Key Takeaways:

- Stablecoins are moving beyond simple digital tokens to integrate with established financial services.

- Clearer US regulations and institutional backing are spurring broader market acceptance.

- Tokenized treasury products and emerging projects are deepening the crypto–traditional finance connection.

- Industry stakeholders are adjusting operations to align with evolving policy frameworks.

The stablecoin market saw major growth in the past year, as digital assets began to integrate more deeply into traditional financial systems.

A report from Keyrock and Centrifuge estimated that stablecoins circulated over $208 billion in the past year, facilitating more than $4 trillion in transactions—a 45% increase year-over-year.

USDC and the Expanding Stablecoin Market

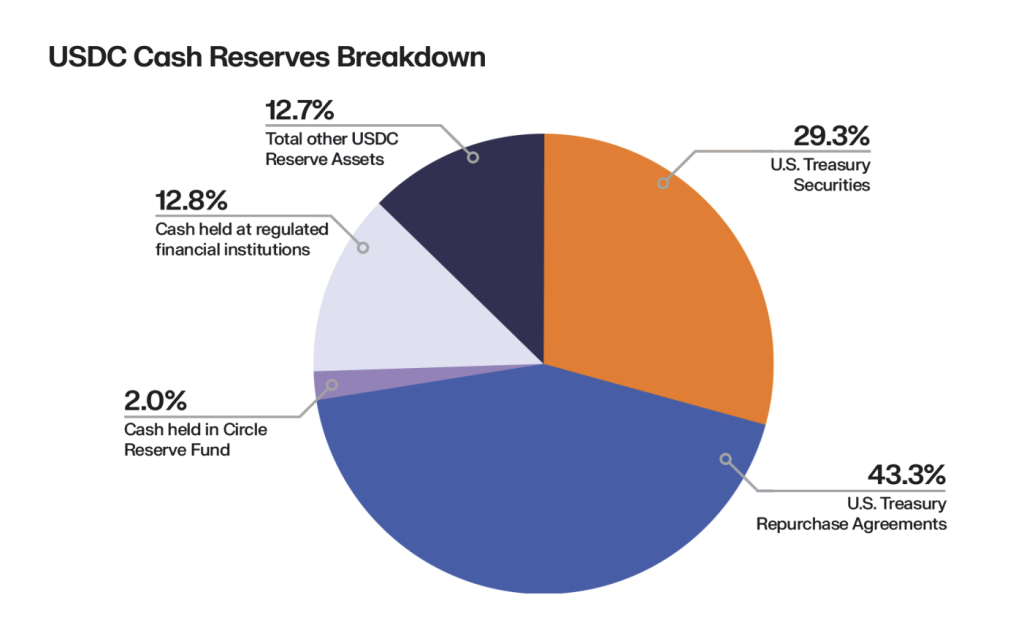

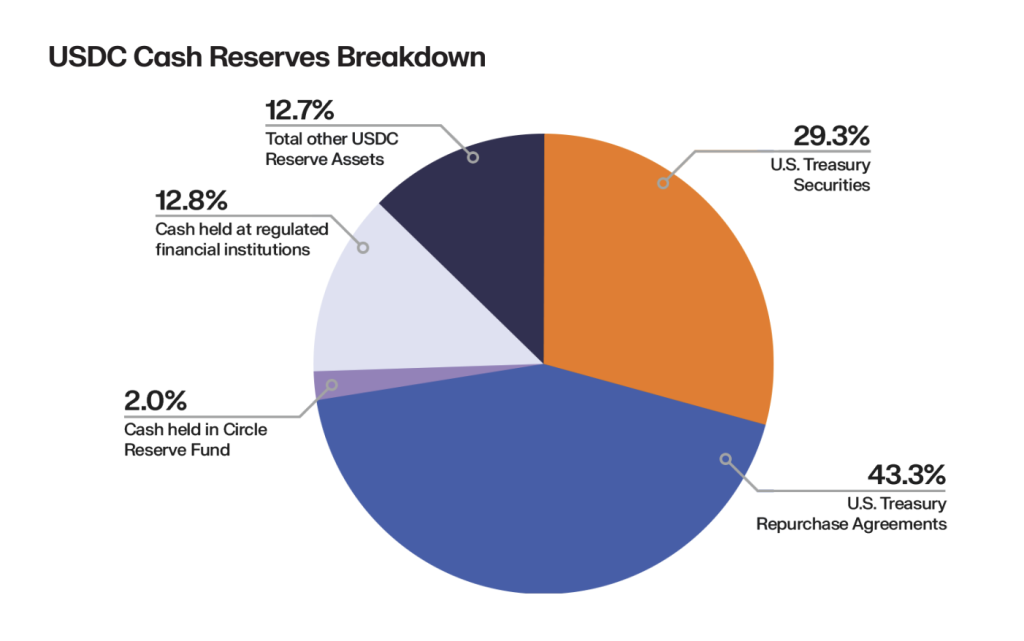

Circle’s USDC stablecoin recently reached a $60 billion market cap, setting a new record.

Between January and March, the supply of USDC grew by $16.3 billion, according to Artemis Analytics.

This growth outpaced Tether’s USDT, which expanded by $4.4 billion in the same period.

Despite this, USDT still holds the lead with a market capitalization of $144 billion.

Tokenized US Treasuries Drive Stablecoin Growth

Recent developments in the United States have played a significant role in supporting stablecoin market expansion.

The Keyrock and Centrifuge report highlights a 415% year-over-year surge in tokenized US Treasuries—from $800 million to $4 billion.

Asset manager Fidelity Investments, which oversees $5.8 trillion in assets, is the latest traditional finance firm entering the sector of tokenized US Treasuries.

Franklin Templeton’s fund, the first on-chain money market product, has already grown to $689 million in assets since its 2021 launch.

Bhaji Illuminati, CEO of Centrifuge, told Cryptonews that stablecoins have moved beyond the proof-of-concept stage.

“With over $200 billion in circulation, the market is now entering the integration era, where real use cases like faster B2B payments, treasury management, and revenue generation are driving adoption,” she said.

She added that one objective of stablecoin regulation is to increase demand for US Treasuries, aligning stablecoin adoption with national interests.

This matters because findings from Keyrock and Centrifuge show that onchain treasury assets account for just 2% of the overall stablecoin market, suggesting massive potential for growth.

“Stablecoin regulation creates a powerful tailwind not only for stablecoin issuers but also for infrastructure providers like Centrifuge, which offer tokenized treasuries that can back these stablecoins,” Illuminati said.

US Legislation Pushes Stablecoin Regulations Forward

Members of the US Congress have made stablecoin regulation a priority.

On March 26, Rep. Bryan Steil, chair of the House Financial Services Committee’s crypto panel, and Rep. French Hill, chair of the full committee, introduced the STABLE Act.

This legislation outlines rules for issuing and operating dollar-backed payment stablecoins in the US.

A spokesperson for Rep. Hill told Cryptonews that the Committee is focused on delivering clear rules for stablecoins.

“Chairman Hill and several of our members on the House Financial Services Committee are working to provide clear regulatory guidelines to allow payment stablecoins to flourish in the United States,” The Spokesperson said. “The Committee is also working on market structure legislation to ensure consumers and investors are protected while maintaining America as a leader in this space.”

Earlier, on March 13, the US Senate Banking Committee passed the GENIUS Act—a bill that proposes a comprehensive framework for regulating payment stablecoins.

“With growing momentum behind legislation like the GENIUS Act and major institutions and even states getting involved, the US is setting the tone for stablecoin adoption,” Illuminati said.

New Stablecoin Projects From Trump and Wyoming

Illuminati also noted that as regulatory clarity improves, more US-based fintechs, banks, and asset managers will likely begin developing dollar-backed digital assets.

One example is former President Donald Trump’s partnership with World Liberty Financial to create a new stablecoin, USD1.

The project is designed to be redeemable 1:1 for the US dollar and backed by dollar deposits, US Treasuries, and other cash equivalents.

Although questions remain about USD1’s structure, Illuminati believes the project shows how stablecoins are entering business, political, and cultural discussions.

“Alongside major institutional players like Fidelity, Robinhood, and PayPal launching their own stablecoins, we’re seeing the model gain visibility and adoption beyond crypto-native circles and become part of the wider economic narrative,” she remarked.

JP Richardson, CEO of Bitcoin wallet Exodus, added that USD1 could influence the market, but the outcome depends on execution.

“If World Liberty Financial can build a strong ecosystem, get institutions on board, and integrate USD1 into global payments, it could carve out a place alongside USDT and USDC,” Richardson said. “But at the very least, it brings more legitimacy to stablecoins and forces regulators to engage more seriously with the sector.”

Meanwhile, the State of Wyoming is testing its own stablecoin. Called WYST, the Wyoming Stable Token is undergoing trials across several blockchain networks.

This testing phase represents an early milestone in launching the first fiat-backed and publicly issued stable token in the US.

At the DC Blockchain Summit held on March 26, Wyoming Governor Mark Gordon outlined the benefits of WYST.

These include legal requirements to over-collateralize the token with cash and Treasuries and directing treasury-generated interest to the state’s school foundation fund.

Barriers to Stablecoin Market Expansion

While the US plays a leading role in stablecoin expansion, several challenges remain.

Caitlin Long, CEO of Custodia Bank, said that tax and accounting rules remain the biggest barriers to adoption.

“Stablecoins have always been the bridge between TradFi and crypto, which is why Custodia proposed to issue them way back in 2020 and was able to obtain the patent on bank deposits tokenized on permissionless blockchains in 2022,” she remarked.

Mike Cahill, CEO of Douro Labs, pointed to regulatory ambiguity as the biggest obstacle.

“Without clear guidelines, banks and institutions will undoubtedly stay on the sidelines,” Cahill remarked.

He further noted that the US requires fit-for-purpose frameworks that distinguish between stablecoins built for payments and those used for speculation.

Frequently Asked Questions (FAQs)

US regulatory updates are prompting banks and fintechs to integrate digital payments under clear oversight. This alignment boosts stablecoin adoption, making them a compliant bridge between crypto and traditional finance.

Stablecoin integration into established systems introduces risks like asset mismatches, liquidity strains, and contagion effects. Tight oversight and transparent practices help curb shocks and protect users.

Growing stablecoin use may alter global liquidity flows and payment methods. With clearer regulation, their spread can stabilize cross-border transactions, yet oversight must evolve to curb market disruptions and concentration risks.

The post How the US Is Driving Growth of the Billion-Dollar Stablecoin Market appeared first on Cryptonews.

https://cryptonews.com/news/us-policies-accelerate-stablecoin-market/

(@Spectura)

(@Spectura)