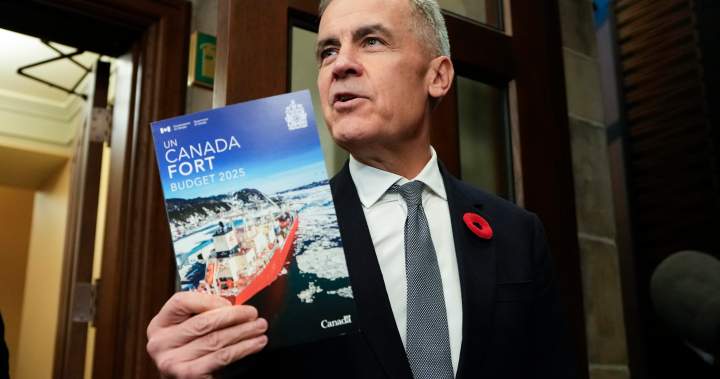

Prime Minister Mark Carney’s government has “limited room to cut taxes” with the fiscal deficit projected to balloon after Budget 2025, a report by the Parliamentary Budget Office said on Thursday.

The PBO published its independent assessment of Budget 2025, highlighting “financial pressures and concerns about transparency.”

“According to the PBO, the Government has limited room to cut taxes or increase spending if it wants to keep the federal debt-to-GDP ratio in 2055–56 at or below its current level,” the PBO said in a press release accompanying the report.

The debt-to-GDP ratio is an economic metric that measures a country’s debt against the total value of goods and services produced in the country.

The federal debt-to-GDP ratio in Budget 2025 is projected to be higher compared with the 2024 fall economic statement, “and is no longer projected to be on a declining path over the medium term,” the PBO report said.

“Budget 2025 projects the debt-to-GDP ratio will stay mostly stable over the next 30 years,” interim parliamentary budget officer Jason Jacques said in a statement accompanying the report.

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

“This is different from the last three years, when fiscal policy provided more flexibility to deal with future risks.”

Budget 2025 projects a deficit of $78.3 billion, or 2.5 per cent of GDP, for the financial year 2025-26. The budget projects that the debt-to-GDP ratio will fall to 1.5 per cent by 2029-30.

In September, Carney said his government did have fiscal anchors, responding to previous PBO concerns.

“We are going to spend less so the country can invest more. We are going to balance the operational budget in three years. We’re going to have a declining level of debt,” he said in the House of Commons in September.

The government has set fiscal anchors around the deficit, with an aim to balance the operating budget and make sure the deficit-to-GDP ratio declines over time.

However, the PBO said there is only a 7.5 per cent chance that the deficit-to-GDP ratio will fall every year from 2026-27 to 2029-30.

“This means the Government’s new anchor is unlikely to hold,” Jacques said.

The PBO also said the Carney government’s definition of capital expenses is “overly expansive.”

While operational expense is money spent on the day-to-day functioning of the government, capital investment is money the government sets aside and invests for long-term gains.

The PBO projects capital investments would total $217 billion from 2024-25 to 2029-30 — about $94 billion less than Budget 2025 estimates.

“To improve transparency, an independent expert group should decide what counts as capital investment under the expanded definition,” Jacques added.

© 2025 Global News, a division of Corus Entertainment Inc.

Carney has ‘limited room to cut taxes’ as debt-to-GDP ratio to grow: PBO