In a surprising turn of events, the cryptocurrency market has experienced a sharp decline, with Bitcoin (BTC) and Ethereum (ETH) both seeing significant losses.

This downturn coincided with the release of the US Job Openings and Labor Turnover Survey (JOLTS) data, which indicated a surge in job openings, signaling a robust labor market.

With Bitcoin dropping over 4% and Ethereum losing nearly 7% in value within an hour, the market dynamics appear to be heavily influenced by macroeconomic indicators.

JOLTS data causes BTC to break below its $100k support

The JOLTS data, showing an increase in job openings, often leads to speculation about rising inflation and potential interest rate hikes, which can dampen speculative investments like cryptocurrencies.

Bitcoin, the leading cryptocurrency by market capitalization, saw its price fall to $97,756.76, marking a 4.3% decrease within hours.

This scenario seems to have spooked investors, leading to a rush of sell-offs as confidence waned.

The trading volume remains high at $52.2 billion, indicating significant market activity despite the price drop.

Over the last week, though, BTC managed a 2.6% increase, suggesting some resilience or recovery in the market.

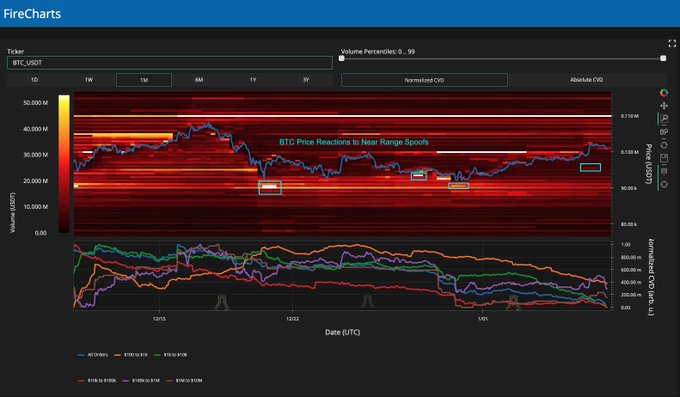

Beyond the macroeconomic data, Bitcoin was also affected by what traders referred to as “spoofing.”

This practice involves placing large orders on exchanges to manipulate liquidity and price, only to cancel them before execution.

Such tactics were highlighted as a reason for the sudden price support disintegration for Bitcoin, leading to a rapid correction of over $4,000.

This manipulation can lead to false market signals, causing panic selling among smaller investors who see the price rapidly declining.

Analysts like Keith Alan noted that such spoofing leads to predictable but volatile price action, particularly in short timeframes.

This was evident from the liquidation of over $30 million in long positions for Bitcoin in just one hour, as depicted by Coinglass’ liquidation data.

Spoofs are annoying, but they do tend to facilitate some predictable price action for Bitcoin.

The market’s reaction to these manipulations, combined with the JOLTS data, has created a perfect storm for the sudden price drop.

Ethereum (ETH) sees an even steeper drop

Ethereum followed suit, with an even steeper decline of 6.7% in the same period, bringing its price to $3,464.08.

The reaction in Ethereum’s market could be attributed to similar macroeconomic concerns but amplified by its utility in DeFi and other blockchain applications, making it sensitive to broader financial market movements.

However, the volume of Ethereum transactions has soared to $27 billion, reflecting active trading despite the price drop.

Like Bitcoin, Ethereum showed a slight weekly gain of 1.7%, hinting at underlying buying interest or optimism.

Other major altcoins also register price drops

Alongside Bitcoin and Ethereum, several other altcoins have faced considerable price drops following the release of the US JOLTS data.

XRP, for instance, saw a 4.9% decline over the last 24 hours, despite having a positive 7-day trend with a 9.4% increase.

Similarly, Solana (SOL) dropped by 5.9% in the same period, showing that the broader market sentiment was affecting even those cryptocurrencies known for their technological advancements in blockchain scaling.

Dogecoin (DOGE) also didn’t escape the downward trend, plummeting by 6.0%, although it had a robust 12.2% rise over the week, suggesting a possible rebound in investor interest or speculative trading.

Cardano (ADA) mirrored the market with a 4.9% decrease despite registering an impressive 20.9% weekly gain, which potentially reflects a growing belief in its technological promise or a speculative bounce-back.

Other significant altcoins like Chainlink (LINK) and Shiba Inu (SHIB) also saw declines of 9.9% and 8.1% respectively, highlighting a broad-based sell-off in the crypto market.

LINK, despite the drop, showed a modest 5.5% weekly increase, while SHIB’s weekly growth was at 4.1%.

Newer or less established tokens like Sui (SUI) and Wrapped stETH (WSTETH) were also not immune, with SUI dropping 6.8% and WSTETH falling by 7.0% in the last 24 hours.

Even Toncoin (TON), which has been gaining popularity, saw a 5.2% decline, indicating the pervasive nature of the market’s reaction to macroeconomic news.

These price drops across a wide range of altcoins underline the interconnectedness of the cryptocurrency market, where macroeconomic indicators can swiftly alter investor behavior, leading to rapid, sometimes panic-driven, sell-offs.

The post Crypto market takes a hit as Bitcoin and Ethereum fall; US job data signals strong labor market appeared first on Invezz

https://invezz.com/news/2025/01/07/crypto-market-takes-a-hit-as-bitcoin-and-ethereum-fall-amid-strong-us-job-data/