Bitcoin’s price has demonstrated resilience, climbing above $118,000 after weathering significant selling pressure from whale activity.

This recovery has sparked discussions among market participants about the extent to which large holders and long-dormant wallets influence Bitcoin’s price movements.

Contrary to widespread assumptions about whale dominance, recent insight from River, a Bitcoin-focused financial institution, shows that more than 67% of all BTC remains under individual ownership rather than institutional control.

Individual Ownership Powers Bitcoin as Indicator Flashes GREEN

The distribution of Bitcoin ownership aligns with Satoshi Nakamoto’s original vision of decentralization, ensuring that ordinary people, rather than a concentrated group of institutions, maintain influence over the financial systems that affect their economic well-being.

Bitcoin’s ability to maintain strength above $117,000 during the recent whale selling episode demonstrates such a belief.

The cryptocurrency has now successfully closed above critical bullish territory, completing the CME gap fill at $115,000.

Market momentum is now in the bulls’ control, with Bitcoin’s price trajectory pointing toward a potential rally to $140,000 as the next significant milestone.

Nevertheless, the inherent volatility of cryptocurrency markets demands careful risk management.

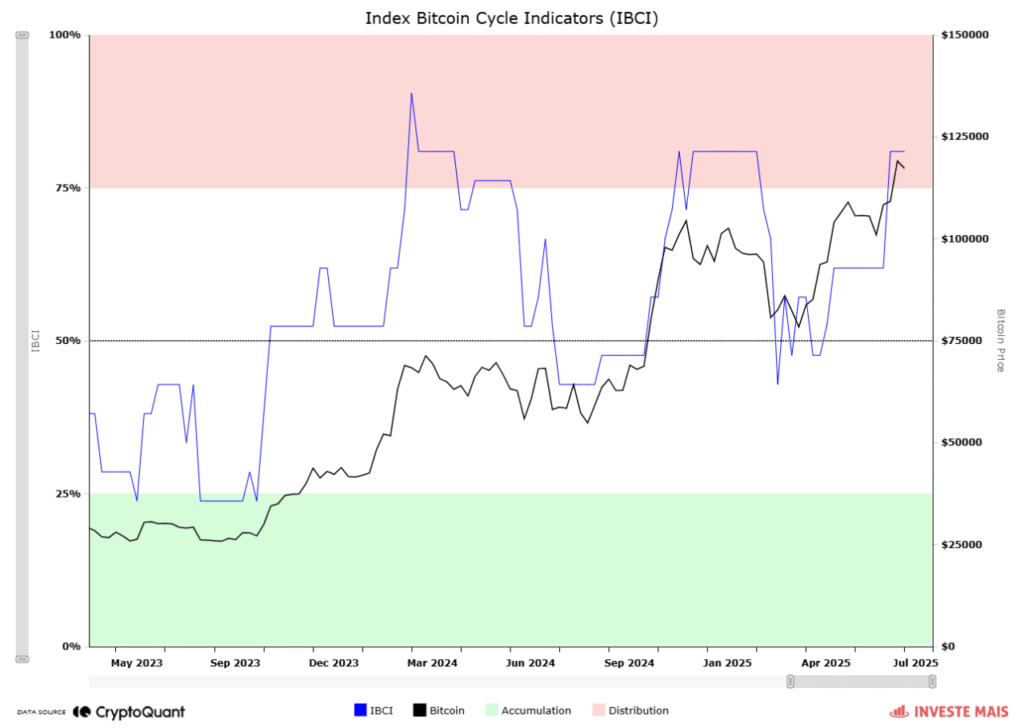

The Index Bitcoin Cycle Indicators (IBCI) has entered the Distribution zone after five months, a range historically linked to market euphoria and potential peaks.

Importantly, the index has only reached the lower boundary of this zone at the 80% level, remaining well below the 100% threshold that previously signaled major cycle tops.

This suggests that Bitcoin’s targets of $140,000-$150,000 remain achievable, as aggressive profit-taking typically seen at cycle peaks has not yet materialized.

Bitcoin Price Analysis: Elliott Wave Points to $131K

From a technical perspective, Bitcoin’s (BTC/USD) daily chart reveals a developing Elliott Wave pattern, with the asset currently positioned in the early phases of Wave (V).

The preceding waves (i) through (iv) have been completed according to established wave principles.

Currently, Bitcoin is consolidating just beneath the 9-day EMA at $118,016.64, which serves as immediate resistance.

The emergence of a bull pennant or flag formation below this resistance level indicates potential for continued bullish momentum toward the projected Wave (V) target around $131,757.

The RSI reading of 66.42 remains below overbought conditions, providing room for additional upward movement.

This New Bitcoin Token Could 10X: $5M Raised

While Bitcoin moves up and down between key price levels, a new project called Bitcoin Hyper is getting a lot of attention.

This project is still in its early funding stage and has already raised over $5 million, showing that many investors believe in it.

So what is Bitcoin Hyper? Think of it as an upgrade to regular Bitcoin.

It’s built on what’s called a “Layer 2” system, basically a newer technology that sits on top of Bitcoin to make it work better.

This is the first project of its kind, which is why so many people are interested in buying in early.

Several crypto experts think the $HYPER token could go up 10 times in value from the current price.

Right now, early investors can buy $HYPER tokens for $0.0124 each.

The price will increase as the project progresses through various funding stages, so purchasing early may result in a better deal.

The post Bitcoin Price Prediction: 67% of BTC Still in Individual Hands – What Does This Say About Price Potential? appeared first on Cryptonews.

https://cryptonews.com/news/bitcoin-price-prediction-67-of-btc-still-in-individual-hands-what-does-this-say-about-price-potential/