The cryptocurrency market was thrown into chaos as Hyperliquid Vault found itself on the receiving end of a massive short position on JellyJelly ($JELLY) following a trader’s self-liquidation.

The short squeeze propelled $JELLY’s price up by an astonishing 429% between 21:00 and 22:00 UTC+8, putting Hyperliquid Vault in a precarious situation with unrealized losses exceeding $10.5 million.

This dramatic turn of events unfolded when an anonymous trader removed their margin, thereby self-liquidating their position and transferring the burden of their short position to Hyperliquid Vault (HLP).

With $JELLY’s open interest (OI) now heavily skewed, HLP holds a 12-million short position against aggressively long traders.

If the price of $JELLY reaches $0.15374, the entire $230 million in Hyperliquid Vault funds could be wiped out.

Furthermore, as funds exit Hyperliquid Vault, the liquidation price of $JELLY is continuously being lowered, making the situation even more precarious.

‘Futures War’: How Traders Are Exploiting the Situation

The ongoing liquidity crisis surrounding Hyperliquid Vault has raised concerns of potential market manipulation.

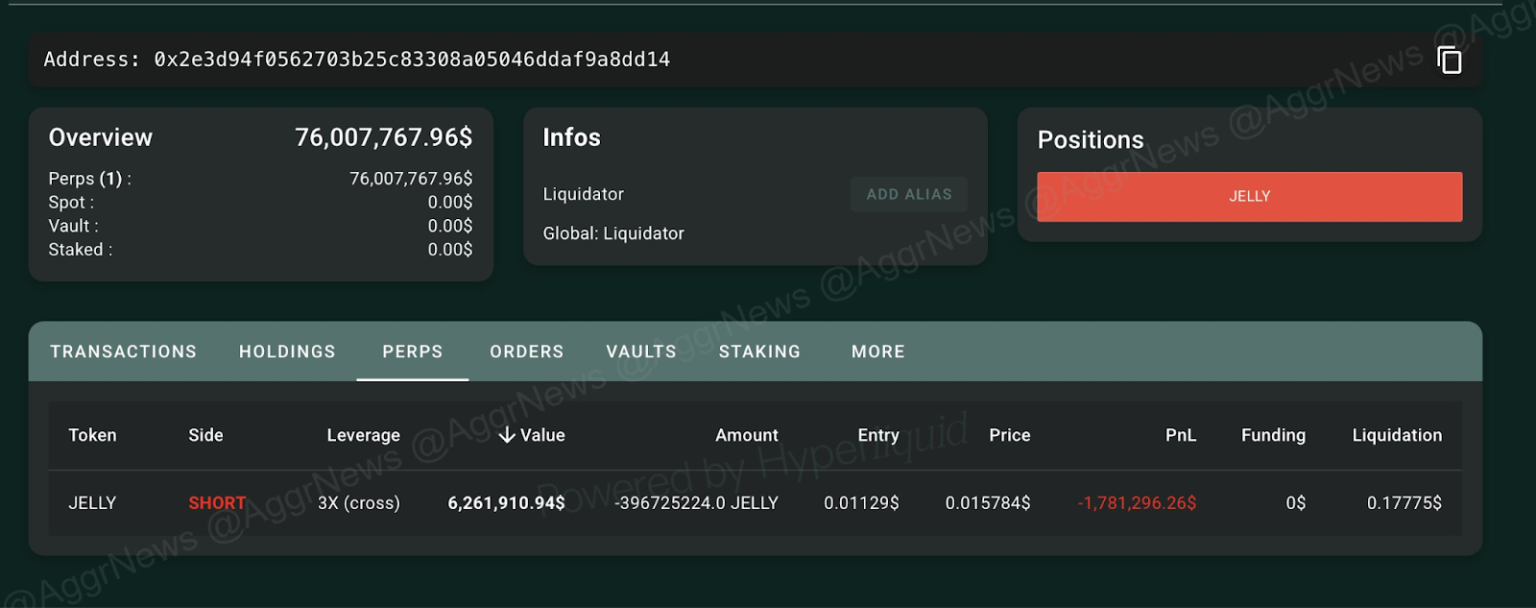

Observers note that two major addresses currently hold long positions in $JELLY, one with a $6 million long position and the other with $6.2 million, creating a combined $15 million in open interest.

This is nearly identical to Hyperliquid Vault’s short position, meaning the market is now in a direct standoff between HLP and traders betting on $JELLY’s surge.

The price action surrounding $JELLY suggests that targeted efforts may be underway to push the token’s value higher, forcing HLP’s liquidation.

A report from Jinse Finance highlights that if $JELLY reaches $0.17, Hyperliquid Vault will face complete liquidation, resulting in a $240 million loss.

Given that the token has already skyrocketed 230% in just one hour, this scenario appears increasingly likely.

Traders monitoring HLP’s every move have observed that it has begun offloading parts of its short position, but the order book remains highly volatile.

The situation has led to speculation that this might be an orchestrated attack. Data indicates that the trader who self-liquidated only ever traded $JELLY, hinting at a possible exploit.

Additionally, HLP accounts for nearly half of all open interest on $JELLY, a dangerous imbalance that leaves it vulnerable to aggressive counterplay from deep-pocketed market participants.

As soon as this gained traction, it was later uncovered that the liquidation attack came from Binance in what was regarded as a “Futures War.”

In fact, ZachXBT, a prominent blockchain investigator, confirmed that the trader addresses were freshly funded from Binance.

Complicating the matter, Yi He, the co-founder of Binance, was tagged to a post calling for a rival war between Binance and HyperLiquid, and she commented that she accepted the call.

Moreso, Hyperliquid has decided to delist Jelly perps following the incident, with the majority of the validators supporting the move to delist the token to prevent further damage.

Hyperliquid’s Previous Whale Scandal

The current crisis echoes a recent controversy involving Hyperliquid, in which a prominent trader, dubbed the “Hyperliquid Whale,” was exposed as a convicted financial criminal.

ZachXBT revealed that the trader, William Parker, had amassed nearly $20 million in profits through high-leverage trading, funded by illicit activities.

For weeks, speculation ran rampant about the whale’s identity, with some suggesting that institutional players or North Korean hacking groups were behind the massive trades.

However, ZachXBT’s research uncovered that Parker had a long history of financial crimes, including phishing scams, casino exploits, and other fraudulent schemes.

His high-stakes trades, such as a 50x leveraged long on Ethereum before a major Donald Trump crypto policy announcement, were fueled by illicitly obtained funds.

Similarly, a report from March 13 shows that another trader known as “ETH 50x Big Guy” shifted focus from Ethereum to Chainlink (LINK) after securing $1.8 million in profits from a leveraged ETH position.

The trader placed a $31 million long bet on LINK with 10x leverage across Hyperliquid and GMX while also accumulating $12 million in spot holdings.

This move follows his intentional liquidation of a $200 million ETH position on Hyperliquid, which resulted in a $4 million loss for the platform’s liquidity pool.

As it stands now, Hyperliquid is doing everything it can to control the situation, especially since the exchange’s net USDC outflow reached as high as $140 million within just a few hours of the incident.

The post Hyperliquid Vault Opens $5M Short on JellyJelly After Trader Self-Liquidates appeared first on Cryptonews.

https://cryptonews.com/news/hyperliquid-vault-opens-5m-short-on-jellyjelly-after-trader-self-liquidates/