Bitcoin has fallen to $103,570, down over 1.50% in the last 24 hours, with over $827 million in liquidations. Most of these were longs being forced to sell into a falling market, accelerating the decline. This wave of selling has added significant downward pressure, and we are now at multi-week lows.

The liquidation spree serves as a reminder of the dangers of leverage in a volatile cryptocurrency market, where significant price movements can trigger automated sell orders.

- $827M liquidated, mostly longs

- BTC below key support, now trying to get back to $104K

- Volume is $52.38B as of today

Macroeconomic Jitters and ETF Outflows Weigh In

Beyond the immediate market chaos, macro and geopolitical risks are adding to the uncertainty. An insufficient US GDP number and ongoing tariff disputes from the Trump era are spooking investors. High-risk assets, such as Bitcoin, are being hit the hardest as caution spreads through the markets.

BlackRock’s iShares Bitcoin Trust (IBIT) saw a record $430.8 million outflow on May 30, ending a 31-day inflow streak. This is the largest single-day outflow since the ETF’s January 2024 debut, indicating that institutional players are becoming increasingly nervous.

Across all 11 US spot Bitcoin ETFs, $616.1 million was outflowed for the day. While BlackRock’s Bitcoin holdings remain at $70 billion, the outflows indicate a shift in sentiment.

Bitcoin Technical Analysis: Key Levels and Rebound Signs

On the technical front, the Bitcoin price prediction appears bearish, as BTC has violated the upward trendline. On the 4-hour chart, Bitcoin has broken below a rising trendline and is forming a descending triangle. This classic pattern, where lower highs converge to horizontal support, indicates more bearish momentum.

The 50-period EMA is a ceiling at $106,932. The MACD is confirming this with a bearish crossover and red histogram bars.

Key levels to watch:

- Support: $102,141 – if this breaks, we could see $100,799 or $99,356

- Resistance: $106,409 – potential reversal point if patterns emerge* Reversal Watch: Bullish candlesticks (Morning Star, Bullish Engulfing) at support, MACD divergence, 50-EMA reclamation as reversal signs

The short term is bearish, but a significant reversal with strong buying at support could take us back to $104K and beyond. But without reversal signs, be cautious, as the path of least resistance is down.

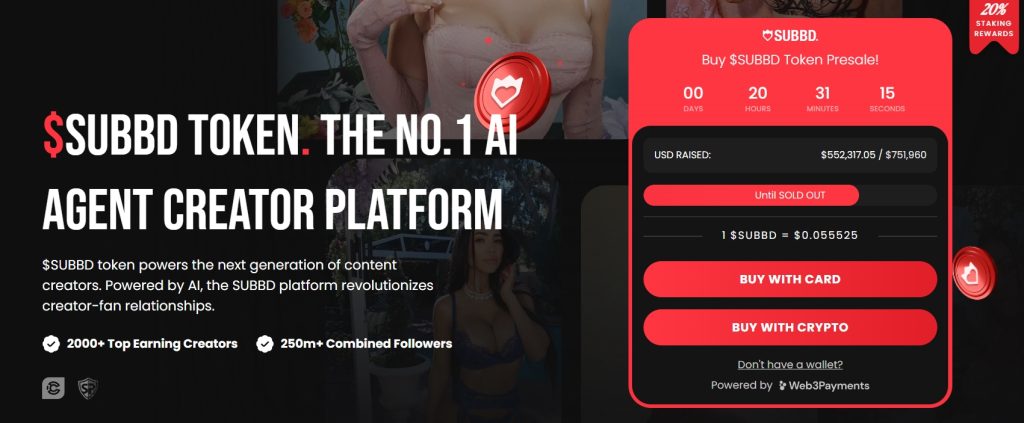

SUBBD Presale Surpasses $552K, Redefining Content Creation

SUBBD is revolutionizing the content creation landscape with a Web3 platform designed to empower both creators and fans. With over 2,000 creators and a combined audience of 250 million already on board, this isn’t just a presale, it’s a movement gaining momentum.

At its heart, SUBBD transforms the way creators and fans connect. Forget middlemen and censorship.

With AI-driven tools, seamless token-gated rewards, and a dynamic ecosystem, fans gain access to exclusive drops while creators monetize directly. It’s a space built for authentic engagement and creativity.

Stake your $SUBBD tokens to unlock a suite of rewards, including XP boosts, premium content, exclusive raffles, and VIP livestream access. Fans can use earned credits for perks, while token holders gain a voice in governance voting.

The presale has already raised over $552,317 out of a $751,960 target, with each $SUBBD priced at $0.055525. The momentum is building fast, and the remaining allocation is limited.

Join the future of decentralized content today. Visit the SUBBD platform, connect your wallet, and swap USDT, ETH, or use a bank card to secure your stake in this evolving content ecosystem.

The post Bitcoin Price Prediction: Post-$827M Liquidation Carnage – Can BTC Reclaim $104k Amid ETF Inflows? appeared first on Cryptonews.

https://cryptonews.com/news/bitcoin-price-prediction-post-827m-liquidation-carnage-can-btc-reclaim-104k-amid-etf-inflows/

Buckle up boys and stay out of high leverage

Buckle up boys and stay out of high leverage

BlackRock’s Bitcoin ETF just saw its BIGGEST outflow since launch!

BlackRock’s Bitcoin ETF just saw its BIGGEST outflow since launch!