Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Sweeping reforms to Isas are in the chancellor’s crosshairs, with the Treasury expected to launch a consultation on the future of tax-free savings and investment accounts.

Yippee, said absolutely no one, apart from lobbyists at UK equity funds and investment platforms who have speared this debate. Getting their hands on some of the £300bn held in cash Isas would massively benefit their businesses — but Rachel Reeves must ensure the coming consultation focuses on what would actually benefit UK consumers.

Isas allow individuals to save or invest up to £20,000 a year tax free, split between cash and stocks in any way they choose. Industry proposals include dropping the cash element to £4,000 in the mistaken belief you can force people to invest, not to mention skewing tax breaks towards UK-listed stocks.

The chancellor frequently talks about her desire to create a greater culture of retail investing in the UK. She looked triumphant this week after forcefully persuading 17 big pension funds to pump an estimated £25bn of workers’ retirement savings into UK companies, infrastructure and property by the end of the decade.

Could she favour wholly or partly restricting the tax-free benefits of investment Isas to UK equities in future? I sincerely hope not. Last year, Labour sensibly axed the previous government’s plans for an additional £5,000 “British Isa” allowance. Fresh from the steamrollering of institutional investors, she might be tempted to rethink it.

The simple fact is, any Isa reforms need to remove barriers to investing, not create more of them.

An estimated 6 per cent of UK adults have a stocks-and-shares Isa; a shockingly low number, especially as the financial regulator believes 4.2mn consumers hold more than £10,000 of investable assets mostly, or entirely, in cash. This is at the heart of what the consultation must address.

Cash savings are vital, but above a certain level, policymakers should be encouraging long-term investments that can generate a better return. The question is, will cutting the cash Isa subscription achieve this?

No! The “right” level of cash depends on your individual circumstances, which vary hugely throughout your life. Tarnish the UK’s most popular savings product by slashing the allowance and the majority of cash Isa savers would just stick their money in another cash savings account rather than seek to invest it, according to a recent survey by AJ Bell.

Instead, the consultation should tackle the siloed structure of the Isa market, with cash and shares kept in separate products run by different kinds of businesses. If a diehard cash saver decided they did want to invest some money, this would require opening a separate Isa product (likely with a different provider) and organising a transfer to preserve the tax benefits. Simplifying this process and supporting the creation of “hybrid” Isas designed to contain both cash and stocks would make this transition easier.

As I’ve argued here before, if we want more long-term cash Isa savers to make the switch, the answer lies in educating the masses about investing. The Treasury should look at how Gen Z is leading the way. Some 38 per cent of 18-25-year-olds in the UK report holding investments; the highest proportion of all age groups according to research by Platforum. The amounts of money invested are small now, but their growing participation and desire to self-educate are encouraging trends.

Investment apps such as Trading 212 and Moneybox are packed with video content designed for the TikTok generation. The ability to own and trade shares in US tech giants is a huge attraction for young investors, whose digital lives are already dominated by these companies. Although regulators are rightly worried about malign influencers on social media, learning by watching is a powerful way of closing the “advice gap”.

How could this translate to older savers hoarding cash who have never invested? Only 9 per cent of UK consumers have taken financial advice in the past year. While adverts for stocks-and-shares Isas are packed with disclaimers about investment risk and ending up with less money than you started, the risk of holding too much cash for long periods is poorly understood. Cash Isas carry no warnings about inflation eroding your spending power over time, or the investment returns you could be missing out on.

The answer lies in loosening the regulatory advice guidance boundary and enabling financial providers to give their customers “targeted support”. This aims to bridge the gap between full financial advice and general guidance, taking a customer’s financial objectives and circumstances into account and pointing them towards a suggested investment solution. I think this will be a game-changer for minting new investors, but it’s at least another 18 months away.

Rather than add complexity by limiting future tax breaks to UK equities, there’s compelling evidence that widening investor participation would naturally increase UK inflows due to investors’ home bias.

The UK market may only make up about 4 per cent of global equity indices, yet 50 per cent of the Isa assets held by customers on both Hargreaves Lansdown’s and AJ Bell’s platforms are UK investments (both shares and funds). At rival Interactive Investor it’s just over 25 per cent.

A further incentive would be to get rid of stamp duty on UK shares. AJ Bell estimates doing this for Isa investors would cost £120mn, which is peanuts in the grand scheme of things.

Finally, the chancellor shouldn’t rush this. Constantly changing the rules governing long-term investments destroys trust in the system, as we have seen with the panicked withdrawal of pensions tax-free cash in the run-up to the last Budget (I wonder how much of that is sitting in cash accounts).

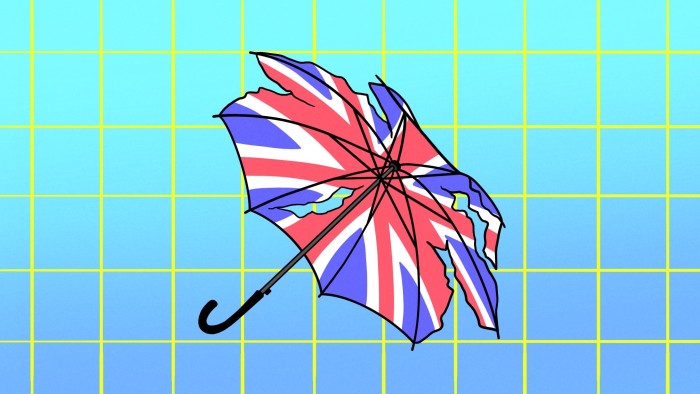

Building a culture of investing is not going to happen overnight, but destroying one by miring Isas in unwise, restrictive legislation could wreck what we have already built very easily.

Claer Barrett is the FT’s consumer editor and author of the FT’s Sort Your Financial Life Out newsletter series; [email protected]; Instagram and TikTok @ClaerB

https://www.ft.com/content/4f8d39ed-bfa6-407a-8822-6710f5baff8b