Ethereum has delivered one of the most impressive performances of 2025, surging over 20% in the past seven days, strengthening ETH bulls’ conviction as they target the $4,000 mark as the next key psychological resistance to overcome.

Currently trading at $3,505 after recently adding more than $120 billion to its market capitalization, the majority of these capital inflows originated from U.S. spot Ether ETFs, which attracted over $2.18 billion in weekly inflows, pushing total inflows to a record-breaking $7.49 billion.

Ethereum On-Chain Volume Surges 280% Signaling ETH Demand

Beyond ETF flows, retail investors and long-term Ethereum whales have continued to remain highly active.

Analytics reveal that Ethereum’s on-chain volume has skyrocketed by over 280% in the past 12 days, elevating the cryptocurrency’s daily usage to approximately $5 billion.

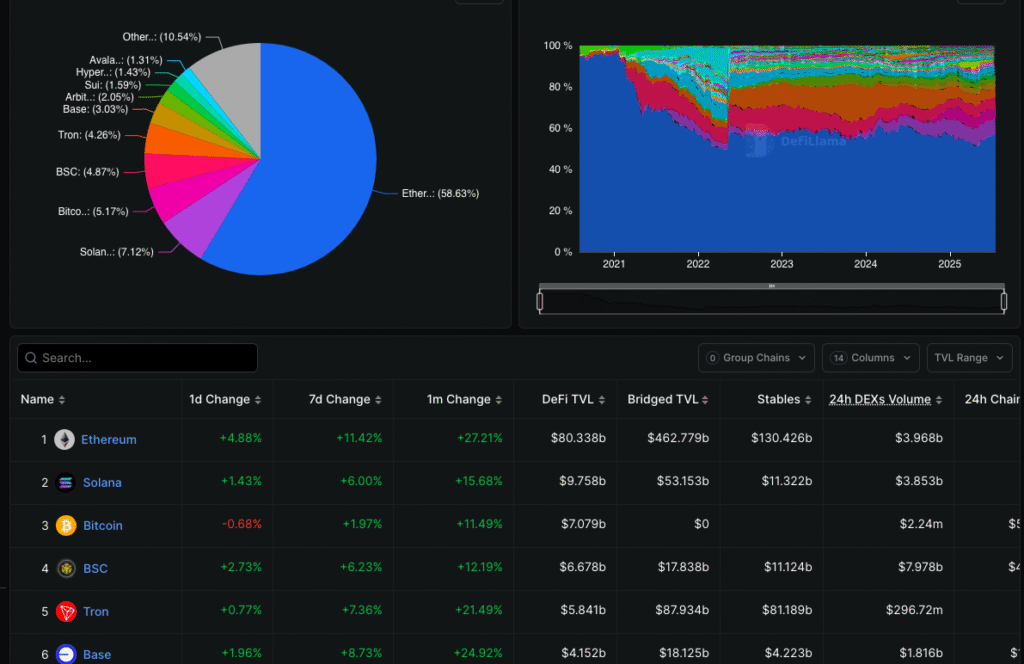

Likewise, the Ethereum DeFi TVL has exceeded $80 billion, representing ten times the size of its competitor, Solana, while the stablecoin market capitalization has reached a record $130 billion.

With the United States progressing the GENIUS stablecoin legislation, many analysts believe Ethereum stands to benefit significantly, given that most infrastructure supporting stablecoin operations is constructed on its network.

Ethereum’s market dominance has entered an upward-only trajectory.

For over three years, ETH experienced price suppression despite substantial network upgrades.

However, prices have now begun catching up, with popular crypto investor TedPillows forecasting a $4,000 target in the near term.

Technical Analysis: Ethereum 3+ Years Suppression Targets $4,000 Breakout

From a technical perspective, the Ethereum (ETH/USD) daily chart indicates a decisive bullish breakout, with the price advancing above a critical resistance level within the $3,250–$3,500 range.

The momentum appears aggressive, fueled by a decisive break of structure (BOS) and a clean bounce from the $2,500 support level, which previously served as a consolidation foundation.

The chart identifies $4,105 as the strong high objective, corresponding with a previous major resistance zone.

Nevertheless, the RSI reading of 84.38 indicates deep overbought conditions, suggesting a potential short-term pullback or consolidation before the trend continues.

Should Ethereum maintain levels above the current resistance-turned-support, the upward movement will likely extend toward the $4,100 objective.

Failure to sustain this breakout could prompt a retracement toward the $2,950–$3,250 area, where buy-side liquidity might reignite bullish momentum.

Best Wallet Raises $14M As 250K Users Ride ETH’s DeFi Wave

Ethereum’s success has historically served as a catalyst for rallies in DeFi tokens and altcoins generally.

Now that ETH is positioning for new highs, Ethereum-based crypto wallet Best Wallet has returned to investor attention.

Launched in late 2024, Best Wallet currently claims more than 250,000 active users and an expanding DeFi ecosystem supported by its native utility and governance token, $BEST.

With a presale that has already secured over $14 million and key platform features being deployed, numerous investors view it as one of the best-positioned projects ahead of broader mass adoption.

The $BEST token is currently priced at $0.025355, with only 4.5% of the token supply available in this round, ensuring scarcity.

Interested parties can visit the presale website to purchase portions of the available supply before it is depleted.

$BEST holders also benefit from enhanced staking APYs and voting rights on future upgrades and protocol modifications within the wallet ecosystem.

The post Ethereum Price Prediction: Eyes on $4,000 – ETH’s 20% Weekly Gain Reshapes Market Outlook appeared first on Cryptonews.

https://cryptonews.com/news/ethereum-price-prediction-eyes-on-4000-eths-20-weekly-gain-reshapes-market-outlook/