their approval will present a much more lucrative way to drive adoption, and continue the drawing together of TradFi and DeFi in increasingly productive partnerships. Ethereum is shaping up to become the foundation of the new digital economy.”

Moreover, Leo Fan, co-founder of Cysic, added that the spot ETF has validated ETH as a yield-generating asset.

ETFs incorporating staking and native yield will present “tangible real-world value, which is exactly what investors are looking for.” Therefore, approving staking yield for ETH ETFs could attract more buyers. “It is the natural next evolution for Ethereum ETFs in making it a more competitive ETF product,” Fan says.

Finally, Dan Hughes, the Founder of L1 Radix DLT, reminds that “substantial institutional capital has poured into” structured TradFi products, “vastly outweighing any retail exposure.”

Therefore, “as approval looms for staking-enabled ETFs and the packaging of other assets, we need to examine who exactly will benefit from any regulatory green lights. It’s inevitable that further collaborations between TradFi and DeFi will gain regulatory approval; the more interesting question is whether the resulting framework will empower genuine innovation or simply transfer traditional power structures into digital assets.”

Hughes continues: “If regulatory approval overwhelmingly favours well-connected institutional players, then we risk recreating TradFi’s gatekeeping mechanisms within crypto, which is exactly what decentralised finance was meant to circumvent.”

On Friday, the U.S. Securities and Exchange Commission (SEC) postponed a decision on approving options trading for Ether exchange-traded funds (ETFs), extending its review period beyond the initial deadline.

The proposal, submitted by asset managers including BlackRock and Fidelity, seeks to introduce options trading for Ethereum ETFs.

Multiple exchanges are affected by the postponement, including the Cboe Exchange, which proposed listing options for Ethereum ETFs such as the…

The post One Year of US Spot Ethereum ETFs – How Far Have They Come and What’s Next? appeared first on Cryptonews.

https://cryptonews.com/news/one-year-of-us-spot-ethereum-etfs-how-far-have-they-come-and-whats-next/

https://t.co/Y9icfuq6u9

https://t.co/Y9icfuq6u9