Corporate Bitcoin adoption is losing steam as monthly data shows that since July, there’s been a 95% drop in the number of companies adopting Bitcoin as a reserve asset, which has made many speculate whether the BTC bull run is over.

According to recent data from CryptoQuant, 2025 peaked with 89 new companies adding BTC to their balance sheets, up from just 6 in 2020.

But that momentum is starting to slow.

The trend started slowly with just 4 companies in January, then grew steadily through July, which saw a peak of 21 new adopters.

However, August marked a sharp reversal with only 15 companies joining – a drop of 6 from July’s high.

September has been even worse, with just one company adopting Bitcoin so far.

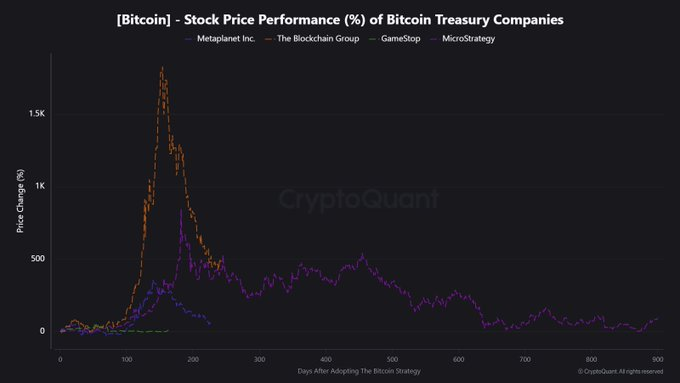

Similarly, the stock prices of most Bitcoin Treasury companies are starting to cool down after massive rallies.

For example, the Blockchain Group, which went up +1,820% following Bitcoin treasury adoption at the peak, is now down 35% in the last month.

Similarly, Metaplanet Inc saw a +355% at the peak, now down 33.2% which is a sign that the Bitcoin adoption hype is deflating as reality sets in.

Corporate Bitcoin Adoption Key to BTC Bull Run

Analysts believe the corporate Bitcoin accumulation has been a key driver of Bitcoin’s explosive rally.

Bitcoin is up 96.75% year-to-date (YTD), which has been mostly as a result of corporate buying and institutional buying via ETFs.

Data from Bitcoin Treasuries shows that over 3.7 million BTC are being held by treasuries. Public companies hold the second largest with over 1 million BTC, only bettered by ETFs with 1.47 million BTC.

However, economists worry that slowing corporate buying could hurt Bitcoin prices, especially if companies start selling.

According to a research report from Sentora shared with Cryptonews in August, analysts warn that corporate Bitcoin strategies don’t work well in rising interest rate environments.

Most Bitcoin treasury companies are unprofitable and rely on Bitcoin’s price gains to stay solvent.

Vincent Maliepaard from Sentora calls these “negative-carry trades”, as companies borrow money to buy Bitcoin, which produces no income.

Coinbase research adds that the corporate treasury trend has shifted from easy profits to intense competition, warning that many participants could fail during economic downturns.

Crypto analyst Ran Neuner claims many treasury firms are just exit schemes for insiders.

JP Morgan and other big analysts are expecting a market dump before a reversal.

They project that $BTC will dump towards $104,000 level before reversal or dump towards $92,000 level, which also has a CME gap before reversal and a new ATH.

Technical Analysis: Bitcoin Might Dip Below $100K But Bull Run Not Over

On the technical side, the Bitcoin daily chart is showing weakness after getting rejected around the $116,600 zone, which aligns with last week’s high and the marked daily bearish breaker.

Price is currently trading near $115,400, struggling to push higher, suggesting sellers are defending this resistance area strongly.

If momentum fails to reclaim and hold above $116,600, the chart projects a downward move that could first test last week’s low around $110,600.

A breakdown from there would expose deeper supports at $100,700, followed by the yearly open at $93,576 and potentially the $88,700 zone.

However, many analysts think that while BTC is down 7.24% from its all-time high, the crypto bull run is not yet over.

Fundstrat’s Tom Lee believes Bitcoin could rally dramatically if the Federal Reserve cuts rates tomorrow..

He told CNBC that crypto is highly sensitive to liquidity changes, citing past Fed pivots in 1998 and 2024 as examples.

Lee predicts a “monster move” in Bitcoin and Ethereum over the next three months.

Meanwhile, Gold has surged 11% since late August, climbing from $3,300 to above $3,690 in an almost uninterrupted rally.

Bitcoin has been much weaker. After rejection at $116,000, it dropped to $109,000 before recovering, but remains stuck in consolidation.

For Bitcoin to match Gold’s performance, it needs to break above $116,000 resistance.

This could spark a move toward $120,000, and potentially $125,000-$127,000 if momentum holds.

The post Corporate Bitcoin Adoption Falls 95% Since July – BTC Bull Run Over? appeared first on Cryptonews.

https://cryptonews.com/news/corporate-bitcoin-adoption-falls-95-since-july-btc-bull-run-over/