ChatGPT’s BTC analysis shows that Bitcoin is testing the key $112,650 support with a -1.46% decline to $113,155 as ETFs recorded massive $333 million outflows while Indonesia explores national reserve adoption.

ChatGPT’s BTC analysis synthesizes 22 real-time technical indicators, ETF outflow dynamics, institutional adoption developments, and regulatory progress metrics to assess Bitcoin’s 90-day trajectory amid a key inflection between bull run continuation and a deeper correction phase.

Technical Analysis: Bearish Breakdown Below All EMAs

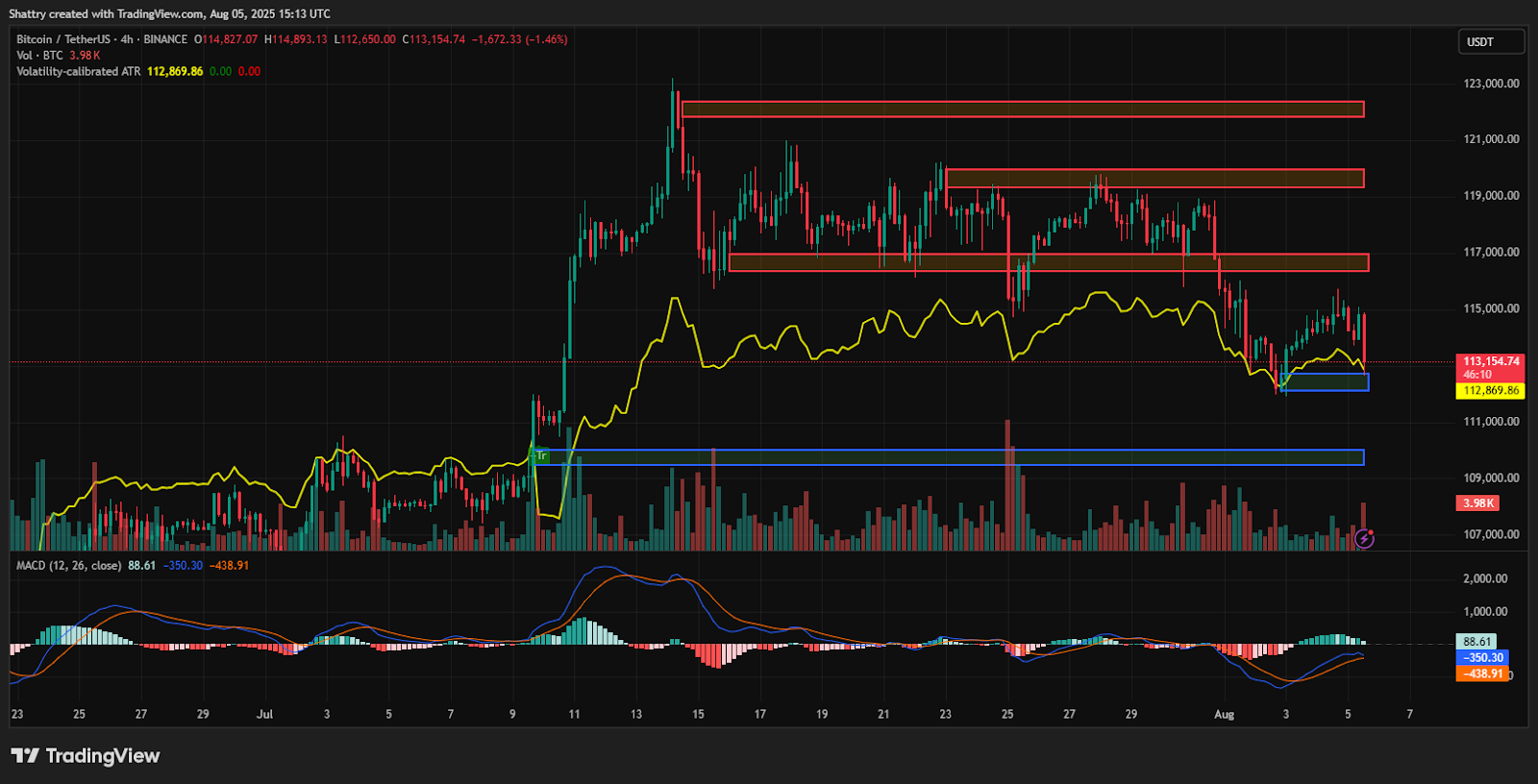

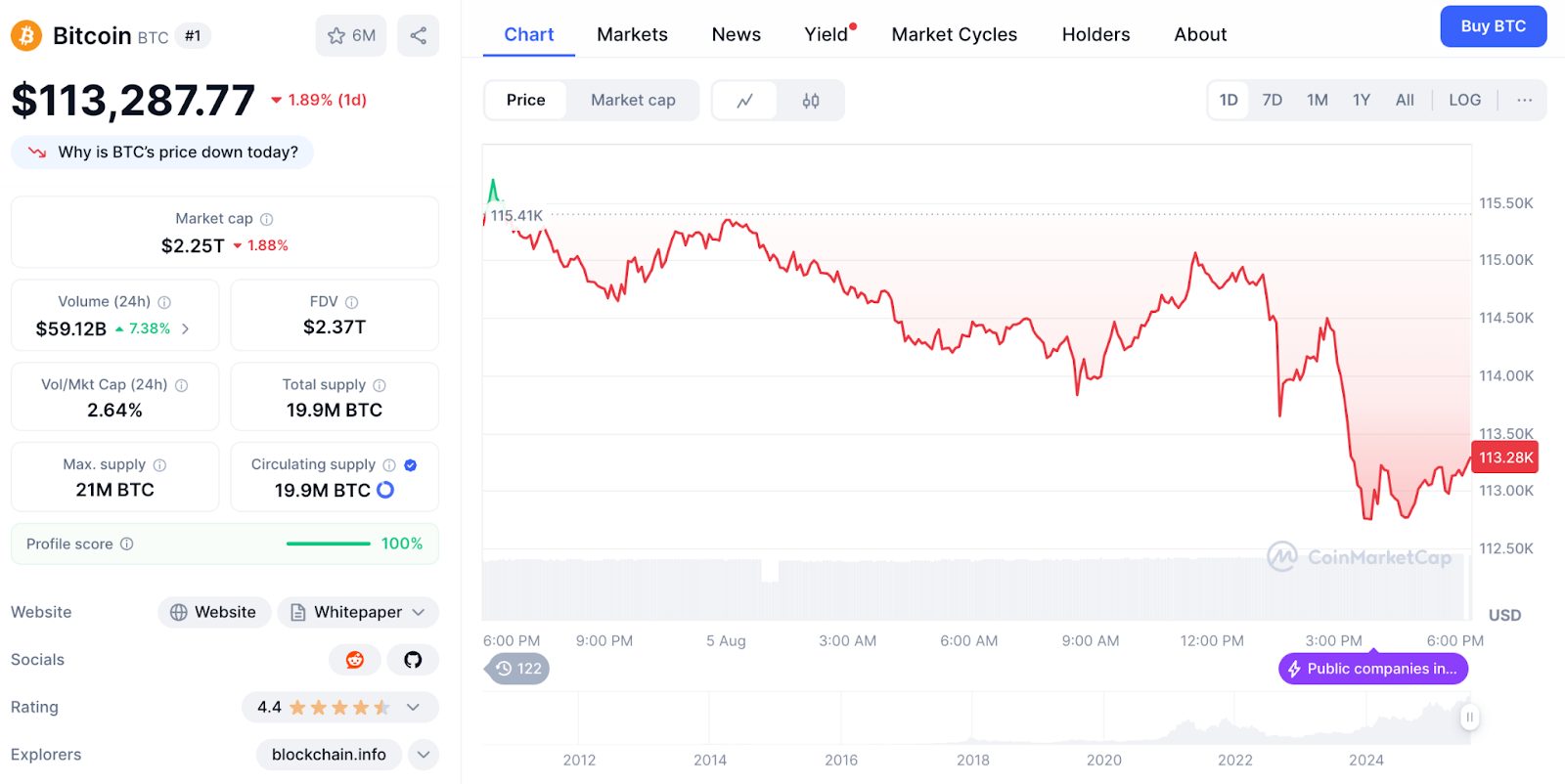

Bitcoin’s current price of $113,155 reflects a concerning -1.46% daily decline from the opening price of $114,827, establishing a trading range between $114,893 (high) and $112,650 (low).

This 2.0% intraday range demonstrates controlled selling pressure typical of institutional distribution phases.

The RSI at 38.63 approaches oversold territory, indicating potential for a short-term bounce if support holds.

Moving averages reveal challenging positioning with Bitcoin below all major EMAs: 20-day at $114,708 (+1.4%), 50-day at $115,380 (+2.0%), 100-day at $115,926 (+2.4%), and 200-day at $114,714 (+1.4%). This EMA structure indicates a clear bearish bias requiring a reclaim for reversal.

MACD shows mixed signs at 88.61 above zero, but a negative histogram at -438.91 suggests strong bearish momentum despite bullish line positioning.

Volume analysis shows moderate activity at 3.58K BTC during the decline, suggesting reduced institutional participation.

ATR at 112,870 indicates an extremely high volatility environment with potential for massive moves once the current consolidation resolves.

Historical Context: Testing Support After July Peak

Bitcoin’s August performance demonstrates vulnerability following July’s peak at $123,218, with current levels representing an 8.22% correction from the all-time high. The pullback tests institutional resolve after explosive first-half gains.

January’s $93,576 start was followed by a February-March correction to $81,976-$82,381, establishing the spring accumulation base.

April-July recovery showed consistent strength with May’s $104,730, June’s $107,199, and July’s climactic $119,447 close.

August’s current decline from the July peak tests whether institutional demand can absorb selling pressure at elevated levels.

The correction remains relatively modest within the context of 232 million percent gains from the 2010 lows.

Current pricing maintains a substantial premium to 2024 levels while testing the psychological support at the $112K-$113K zone that could determine medium-term direction.

Support & Resistance: Key $112K Defense

Immediate support emerges at today’s low around $112,650, representing key defense of the psychological $112K level. This zone provides primary support with major psychological importance, requiring defense for bull market continuation.

Key support demonstrates key importance with $110K-$111K representing a major historical accumulation zone. Breaking below $112K would trigger selling toward this major support cluster, where institutional buying may emerge.

Resistance begins immediately at the 20-day EMA around $114,708, followed by the 50-day EMA at $115,380 and the 100-day EMA at $115,926.

This EMA cluster creates significant overhead resistance, requiring volume expansion for a breakthrough.

The setup suggests further downside toward $110K-$111K if current support fails, while recovery above $114,708 could trigger short covering toward the $117K-$119K resistance zone.

ETF Outflow Crisis: $333M Daily Exodus

Bitcoin ETFs recorded devastating $333 million daily outflows, representing the largest institutional selling pressure this month.

This massive capital withdrawal reflects growing uncertainty about bull run sustainability and erosion of institutional confidence.

The ETF selling contrasts sharply with previous accumulation phases, suggesting an institutional positioning shift from buying to distribution.

BlackRock is reportedly preparing to sell 2,544 BTC ($292 million), adding to concerns about the pressure of sales.

However, there is more to this sell-off beyond the initial reaction, as it creates an accumulation opportunity for smart money to move in.

In that regard, speaking with Cryptonews, Shawn Young, Chief Analyst at MEXC Research, specifically noted that “despite the broader market sell-off, buyers stepped in to aggressively defend key support levels, allowing Bitcoin to rebound above $118,000.“

Ethereum ETFs recorded even larger $465 million outflows, indicating broader institutional cryptocurrency selling across asset classes.

This synchronized selling suggests systematic de-risking rather than Bitcoin-specific concerns.

ChatGPT’s BTC Analysis: Regulatory Progress Amid Selling

ChatGPT’s BTC analysis reveals mixed signs with regulatory progress offsetting institutional selling pressure.

The White House’s preparation of action against banks accused of crypto debanking provides a supportive regulatory backdrop.

Speaking with Cryptonews, Ray Youssef, CEO of NoOnes, emphasized: “The conviction in Bitcoin’s long-term value proposition remains solid. Bitcoin’s supply dynamics and institutional demand continue to provide a hard floor beneath its price action.“

And this is evident with Indonesia’s recent exploration of Bitcoin as a national reserve asset, which represents a major catalyst for sovereign adoption.

This follows a growing trend of nation-state accumulation, providing fundamental demand support.

Market Fundamentals: Dominance Under Pressure

Bitcoin maintains overwhelming market dominance at 61% with $2.24 trillion market cap, demonstrating resilience despite institutional selling. The 1.66% market cap decline accompanies an exceptional 12.65% volume surge to $59.33 billion.

The 2.62% volume-to-market cap ratio indicates moderate trading activity, suggesting controlled selling rather than panic distribution.

Circulating supply of 19.9 million BTC represents 94.8% of the maximum 21 million token supply, with mining rewards creating minimal inflation.

This supply scarcity provides fundamental support during selling periods.

Market dominance maintenance above 60% despite selling pressure demonstrates Bitcoin’s continued institutional preference and relative strength versus alternative cryptocurrencies.

LunarCrush data reveals declining social performance with Bitcoin’s AltRank dropping to 701, indicating community concern during the correction.

Galaxy Score of 63 reflects building negative sentiment around ETF outflows and price decline.

Engagement metrics show substantial activity with 80.08 million total engagements despite a 21.24M decline, and 259.31K mentions.

Social dominance of 19.4% demonstrates continued attention during uncertainty.

Sentiment registers at 75% positive despite recent decline, reflecting community resilience during the correction.

Recent themes focus on support defense, Elliott Wave patterns, and $150K predictions.

Three-Month BTC Price Forecast Scenarios

Support Defense Rally (40% Probability)

Successful defense of $112K support combined with regulatory progress could drive recovery toward $125K-$130K, representing 10-15% upside from current levels.

This scenario requires ETF outflow stabilization and institutional re-engagement.

Extended Consolidation (35% Probability)

Continued ETF outflows could result in consolidation between $105K-$115K, allowing technical indicators to reset while sovereign buying provides support.

This range-bound action could extend 8-12 weeks.

Deeper Correction (25% Probability)

Breaking below $112K support could trigger selling toward $100K-$105K major support zone, representing 10-15% downside.

This scenario would require sustained institutional selling and regulatory setbacks.

ChatGPT’s BTC Analysis: Institutional Test Meets Sovereign Support

ChatGPT’s BTC analysis reveals a key juncture between institutional selling pressure and emerging sovereign demand.

Next Price Target: $125K-$130K Within 90 Days

The immediate trajectory requires decisive defense of $112K support to validate continued institutional confidence over distribution pressure.

From there, regulatory progress acceleration could propel Bitcoin toward $125K psychological milestone, with sustained sovereign adoption driving toward $130K+ representing new cycle highs.

However, failure to hold $112K would indicate an extended correction to the $100K-$105K range as institutional selling accelerates, creating an optimal sovereign accumulation opportunity before the next adoption wave drives Bitcoin toward $150K+ targets, validating the digital gold reserve thesis.

The post ChatGPT’s BTC Analysis Shows Key $112K Support Amid $333M ETF Outflows as Bull Run Faces Uncertainty appeared first on Cryptonews.

https://cryptonews.com/news/chatgpt-btc-analysis-112k-support-333m-etf-exit/

BREAKING:

BREAKING:

Indonesia explores adding

Indonesia explores adding