Bitcoin (BTC) has gone down by 1.5% in the past 24 hours to stand at $81,927. This would be the fourth consecutive day of losses for the top crypto and its sixth red session in the past seventh.

A total of $58 million worth of BTC long positions have been wiped during this period and a similar amount of Ethereum (ETH) has also been flushed out of the system as the price drops near key levels.

Analysts see the $80,000 level as a key support area to watch in the near term as these psychological thresholds tend to trigger a spike in buying volumes.

If BTC does bounce off the $80K level, this could propel the price of cryptocurrencies like XRP whose correlation with Bitcoin is quite high.

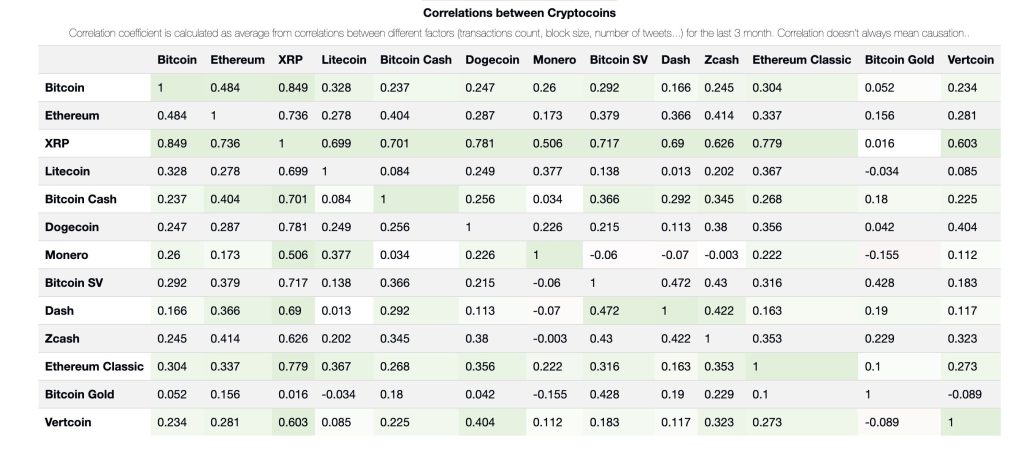

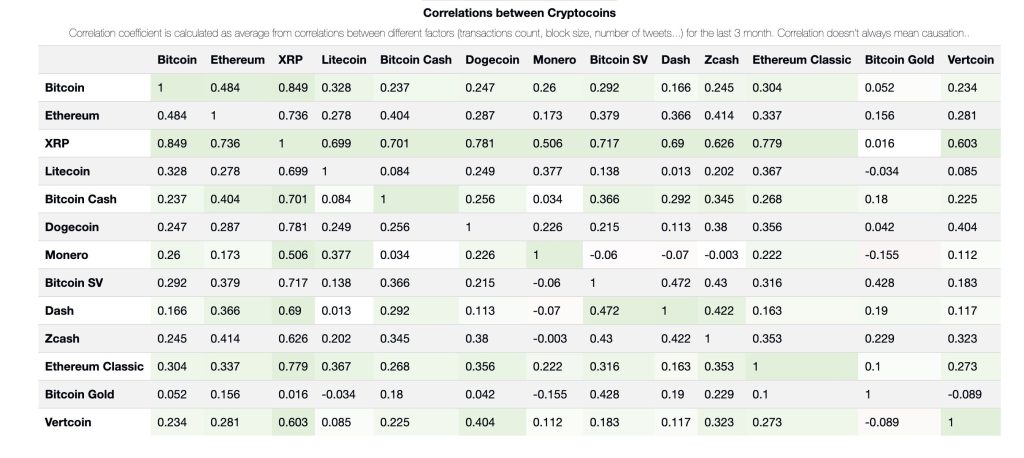

XRP (XRP) has one of the highest correlations with BTC at 0.849 according to data from BitInfoCharts. A price correlation of 1 indicates that for every 1% that BTC gains, the dependent asset gains exactly the same percentage. In this case, a 1% increase in BTC price would result in a 0.85% gain for XRP.

Bitcoin Could Retest its Nearest Key Support if It Breaks Below $80K

From a technical standpoint, bearish momentum has gained traction in the past trading sessions as BTC seems to have rejected a move above a key trend line resistance.

Bitcoin’s latest rally appears to be fading, with the daily chart showing a firm rejection at the $89,000 level last week.

Technical indicators support a bearish near-term outlook. The Relative Strength Index (RSI) has issued a sell signal, and the MACD histogram reflects waning bullish momentum.

Adding to this, BTC has also been pushed back from the 61.8% Fibonacci retracement level—often seen as a last major resistance before trend reversal.

If BTC breaks below the $80,000 threshold, downside pressure could intensify, potentially dragging the price to its next support at $76,600.

Still, most analysts remain bullish on Bitcoin’s long-term trajectory, with expectations of new all-time highs later this year.

Indeed, analyst Stockmoney Lizards thinks BTC could bottom out around $80,000 with a rally following soon after for alts.

For investors, current weakness may offer a rare opportunity to accumulate before the next breakout.

In the meantime, a new meme coin called BTC Bull Token (BTCBULL) is turning heads—offering holders passive BTC rewards as Bitcoin climbs higher.

BTC Bull Token (BTCBULL) Captures Investors’ Interest by Introducing an Innovative Rewards Scheme

BTC Bull Token (BTCBULL) is the meme coin built for true Bitcoin believers—rewarding holders as BTC climbs to new heights in 2025.

Here’s how it works: every time Bitcoin hits a major milestone, $BTCBULL holders benefit. The project features an aggressive supply burn and airdrop strategy, making it one of the most ambitious and rewarding meme coins in the market.

Here’s the reward roadmap:

- BTC $100K – $BTCBULL Launch

- BTC $125K – Token Burn

- BTC $150K – BTC Airdrop

- BTC $175K – Token Burn

- BTC $200K – BTC Airdrop

- BTC $225K – Token Burn

- BTC $250K – Massive $BTCBULL Airdrop

As Bitcoin marches toward the $1 million mark, $BTCBULL holders will enjoy milestone-based rewards, reduced token supply, and direct BTC incentives along the way.

To buy $BTCBULL, simply head to the BTC Bull Token website and connect your wallet (e.g. Best Wallet).

You can either swap USDT or ETH for this meme coin or use a bank card to complete your investment.

The post Is $80K Bitcoin the Bottom? Analysts Say It Could Spark Massive Breakouts appeared first on Cryptonews.

https://cryptonews.com/news/is-80k-bitcoin-the-bottom-analysts-say-it-could-spark-massive-breakouts/