After hitting multi-month lows last week, Bitcoin has bounced back above $90,000 following some bullish developments triggered by United States President Donald Trump.

Likewise, for the total cryptocurrency market capitalisation, today was a day of recovery marked by a surge of over 6% in the past 24 hours.

At press time, the total crypto market cap had stabilised back above the $3 trillion mark.

Market sentiment has significantly improved in the past day as well, with the crypto fear and index climbing over ten points in the past day alone to hit 33.

While this still flags that the industry remains in the fear territory, it’s a sign of possible relief from imminent selling pressure.

Some altcoins have also forged a comeback, climbing from the previous week’s losses.

Several tokens led the day’s recovery, posting double-digit gains as bullish momentum returned across the board.

Why is Bitcoin going up?

Bitcoin was up nearly 10% on the back of positive news on crypto adoption in the United States.

Trump sparked a rally after confirming plans for a crypto reserve that would include Bitcoin, Ethereum, and several altcoins.

Initially, his Truth Social post mentioned XRP, Solana, and Cardano, but a later update confirmed that BTC and ETH would be “at the heart of the Reserve.”

This confirmation from Trump injected fresh confidence into the market, pushing Bitcoin back above $90,000 and lifting the broader crypto market.

What’s next for Bitcoin?

Right now, all eyes are on the White House Crypto Summit set for March 7. The meeting will see the returning president discuss crypto regulatory policies with various government and industry officials.

Whether the current hype sticks around depends on what comes out of this summit— pro-crypto developments could fuel more gains, while regulatory uncertainty might cool things down.

In terms of price, BTC needs to reclaim $93,500 to continue its journey towards six figures.

According to Rekt Capital, Bitcoin has pulled off a rare technical move—dipping sharply but still closing within its ReAccumulation range.

History suggests this downside deviation could mark the bottom, but short-term volatility isn’t off the table.

“For instance, the Post-Halving downside deviation showed us that price can produce a large downside wick below the ReAccumulation Range and then downside deviation again only to form a Higher Low relative to the low of said wick,” the analyst wrote on X.

There’s also a CME gap between $84,650 and ~$93,000, which Bitcoin might revisit. Even if the price dips to fill it, maintaining a higher low above last week’s $78,600 bottom would keep the macro uptrend intact.

As long as $93,500 holds as support, any short-term downside could be just another buying opportunity, according to the analyst.

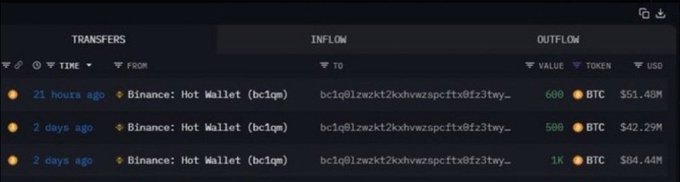

Another analyst pointed to whale activity, which they believe is indicative of a potential upside in the short-term. See below:

SOMEONE KNOWS SOMETHING… 👀

A whale just bought $192 MILLION in $BTC!

This market is about to get WILD!

Upon writing, Bitcoin was at $90,529.00, up 3.7% after losing some of its daily gains.

Some altcoins make a comeback

Altcoins were the biggest winners of the day’s bullish rally after Trump name-dropped three US-linked tokens in his crypto reserve plans.

XRP, Solana, and Cardano saw a surge in interest after getting a presidential nod.

Yet, overall sentiment in the altcoin market remained shaky, with the sector’s total market cap slipping over 16% to $1.25 trillion by late Asian trading hours.

The Altcoin Season Index saw a slight bump, rising two points to 16 since yesterday.

The best performers for the day were as follows:

Cardano

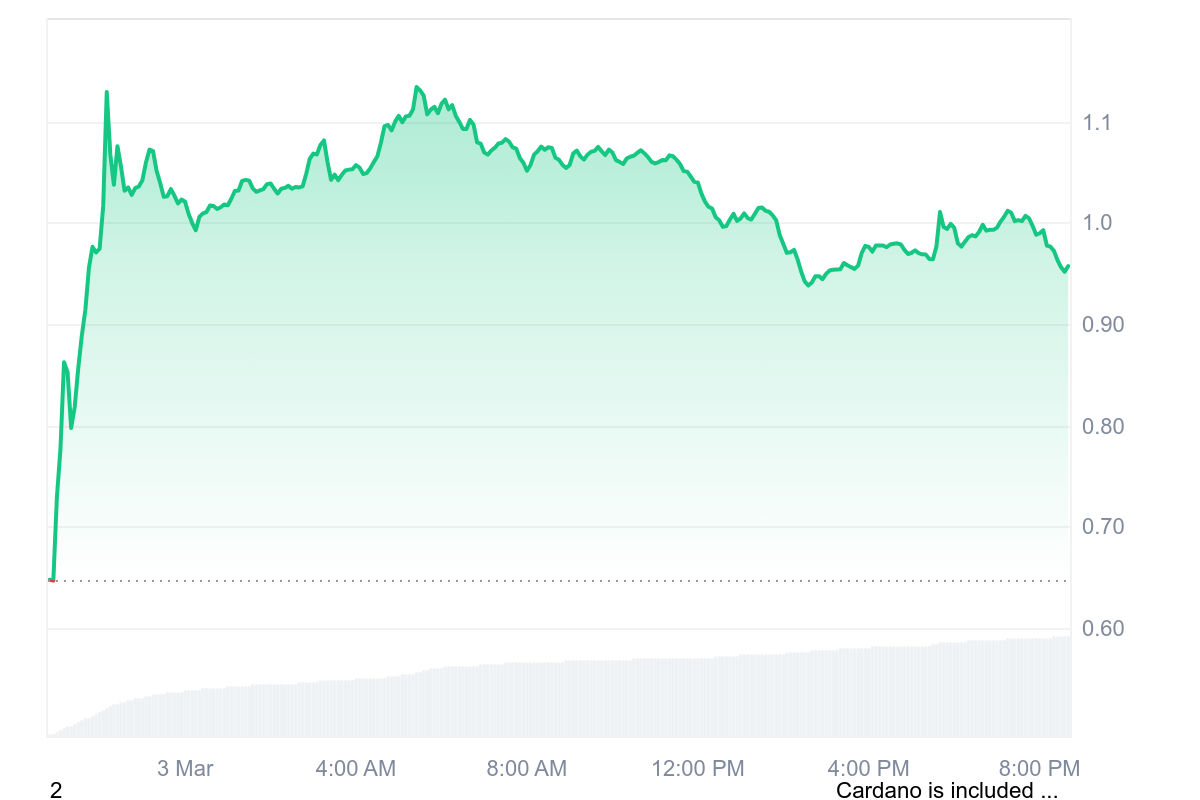

Cardano (ADA) soared 47% over the past day as it crossed the $1 resistance level for the first time since April 2022 before settling at $0.9551 at press time.

Its market cap was seated at $33.63 billion, while its daily trading volume surged over 20x in the past 24 hours to $11.91 billion.

Source: CoinMarketCap

Almost all the gains seen on the day came from Trump’s announcement of a crypto strategic reserve that will include ADA among a basket of other crypto assets.

The altcoin is also getting more attention as people anticipate the possible approval of Grayscale’s spot Cardano ETF by US regulators.

If approved, it would be the first ETF in the US focused only on ADA, making it easier for traditional investors to access and potentially promoting its long-term growth.

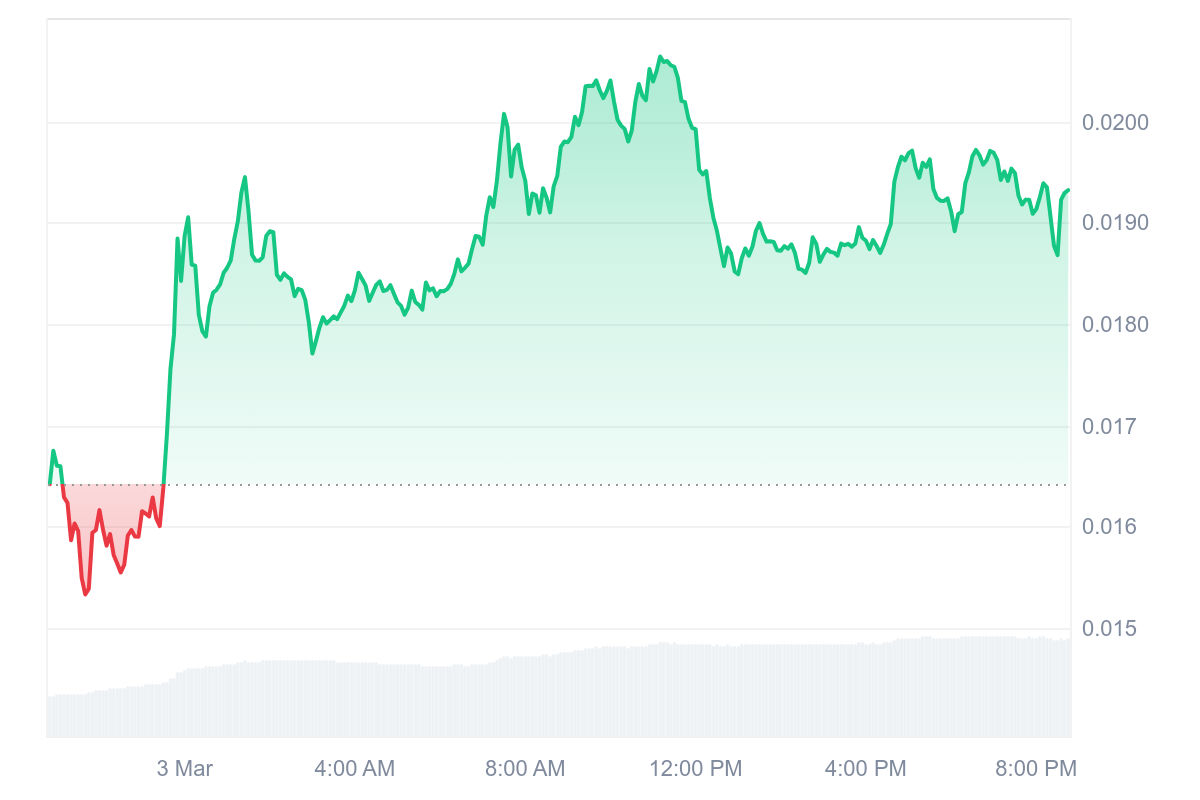

Onyxcoin

Over the past day, Onyxcoin (XCN) surged to an intraday high of $0.0206 on March 3, breaking out of a downtrend that had held it back since late January.

In the last 24 hours, XCN jumped 17%, with a market cap of $625 million, while its daily trading volume more than doubled to $314 million.

Source: CoinMarketCap

Today’s gains are fueled by the community’s anticipation of Onyx’s Goliath Mainnet launch, which aims to enhance the modular blockchain’s capabilities for supporting decentralized apps and smart contracts.

Market commentators also pointed out that Onyxcoin, being a US-based company, has added a level of credibility and regulatory compliance that may be drawing more investors to the altcoin.

Curve DAO

Curve DAO (CRV) held onto an 11% gain over the past day, trading at $0.48, with a market cap of $631 million at the time of writing.

The jump came as trading activity surged, with daily volume tripling to $230 million, while the circulating supply stood at 2.23 billion CRV tokens.

Source: CoinMarketCap

While no major catalyst could be identified as of press time, Vyper, a Python-based smart contract programming language used to write Curve Finance’s smart contracts, has recently received an update focusing on polishing the language, addressing bug fixes, and improving user experience.

The post Crypto price recap: Bitcoin recovers back above $90k, ADA leads daily gains appeared first on Invezz

https://invezz.com/news/2025/03/03/crypto-price-recap-bitcoin-recovers-back-above-90k-ada-leads-daily-gains/