Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

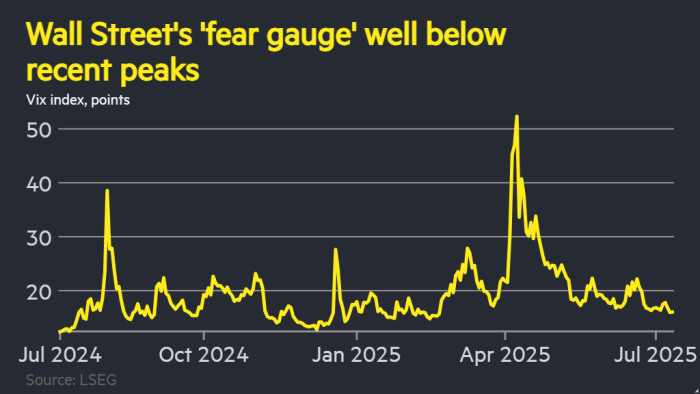

Market volatility has dropped to near its lowest levels of the year and stocks are trading at record highs as anxiety over Donald Trump’s tariffs melts away despite the latest escalation of his trade war.

The Vix index, a measure of short-term expected volatility in the S&P 500, has fallen to 16, well below its long-run average of about 20. A similar index for expected volatility in the US government bond market is close to its lowest levels in three years.

At the same time, Nvidia has led a surge in tech stocks as the chipmaker reached an unprecedented $4tn valuation on Wednesday.

The moves come even as the US president unleashed a barrage of fresh trade threats this week, including a 50 per cent tariff on copper, 200 per cent on the pharmaceutical sector and levies on countries including Japan, South Korea and the Philippines.

“I don’t care about tariffs any more,” said Max Kettner, head of multi-asset strategy at HSBC. “This is all self-imposed. What’s to stop them saying, let’s give it another three months?”

Trump’s latest moves on tariffs bring their levels closer than some analysts had expected to the steep duties he unveiled in early April on dozens of US trading partners.

However, those initial so-called “reciprocal” tariffs were later postponed and renegotiated after stocks cratered, and Trump then pushed back again the deadline for implementing the duties from July 9 to August.

As a result, investors are now taking the US president’s current threats much less seriously than they took his early rhetoric, and are betting that the president will ultimately step back from tariffs that seriously harm US growth.

The trade has become known in markets as “Taco”, an acronym for “Trump Always Chickens Out”.

“May 12 onwards, that was the big game-changer,” said Kettner, referring to the date the US struck a deal with China in which both sides sharply reduced their previously planned tariffs, prompting investors to move back into risky assets.

“We learned that there is a Trump put,” he added.

In currency markets, Trump’s threat of 50 per cent tariffs on Brazil knocked the real on Wednesday, but broader markets are calm.

CME Group indices of expected swings in exchange rates such as euro-dollar are significantly down from their April highs and are at roughly the level where they traded at the start of the year.

“There’s a view that the Trump administration is unlikely to want a repeat of the disruption triggered by the ‘liberation day’ tariffs in early April,” said Lee Hardman, senior currency analyst at MUFG.

Matthias Scheiber, head of multi-asset at US asset manager Allspring Global Investments, said: “I can see it being tested, but would expect the Taco trade to stay, with any volatility presenting a buying opportunity.”

But investors warned that the exuberant sentiment in equity markets in itself could encourage Trump to increase his aggression on trade more than the market at present anticipates.

“With US equities at a record high and the budget passed, there is a risk Trump could be emboldened to go harder with tariffs than expected,” said Hardman.

Some investors are more alarmed that the market is pricing in a degree of complacency, with the S&P close to record highs and trading at a forward price-to-earnings ratio of 24. Stock indices in the UK and Germany are trading at all-time peaks.

“My concern is that there’s not a great margin of safety now in valuations,” said Kasper Elmgreen, chief investment officer of equities and fixed income at Nordea Asset Management.

“We have the biggest increase in tariffs in anybody’s living memory, but [the market] is taking a very relaxed view on what that might do,” said Elmgreen. “I’m concerned about the lack of concern.”

https://www.ft.com/content/5af6b3eb-1508-4073-bf9c-b60066d0dfc9