Bitcoin’s efficiency in September, which noticed it closing the month within the inexperienced, has piqued the curiosity of analysts on the crypto alternate Bitfinex, who counsel this might sign a bullish October for the primary cryptocurrency.

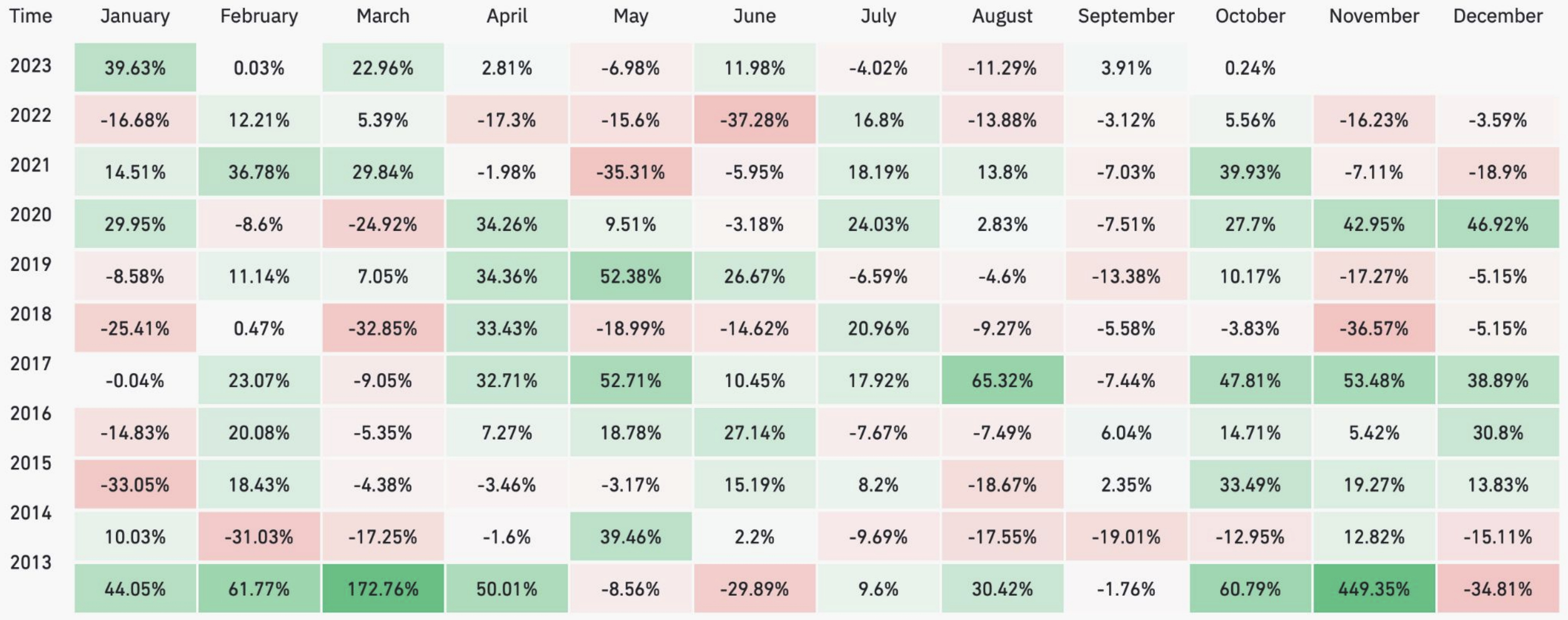

Historically, a constructive September has typically set the stage for a bullish October within the Bitcoin market.

Bitfinex analysts level out that the mixed crypto market cap elevated by 6.1% throughout September, marking a uncommon prevalence of the month closing positively.

The Bitfinex Alpha report for the week highlights that a number of elements help a forecast of elevated volatility and potential upside for Bitcoin within the coming month.

Futures market metrics and different indicators trace at the potential of extra vital value actions, significantly on larger timeframes.

Options information reveals larger volatility expectations

In the report, the analysts additionally stated the crypto choices market is exhibiting indicators of anticipating larger market volatility.

When implied volatility surpasses historic volatility, it typically signifies that merchants are bracing for elevated value swings.

Strong on-chain help at present value

Bitfinex’s report additionally references on-chain information that implies robust help for Bitcoin’s present value ranges.

Long-term holders seem decided to take care of their positions, which is contributing to the cryptocurrency’s stability.

Additionally, the report notes that Bitcoin held for durations between 6 and 12 months stays comparatively static, whereas BTC provide aged greater than three years has been largely inactive since February 2023.

These developments counsel that long-term traders are holding onto their Bitcoin holdings, sometimes called “HODLing” in crypto circles.

Bitcoin started September at roughly $25,900 and closed the month slightly below $27,000, representing a 3.9% achieve for the month.

https://cryptonews.com/news/bitfinex-analysts-bitcoins-september-surge-signals-potential-bullish-october.htm