Kadena, once hailed as one of the most promising blockchain ventures, has announced that it is shutting down operations after running out of funds.

While the blockchain network will remain online due to its decentralized nature, the organization behind it said it will cease all business activity and active maintenance.

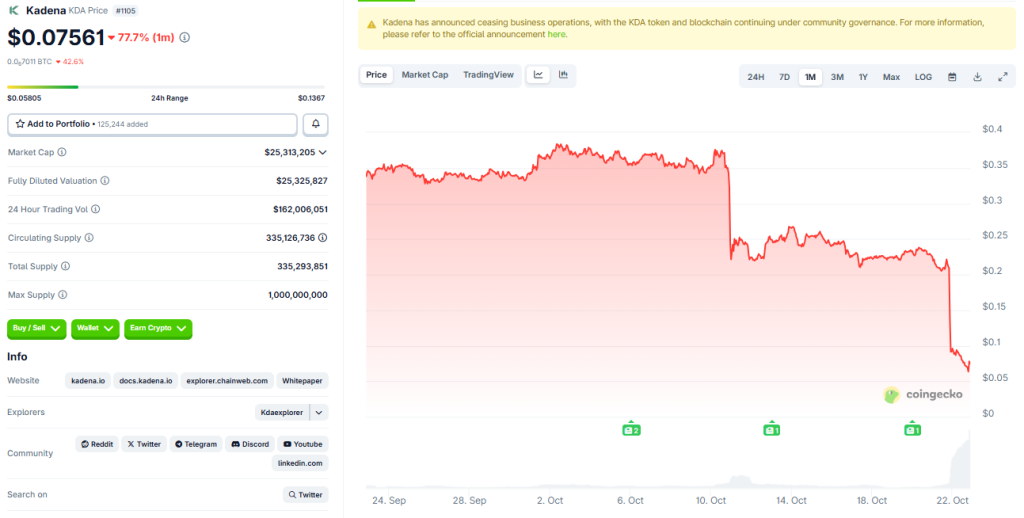

Kaneda’s announcement added that the decision came after market conditions made it impossible to sustain operations or promote the project’s adoption, as its native token dropped 77% over a month’s timeline.

The team said it would retain a small group of employees to oversee the transition process and assist with winding down operations.

The announcement quickly rippled through the market, and the impact was immediate.

Kadena Crashes 99% as Project Shuts Down, Exchanges Begin Delisting KDA

The announcement sent the Kadena token (KDA) into a steep decline. As of Tuesday, KDA was trading around $0.12, down more than 47% in the past 24 hours, 77% in a month, and more than 99% from its all-time high of $27.64 set in 2021, according to CoinGecko data.

Kadena’s mainnet went live in January 2020, promising to combine Bitcoin-style security with high throughput through an architecture known as “braided chains.”

At its peak in 2021, Kadena’s token reached a market capitalization of nearly $4 billion, supported by a growing community and a $100 million grant program for Web3 developers. But the network struggled to attract sustained adoption.

According to data from DeFiLlama, Kadena’s total value locked in DeFi has plunged to just $128,000, down 71% in 24 hours and a far cry from its all-time high of $11 million in August 2022.

Most of its DeFi protocols have suffered sharp declines in liquidity. Kadena Cabinet, a governance platform, dropped over 70% in TVL in the last day, while decentralized exchanges like KDSwap and Mercatus fell by 83% and 64%, respectively.

In the aftermath, exchanges have started delisting the token. OKX announced plans to delist KDA trading pairs (KDA/USDT and KDA/USD) by October 29, citing failure to meet listing requirements.

Deposits have already been suspended as of October 22, with withdrawals set to close on January 22, 2026. Additionally, Bybit announced the end of perpetual contracts on KDA, effective October 2nd, and has ceased all lending and borrowing services related to KDA at the time.

Despite Company Closure, Kadena Blockchain to Operate Uninterrupted

Kaneda said that while it is stepping away, the blockchain will continue to function independently as a proof-of-work network maintained by miners and governed by on-chain smart contract developers.

The company said it would soon release a new binary to ensure uninterrupted operation and encouraged all node operators to upgrade.

The project’s token and protocol will also continue to function, as 566 million KDA remain to be distributed as mining rewards through 2139.

Also, around 83.7 million KDA are still set to come out of lockup by November 2029. The team said it will engage with the community on transitioning to full community governance and maintenance.

Investors Reeling After Shutdown; Cardano’s Hoskinson Extends a Hand

The shutdown marks the end of a project that began with high expectations. Founded by former JPMorgan engineers Stuart Popejoy and William Martino, Kadena set out to build a scalable, proof-of-work blockchain designed for business use.

The founders had previously helped the bank explore blockchain initiatives before leaving to launch their own network.

Kadena’s fall has left investors reeling. On X, one longtime holder, Le Phu, wrote that he had lost more than 90% of his investment and accused the project of being a “scam,” noting that the team had continued making corrections and updates shortly before announcing the shutdown.

“My journey with KDA also ends here,” he said. “All my investments have lost value, and so has my faith in crypto.”

Some industry figures have responded with sympathy and possible interest. Cardano founder Charles Hoskinson publicly offered to connect with the Kadena community following the announcement, hinting at potential collaboration or support.

The shutdown has also reignited debate about the long-term sustainability of Layer-1 blockchains.

Kadena’s Shutdown Becomes a Cautionary Tale in Overcrowded Layer-1 Market

Analysts pointed out that despite Kadena’s technical innovations, the project struggled to attract users in a crowded market dominated by Ethereum, Solana, and their growing ecosystem of rollups and Layer-2 networks.

Crypto researcher Noveleader noted that Kadena “always struggled with the price action of their token and the ecosystem projects,” saying the community had been trying to engage with the team for years as momentum faded.

Data from DeFiLlama shows that over 100 rollups and more than 200 independent blockchains are currently active, yet most have fewer than 2,000 daily users.

Kadena’s collapse has become a cautionary example of how many projects built on technological ambition fail to secure meaningful adoption.

Founded on the promise of scalable proof-of-work innovation, Kadena was once positioned as “the blockchain for business.”

Yet, as user activity and liquidity shifted toward ecosystems with deeper network effects, Kadena’s vision faltered.

https://cryptonews.com/news/kadena-shuts-down-how-a-65-crash-and-cash-burn-ended-one-of-cryptos-most-ambitious-projects/