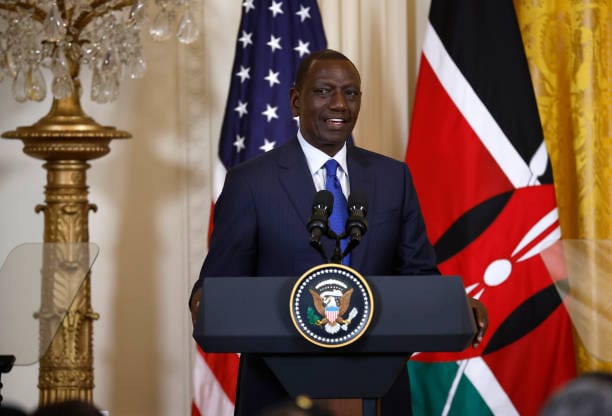

Nairobi, Kenya — Kenyans are coming to grips with the stark reality of rising taxes under President William Ruto’s administration, as he advocates for higher contributions to boost public services and reduce the national debt. President Ruto argues that Kenyans are currently under-taxed, despite widespread public frustration and protests over the escalating cost of living.

President Ruto contends that Kenyans have been “socialised to believe they pay the highest taxes,” but maintains that the overall tax burden in Kenya is lower compared to other African countries. “We must be able to enhance our taxes,” he stated, though he acknowledged the difficulty of this task.

Since his election in August 2022, Ruto’s government has implemented several tax increases and introduced new ones. These include higher taxes on salaries, a doubled sales tax on fuel, a new housing levy, and increased health insurance contributions. The president’s message is clear: to improve public services and alleviate the country’s debt, citizens must contribute more.

However, the public’s response has been overwhelmingly negative. Last year, the introduction of new taxes amidst rising living costs sparked deadly street protests. Today, conversations are dominated by the financial strain of taxation, exacerbating the exasperation of Kenyans who already feel overburdened.

Ruto highlighted that government tax revenue last year was 14% of the nation’s GDP, compared to an average of 22% to 25% in other African countries. However, it is unclear which countries he referred to as “peers.” While South Africa, Morocco, Mauritius, and Namibia have high tax-to-GDP ratios, many others, including Nigeria, Ghana, Uganda, Tanzania, and Zambia, do not. An African Union report indicated that the average tax-to-GDP ratio for the continent in 2021 was 15.6%, only slightly higher than Kenya’s.

Opposition figure and lawyer Miguna Miguna summed up the public’s frustration, stating, “Kenyans are overtaxed, repressed, exploited and abused,” and argued that people “don’t receive even 1% worth of value from our taxes!”

Despite the public uproar, President Ruto has indicated that more taxes are on the way, aiming to increase the tax-to-GDP ratio to at least 20% by the end of his term in 2027. He defends this approach as necessary to boost government revenue and reduce borrowing, addressing Kenya’s nearly $80 billion national debt inherited from previous administrations.

Government spokesman Isaac Mwaura emphasized the administration’s commitment to balancing debt repayment with economic regeneration. The government’s budget proposal for the next financial year includes new taxes on car owners and sales taxes on bread and financial transactions.

Economist Odhiambo Ramogi argues that focusing on the tax-to-GDP ratio is misguided. He suggests that the primary issue is inefficient tax collection and poor governance, leading to wasteful state spending. Despite rising taxes, the tax-to-GDP ratio has fallen, indicating that more people are withholding their money due to the disincentive effect described by the “Laffer curve.”

Ramogi points out that countries with high tax rates typically provide good public services, whereas Kenyans face double taxation, paying for public services out of pocket despite high taxes. He recommends improving tax collection efficiency and eliminating corruption to foster economic growth.

Ken Gichinga, CEO of Mentoria Economics, warns that higher taxes could be counterproductive, increasing the cost of doing business and leading to closures, job losses, and reduced income tax revenue. Economist and former MP Billow Kerrow also challenges the logic of raising the tax burden to match other African countries, noting that a high tax rate does not necessarily correlate with economic strength.

President Ruto remains steadfast in his tax policy, acknowledging the need for extensive public explanation. “People will complain but I know finally they will appreciate… We have to begin to live within our means,” he asserted, emphasizing the necessity of fiscal responsibility in his administration’s economic strategy.

https://www.africanexponent.com/kenyans-face-increased-tax-burden-under-president-rutos-economic-plan/