The Bitcoin futures market is cooling, with reduced whale activity and stronger retail influence painting bearish sentiment ahead of key inflation data.

CPI and PPI reports are expected on Wednesday and Thursday, with market analysts now eyeing a $105K BTC price retest.

PPI (Producer Price Index) shows producer-level inflation trends, while CPI (Consumer Price Index) shows consumer-level inflation trends. Together, they shape Fed policy expectations.

Inflation Panic: Can Bitcoin Survive Another “Hotter Than Expected” CPI Print?

In the last inflation data released in August, PPI rose YoY by 3.7% vs the expected 3.0%, while CPI rose YoY by 3.3% vs 2.5% expected.

These hotter-than-expected inflation reports initially pressured risk assets, including Bitcoin, as markets fell 2% and scaled back expectations of aggressive Fed rate cuts.

However, analysts expect the upcoming CPI to cool slightly due to easing shelter and energy prices, possibly coming in closer to 3.0% year-over-year.

PPI is also expected to moderate as supply chain pressures ease, though energy volatility remains a risk.

For Bitcoin, a cooler-than-expected inflation print could be bullish, indicating the Fed may move toward a rate cut later in September or in Q4 2025.

A hot inflation reading, however, could trigger another risk-off move, with Bitcoin facing short-term selling pressure.

Analysts at CryptoQuant reveal that Bitcoin’s price has remained confined within a narrow range ($108K – $113K) over recent months, despite notable accumulation by institutional investors.

A closer examination of market dynamics shows that the futures market, which is a primary driver of Bitcoin’s price, has shown signs of weakness during this period.

Bitcoin Futures Market Shows Signs of Weakness

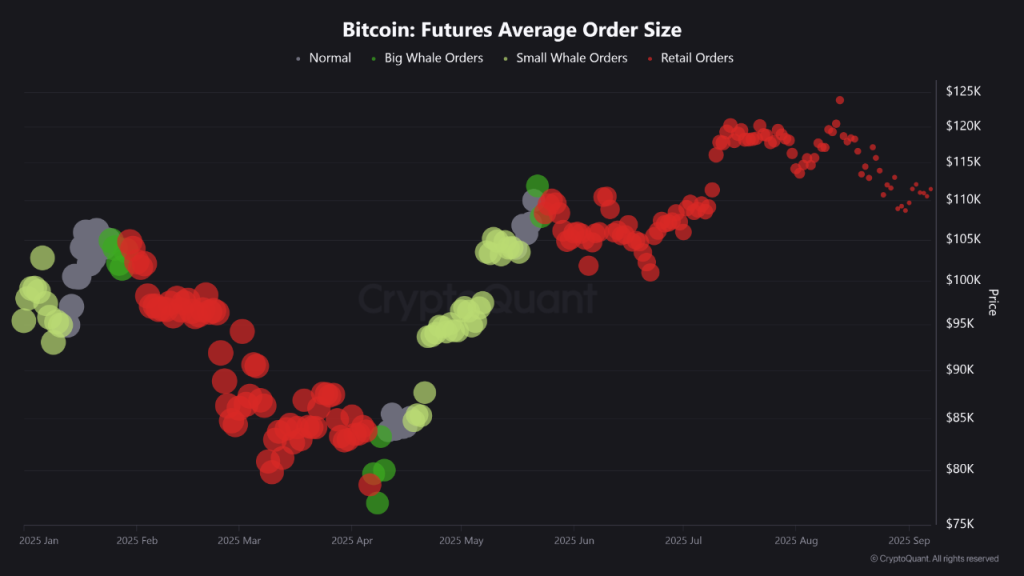

Data reveals a decline in participation from futures market whales.

This is reflected in the Average Order Size, calculated as total trading volume divided by the number of trades, which suggests greater influence from smaller, retail-driven transactions rather than large whale orders.

The Futures Volume Bubble Map further adds to the bearish observation, as it reflects reduced trading activity.

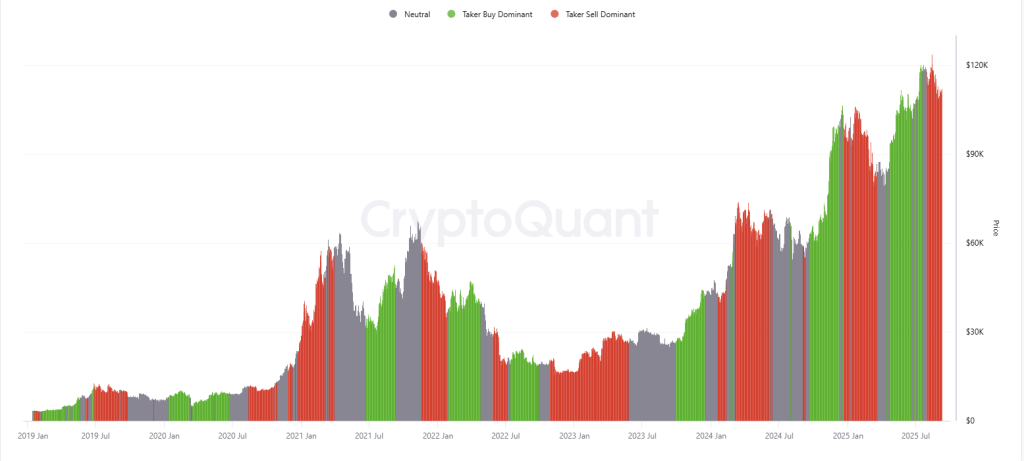

Additionally, the Bitcoin Futures Taker CVD (Cumulative Volume Delta, 90-day) highlights that sellers (Taker Sell) have been exerting greater pressure on the market.

This dominance of selling activity is another bearish indicator, pointing to the fact that futures market participants currently anticipate downward movement in Bitcoin’s price.

Data from Coinglass shows that Bitcoin futures outflow has topped $8.55 billion in the last 12 hours, with more than -130% in net inflow change, showing investors are taking a cautious approach in the market.

Bitcoin spot inflows are showing similar signs with over -346% net inflow change in the last 8 hours.

Technical Analysis Points to $103K-$105K Retest

DaanCrypto believes the $103K-$105K level is the bearish retest support that could see volatility from inflation data push BTC to this week.

Current price has been rejected from the $112K level and 4H 200MA/EMA consistently.

According to Daan, the market would regain strength when BTC holds above $115K or sees a monthly low sweep into a retake of $107K and $112K after.

This scenario is expected to be the most bullish scenario for a longer 1-2 month rally into October/November, where a new ATH above $130K could be achieved.

On the technical front, the Bitcoin 4-hour chart shows repeated rejections from the VWAP line, which has acted as strong dynamic resistance.

The most recent attempt to reclaim VWAP at around $113,000 failed, pushing the price back into consolidation.

Despite occasional volume spikes, buyers have not managed to sustain momentum above this resistance zone, signaling that sellers are still in control around current levels.

Unless Bitcoin can break and hold above VWAP with strong volume, the price risks drifting lower toward the next support around $104,600.

For now, the structure leans bearish-to-neutral, with any upside potential heavily dependent on a decisive reclaim of VWAP.

The post Bitcoin Futures Cool as Whale Activity Drops Ahead of Key Inflation Data – $105K Retest Next? appeared first on Cryptonews.

https://cryptonews.com/news/bitcoin-futures-cool-as-whale-activity-drops-ahead-of-key-inflation-data-105k-retest-next/

BIG WEEK INCOMING

BIG WEEK INCOMING