MetaMask has entered the on-chain derivatives market with the launch of perpetual futures trading directly inside its mobile app, a move seen as a challenge to centralized exchanges.

The update, announced on Oct. 8 by Consensys, introduces “MetaMask Perps,” powered by decentralized exchange Hyperliquid. The feature allows users to trade more than 150 tokens with up to 40x leverage while maintaining full control of their private keys.

MetaMask Turns Wallet Into Full Trading Platform With New “Perps” Tab

The rollout marks a major expansion of MetaMask’s trading capabilities. Users can now open long or short positions on popular tokens like Bitcoin, Ethereum, LINEA, and BONK without leaving the app.

Funding can be done using any EVM-compatible token, such as ETH, USDT, or BNB, which is automatically converted to USDC for trading without additional swap fees.

MetaMask said the integration offers the same level of trading performance expected from centralized exchanges but within a fully self-custodial framework.

The redesigned mobile interface includes instant trade execution, live market charts, and a suite of risk management tools such as stop-loss, take-profit, and limit orders.

Trades settle within seconds, allowing users to react to price movements on the go. To begin trading, users must update to MetaMask Mobile version 7.56 or later, then access the new “Perps” tab on the home screen.

Once funded, traders can open and manage positions with a single tap, monitor them in real-time through push notifications, and close positions anytime.

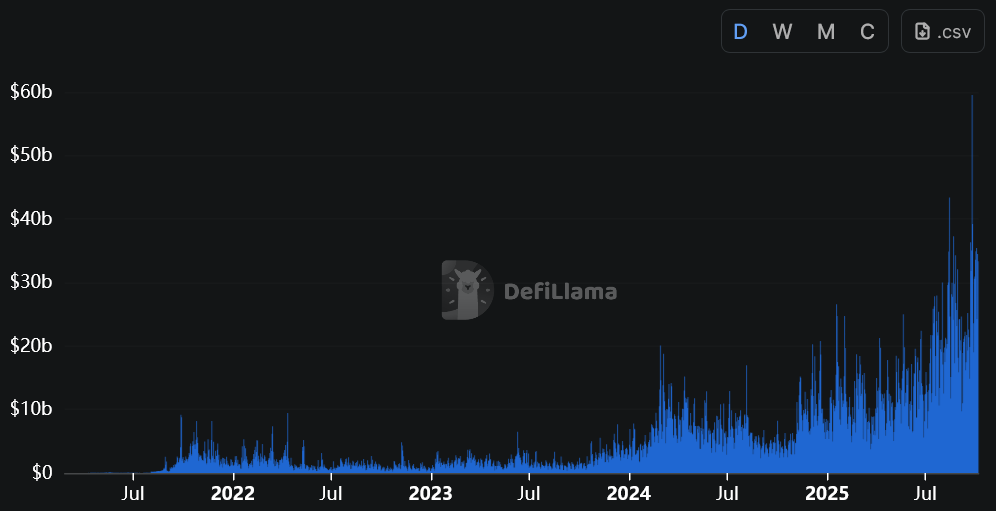

The launch comes amid surging demand for decentralized perpetuals. According to DefiLlama, DeFi-based perps trading volumes exceeded $1.14 trillion in September, with platforms like Hyperliquid, Aster, and Lighter driving activity.

Hyperliquid currently dominates the sector, recording record-breaking volumes of over $59.5 billion on Sept. 25 alone.

MetaMask’s global product lead, Gal Eldar, described the launch as a step toward transforming MetaMask into an all-in-one, self-custodial trading platform.

“By embedding the Hyperliquid engine directly into our wallet and optimizing it for mobile, we’re offering a frictionless path for passive holders to become active traders,” he said.

MetaMask’s entry into the market comes as competition among trading platforms intensifies. In recent months, Phantom Wallet introduced a similar perps feature for Solana users, also using Hyperliquid’s infrastructure, while Kraken launched its custodial “Kraken Perps” platform in September.

The move places MetaMask in direct competition with centralized exchanges such as Binance and OKX, which have long dominated the perpetuals market. But unlike those platforms, MetaMask Perps operates without custodial risk; users retain control of their assets at all times.

MetaMask Expands Offerings with Stablecoin, and Token Launch Plans

The launch of MetaMask Perps follows weeks of speculation after GitHub code updates revealed plans for a “Perps” tab and Hyperliquid deposit flow

In September, there was a rumor that code updates on MetaMask’s public GitHub suggested the wallet is preparing to integrate perpetual futures trading through a partnership with Hyperliquid, a decentralized derivatives exchange built on its own Layer 1 network.

References to a “Perps” trading screen and USDC deposit flow indicate users will soon be able to trade leveraged derivatives directly within the MetaMask interface.

Notably, the wallet is entering a new phase of expansion following a series of major updates.

Consensys CEO and Ethereum co-founder Joseph Lubin confirmed that MetaMask’s long-awaited token, dubbed MASK, “may come sooner than expected.”

Lubin said the token will support the decentralization of MetaMask’s ecosystem. The announcement follows years of speculation and renewed optimism among users anticipating a large airdrop for active wallet holders.

MetaMask has also launched MetaMask USD (mUSD), its first native stablecoin, making it the only major self-custodial wallet to issue one. The stablecoin aims to enhance liquidity and utility across decentralized finance.

In August, the wallet introduced social login functionality, allowing users to create or recover accounts using Google or Apple credentials without compromising self-custody. The feature employs advanced cryptographic techniques, ensuring that neither MetaMask nor login providers can access private keys.

Together, these developments signal MetaMask’s shift from a simple Ethereum wallet to a full-fledged DeFi hub, integrating trading, payments, and stable assets while preserving user control.

https://cryptonews.com/news/metamask-unleashes-cex-killer-with-new-in-wallet-perps-trading/