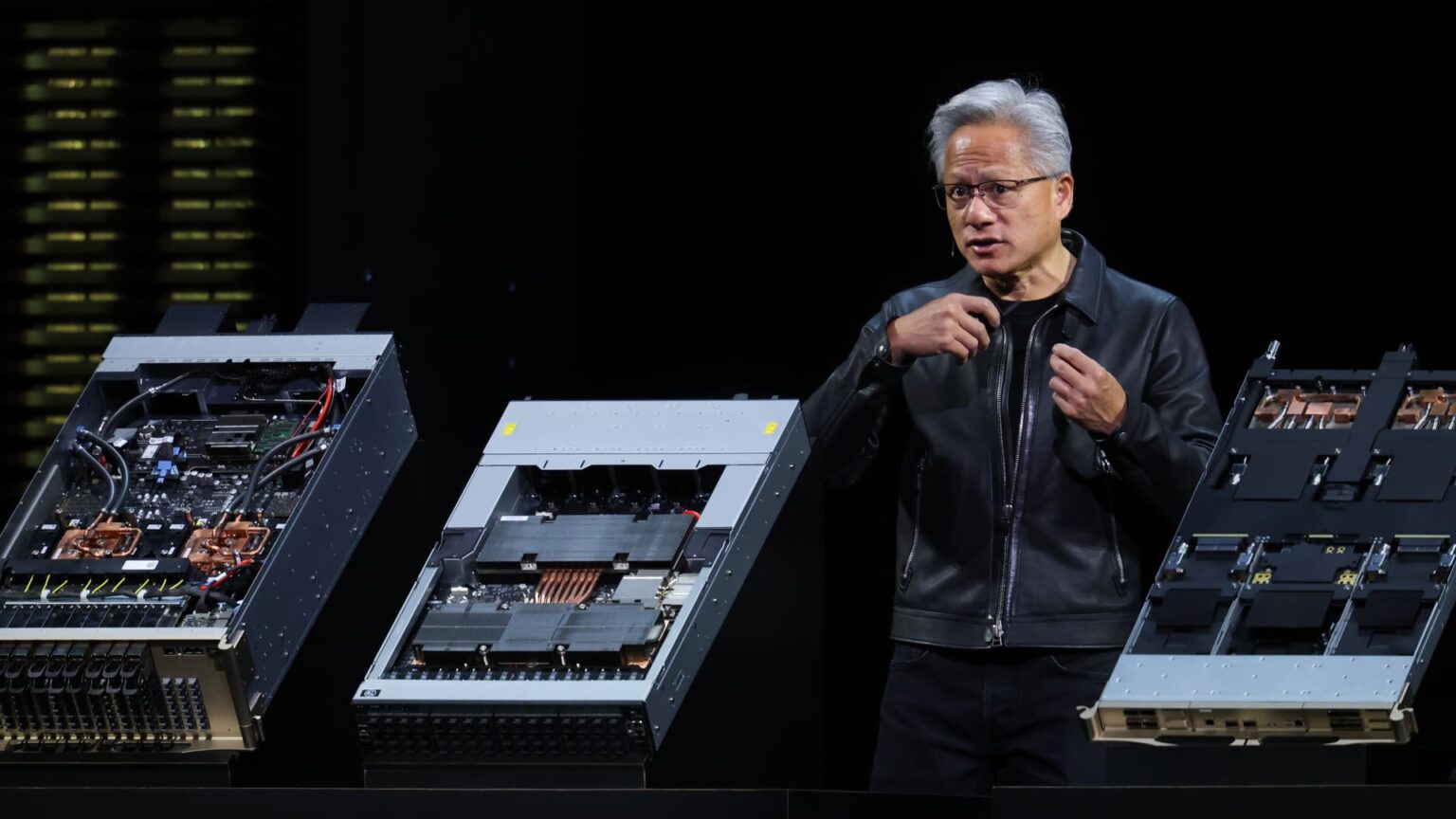

Nvidia President and CEO Jensen Huang speaks about NVIDIA Omniverse as he delivers the keynote address during the Nvidia GTC (GPU Technology Conference) at the Walter E. Washington Convention Center on Oct. 28, 2025 in Washington, DC.

Anna Moneymaker | Getty Images

As a handful of the world’s most valuable companies set out to spend $1 trillion over the next five years on data centers for artificial intelligence, one line item is on the minds of executives and investors: depreciation.

In accounting, depreciation is the act of allocating the cost of a hard asset over the course of its expected useful life. It’s an increasingly important concept in the tech industry, as companies predict how long the hundreds of thousands of Nvidia graphics processing units, or GPUs, they’re purchasing will remain useful or retain their value.

Infrastructure giants like Google, Oracle and Microsoft have said their servers could be useful for up to six years. But they could also depreciate much sooner. Microsoft said in its latest annual filing that its computer equipment lasts two to six years.

That’s a lot to consider for the investors and lenders financing the giant AI buildouts, because the longer equipment remains valuable, the more years a company can stretch out depreciation and the less it hurts profits.

AI GPUs represent a particular challenge because they’re still relatively new to the market. Nvidia’s first AI-focused processors for data centers came out around 2018. The current AI boom started with the launch of ChatGPT in late 2022. Since then, Nvidia’s annual data center revenue has jumped from $15 billion to $115 billion in the fiscal year that ended in January.

There’s no real track record for how long GPUs last when compared with other types of heavy equipment that businesses have been using for decades, said Haim Zaltzman, vice chair of Latham & Watkins’ emerging companies and growth practice.

“Is it three years, is it five, or is it seven?” said Zaltzman, who works on GPU financings, in an interview. “It’s a huge difference in terms of how successful it is for financing purposes.”

Some of Nvidia’s customers say AI chips will retain value for a long time and that customers will continue to pay for access to older processors because they’ll still be useful for other tasks. CoreWeave, which buys GPUs and rents them out to clients, has used six-year depreciation cycles for its infrastructure since 2023.

CoreWeave CEO Michael Intrator told CNBC this week, following quarterly earnings, that his company is being “data driven” about GPU shelf life.

Intrator said that CoreWeave’s Nvidia A100 chips, which were announced in 2020, are all fully booked. He also added that a batch of Nvidia H100 chips from 2022 became available because a contract expired, and they were immediately booked at 95% of their original price.

“All of the data points that I’m getting are telling me that the infrastructure retains value,” Intrator said.

CoreWeave CEO, Michael Intrator appears on CNBC on July 17, 2024.

CNBC

Still, CoreWeave shares plunged 16% after its earnings report as delays at a third-party data center developer hit full-year guidance. The stock is down 57% from its high reached in June, part of a broader sell-off reflecting concerns about overspending in AI. Oracle shares have plummeted 34% from their record high in September.

Among the most vocal skeptics of the AI trade is short seller Michael Burry, who recently disclosed bets against Nvidia and Palantir.

Burry this week suggested that companies including Meta, Oracle, Microsoft, Google and Amazon are overstating the useful life of their AI chips and understating depreciation. He pegs the actual useful life of server equipment at around two to three years, and said companies are inflating their earnings as a result.

Amazon and Microsoft declined to comment. Meta, Google and Oracle did not respond to requests for comment.

‘You couldn’t give Hoppers away’

There are a number of ways AI chips could depreciate before six years. They could wear out and break, or they could become obsolete as newer GPUs are released. They could still be useful for running certain workloads, but with much worse economics.

Nvidia CEO Jensen Huang has implied as much. When Nvidia announced a new Blackwell chip earlier this year, he joked that the value of its predecessor, the Hopper, would deteriorate.

“When Blackwell starts shipping in volume, you couldn’t give Hoppers away,” Huang said in March at Nvidia’s AI conference.

“There are circumstances where Hopper is fine,” he continued. “Not many.”

Nvidia now releases new AI chips on an annual basis, versus the two-year cadence it had before. Advanced Micro Devices, its closest GPU competitor, followed suit.

Nvidia reports quarterly results next week.

Amazon, in a February filing, said it decreased the useful life for a subset of its servers from six years to five years because it conducted a study that found “an increased pace of technology development, particularly in the area of artificial intelligence and machine learning.”

Meanwhile, other hyperscalers are extending their GPU useful life estimates for newer server equipment.

Microsoft Chairman and Chief Executive Officer Satya Nadella speaks during the Microsoft Build 2025, conference in Seattle, Washington, on May 19, 2025.

Jason Redmond | AFP | Getty Images

Although Microsoft plans to build AI infrastructure aggressively, CEO Satya Nadella said this week that his company is trying to space out its AI chip purchases and not overinvest in a single generation of processors. He added that the biggest competitor for any new Nvidia AI chip is its predecessor.

“One of the biggest learnings we had even with Nvidia is that their pace increased in terms of their migrations,” Nadella said. “That was a big factor. I didn’t want to go get stuck with four or five years of depreciation on one generation.”

Nvidia declined to comment.

Dustin Madsen, vice president of the Society of Depreciation Professionals and founder of Emrydia Consulting, said depreciation is a financial estimate by management and that developments in a fast-moving industry like technology can change initial predictions.

Depreciation estimates, Madsen said, generally take into account assumptions such as technological obsolescence, maintenance, historical lifespans of similar equipment and internal engineering analysis.

“You’re going to have to convince an auditor that what you’re suggesting what its life will be is actually its life,” Madsen said. “They will look at all of those factors, like your engineering data that suggests that the life of these assets is approximately six years, and they will audit that at a very detailed level.”

— CNBC’s Jordan Novet contributed to this story.

WATCH: Chris Wood: We’ve removed Nvidia from our portfolio, prefer China AI names

https://www.cnbc.com/2025/11/14/ai-gpu-depreciation-coreweave-nvidia-michael-burry.html