A Delaware judge ruled Friday that a shareholder lawsuit alleging insider trading by Coinbase directors can proceed, rejecting a special committee’s recommendation to dismiss the case despite its 10-month investigation clearing the defendants.

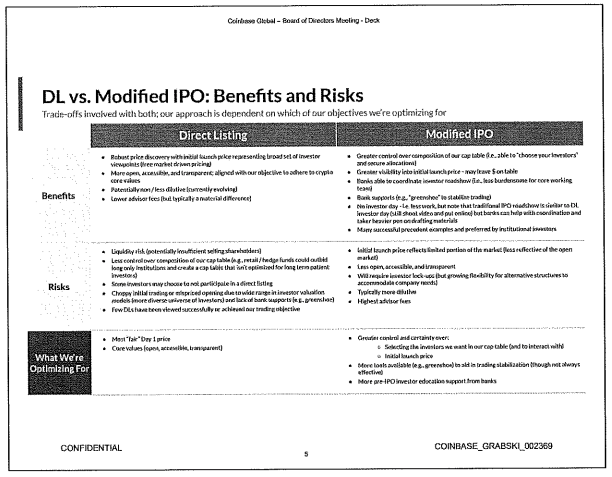

The decision affects several high-profile directors, including venture capitalist Marc Andreessen and CEO Brian Armstrong, who collectively sold over $2.9 billion in stock during the company’s April 2021 direct listing.

According to Bloomberg Law, Judge Kathaleen St. J. McCormick allowed the case to proceed due to conflicts involving one committee member, though she acknowledged the internal investigation “paints a compelling narrative” in support of the directors’ defense.

The lawsuit, filed in 2023 by shareholder Adam Grabski, claims directors used confidential valuation information to avoid more than $1 billion in losses by selling shares when Coinbase went public without traditional lockup restrictions.

Independence Concerns Undermine Internal Review

The special litigation committee comprised two Coinbase board members: Kelly Kramer, former chief financial officer of Cisco Systems, and Gokul Rajaram, a Silicon Valley angel investor.

Neither was named as a defendant nor sold shares in the direct listing. However, McCormick identified substantial business ties between Rajaram and Andreessen Horowitz as disqualifying conflicts of interest.

According to court filings, interactions included a 2007 investment by Andreessen in a startup co-founded by Rajaram, and at least 50 financing rounds in which Rajaram or his venture firm participated alongside Andreessen Horowitz since 2019.

“No one—not plaintiff and thus not the court—questions Rajaram’s good faith,” McCormick wrote. “But the thick ties between him and the subject of the SLC’s investigation are sufficient to raise material disputes regarding his independence.“

Attorneys for the committee argued that the business interactions were “immaterial,” given the 700 total investments, and noted that there was no evidence of coordination in financing rounds.

“These are not close personal ties. These are professional ones,” said Brad Sorrels, representing the committee, during an October hearing.

Direct Listing Structure Enabled Immediate Sales

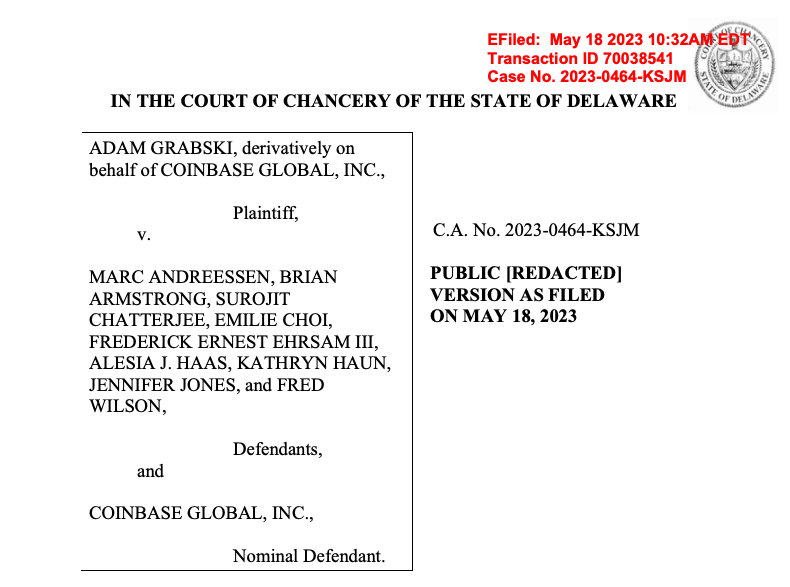

The shareholder complaint centers on Coinbase’s unconventional path to public markets through a direct listing rather than a traditional IPO.

This structure allowed existing shareholders to sell immediately without the lockup periods typically imposed by underwriters to prevent insider trading on material nonpublic information.

Armstrong sold $291.8 million in shares, according to the complaint, while Andreessen Horowitz divested $118.7 million through the direct listing.

Other defendants included Chief Operating Officer Emilie Choi, who sold $224 million, and co-founder Fred Ehrsam, who sold $219.5 million.

The lawsuit alleges that directors knew the shares were overvalued, based on an internal Andersen Tax valuation that was substantially below market expectations when trading began at $381 per share.

Within five weeks of the April 14, 2021 listing, Coinbase shares declined by more than 37% as the company disclosed fee compression affecting retail revenues and announced a dilutive convertible note offering.

By May 18, 2021, the stock had wiped out just over $37 billion in value, according to the complaint.

Company Disputes Claims Amid Delaware Criticism

“We are disappointed by the court’s decision and remain committed to fighting these meritless claims in court,” Coinbase said in a statement.

The committee’s report concluded that the defendants didn’t rely on confidential information, noting that Coinbase stock is “highly correlated” with Bitcoin prices, making it impossible to prove insider trading allegations.

The committee argued directors “reluctantly” sold stock to provide sufficient supply for the direct listing, divesting only small portions of their holdings.

“The evidence roundly showed that defendants, including the two biggest stockholders, didn’t want to sell because they were bullish about the company,” Sorrels said during the October hearing.

Armstrong and Andreessen Horowitz “ultimately agreed to sell just over 1% of their respective shares only after the company and its banker pleaded with them to provide supply necessary for the direct listing to launch,” according to committee filings.

Andreessen Horowitz has publicly criticized Delaware’s business courts, announcing plans last July to reincorporate portfolio companies elsewhere due to perceived bias “against founders and their boards.“

Coinbase announced its own reincorporation plans on November 12, following similar moves by other major companies seeking to exit Delaware’s jurisdiction.

Beyond civil litigation, Coinbase faced a similar, but criminal insider trading case in 2023, when former product manager Ishan Wahi received a two-year prison sentence for sharing confidential listing information with family members who profited from the advanced knowledge.

https://cryptonews.com/news/coinbase-insider-trading-lawsuit-advances-despite-2-9b-stock-sale-defense/