Bitcoin is trading around $115,930 on Wednesday, down 0.7% in the past 24 hours, as traders digest the Federal Reserve’s first interest rate cut in nearly a year.

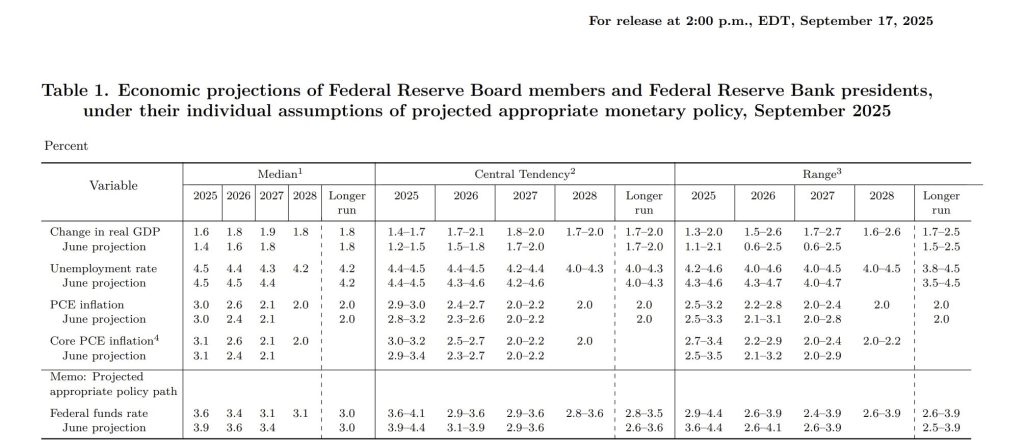

The Fed lowered its benchmark federal funds rate by 25 basis points to a target range of 4.00%–4.25%, a move widely anticipated after months of slowing job growth and sticky inflation.

Chair Powell said it was a “risk management cut,” so the Fed is moving to a data dependent approach.

The new projections show US GDP 1.6% in 2025, unemployment 4.5% and inflation easing to 2% by 2028. Powell’s comments calmed some investors but markets got volatile as his press conference started, showing the tension between easing and uncertainty.

For Bitcoin, which is both a risk asset and an inflation hedge, the path forward depends on how the Fed’s dovish tilt intersects with the chart.

Rising Wedge Signals Pressure on Bulls

On the technical front, Bitcoin has formed a rising wedge, a bearish continuation pattern that tends to appear when upside momentum begins to fade.

After failing to hold above the $117,300 resistance, BTC is now testing the $115,800 support area, reinforced by the 50-period SMA and the wedge’s lower boundary.

The RSI has slipped below 50, reflecting weakening momentum, while recent candles show signs of hesitation, with small-bodied formations hinting at indecision.

If sellers gain control, the TradingView path projection points to a drop toward $114,400, with a deeper slide possible to $113,200, where the 200-SMA aligns with a prior demand zone. A three black crows candlestick pattern beneath support would confirm this bearish continuation.

Still, bulls are not out of the picture. Should Bitcoin hold $115,800 and print a bullish engulfing candle or hammer at support, a rebound could follow. A breakout above $117,300 would invalidate near-term downside pressure, opening the way to $118,500 and $119,350.

Outlook: Can Bitcoin Break Higher?

For traders the $115,800 level is the line in the sand. Above it is accumulation and fresh longs to $118K-$119K. Below it is a deeper correction but the bigger picture of higher lows across the cycle still supports the long term bull case.

If the Fed’s rate-cut cycle unfolds in line with 2020, when looser monetary policy helped fuel one of Bitcoin’s strongest bull runs, a new wave of institutional demand could emerge.

In that scenario, BTC’s next breakout could extend beyond short-term resistance and build momentum toward the $130,000 region in the months ahead.

For investors, today’s volatility is less about short-term noise and more about positioning for Bitcoin’s potential role in the next expansion phase of global liquidity.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $16.5 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012935—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Fed Cuts After Almost a Year – Is a 2020-Style Explosion Coming? appeared first on Cryptonews.

https://cryptonews.com/news/bitcoin-price-prediction-fed-cuts-for-first-time-in-12-months-could-btc-explode-like-2020-again/