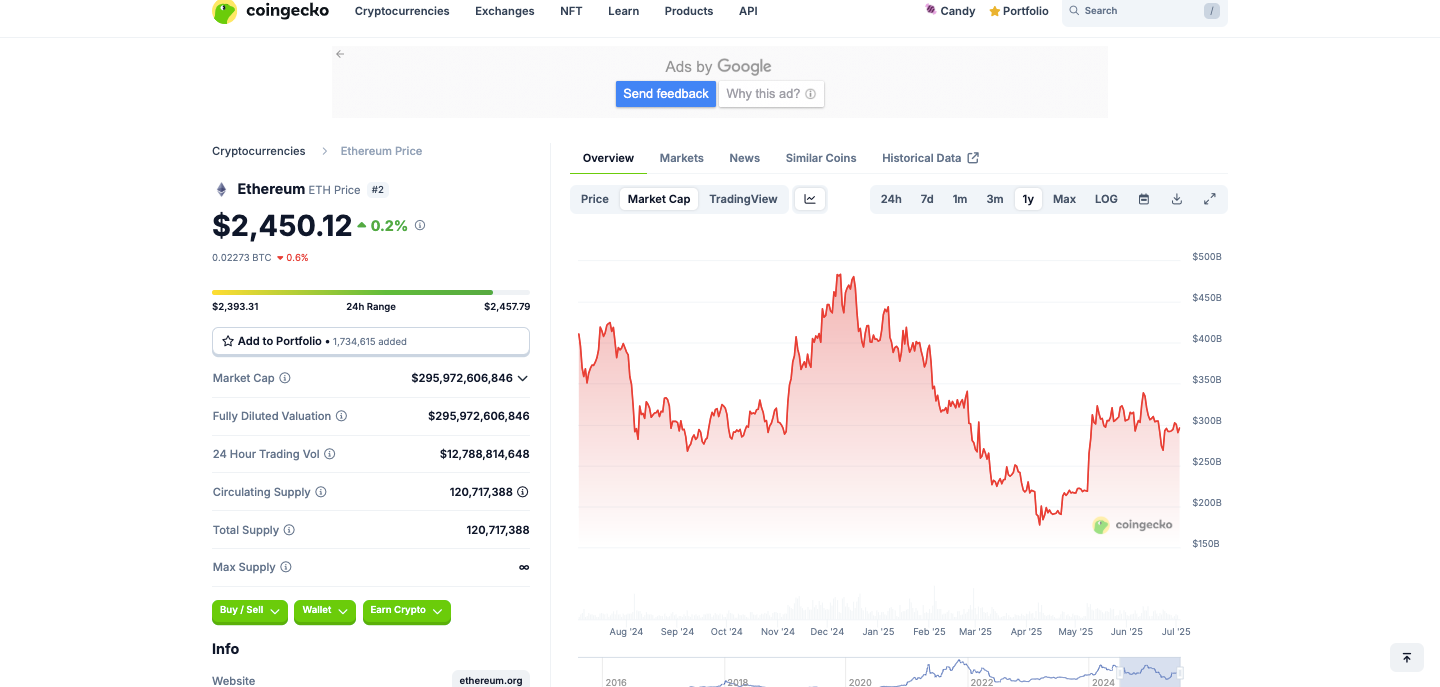

Ethereum ($ETH) just staged a $200 rebound off the key $2,400 support—but traders are watching one key level that could spark the next major move.

The recovery comes after $ETH weathered a brief rounded top pattern last week, with institutional inflows and Layer-2 adoption providing fundamental support. All eyes now turn to whether bulls can reclaim the $2,600 resistance zone.

Ethereum’s Unrivaled Network Activity and Layer-2 Innovation

Since its launch in 2014, Ethereum has transformed blockchain technology, with developers now building the majority of smart contracts and decentralized applications (dApps) on its network.

The platform’s flexible architecture allows innovations. Teams use Ethereum’s infrastructure to create secure DeFi protocols, NFT marketplaces, and efficient Layer-2 solutions. This technological foundation continues to attract builders worldwide.

The network remains the leading blockchain for utility and trust, with a total value locked (TVL) of $62.6 billion, commanding 53% of global DeFi TVL. This surpasses competitors like Tron, which is primarily used for stablecoin transfers and centralized finance (CeFi) hybrids, as well as Solana and Avalanche.

The Ethereum network processes 1.45 million daily transactions and hosts over 645,000 active wallets, indicating strong and consistent usage. The Pectra upgrade has further enhanced staking efficiency and Layer-2 scalability, reinforcing Ethereum’s long-term viability.

Ethereum hosts industry-leading DeFi platforms, including Uniswap, the largest decentralized exchange; Aave, a leading lending protocol; and Curve Finance, a dominant stablecoin decentralized exchange.

Layer-2 solutions have emerged to address high fees and scalability limitations. They include Optimism and Arbitrum, which recently surpassed 2 million daily transactions, as well as zkSync and StarkNet.

These solutions offer faster and cheaper transactions while taking advantage of Ethereum’s existing security infrastructure.

Institutions are also increasingly adopting an Ethereum treasury, similar to that of Bitcoin.

Some important examples include Bit Digital, a Nasdaq-listed company that raised $163 million to expand its Ethereum treasury, now holding 24,434.2 ETH. The firm is shifting from Bitcoin mining to Ethereum staking infrastructure.

SharpLink Gaming has also become the world’s largest corporate Ethereum holder, with 188,478 ETH (worth $457 million) acquired through aggressive buying campaigns.

Other public companies, such as BitMine and BioNexus Gene Lab, have also adopted Ethereum as a reserve asset, indicating growing institutional confidence in its long-term value.

Ethereum Forms Bearish Rounded Top: Breakdown Targets $2,300

The Ethereum ($ETH/$USDT) 30-minute chart presents a clear rounded top formation, typically interpreted as a bearish reversal pattern.

The arc began forming on June 29, with Ethereum gradually losing upward momentum after peaking just below $2,530.

This slow transition from bullish to bearish sentiment is often driven by fading buyer interest and profit-taking, leading to a progressively weaker price structure.

The rounded top was completed between June 30 and July 1, culminating in a breakdown below the neckline zone near $2,470, marked with a red arrow. This breakdown indicates a shift in market control from buyers to sellers, leading to a sharp price rejection and initiating a short-term downtrend.

The decline pushes $ETH down to lows of approximately $2,390, a retracement of over 5% from the local high.

Interestingly, following the breakdown, the chart shows signs of short-term recovery, with buyers stepping in around the $2,400 support zone.

A green candle appears near July 2, indicating a potential relief bounce or dead cat bounce. However, unless Ethereum reclaims the $2,470–$2,600 zone convincingly, this move may be short-lived.

In summary, Ethereum has exhibited a textbook rounded top breakdown, and caution is advised unless a strong recovery invalidates this bearish setup.

The post Ethereum Snaps $200 Higher; Bulls Eye $2.6K Breakout on Institutional Inflows appeared first on Cryptonews.

https://cryptonews.com/news/ethereum-200-rebound-bulls-eye-2600-breakout/