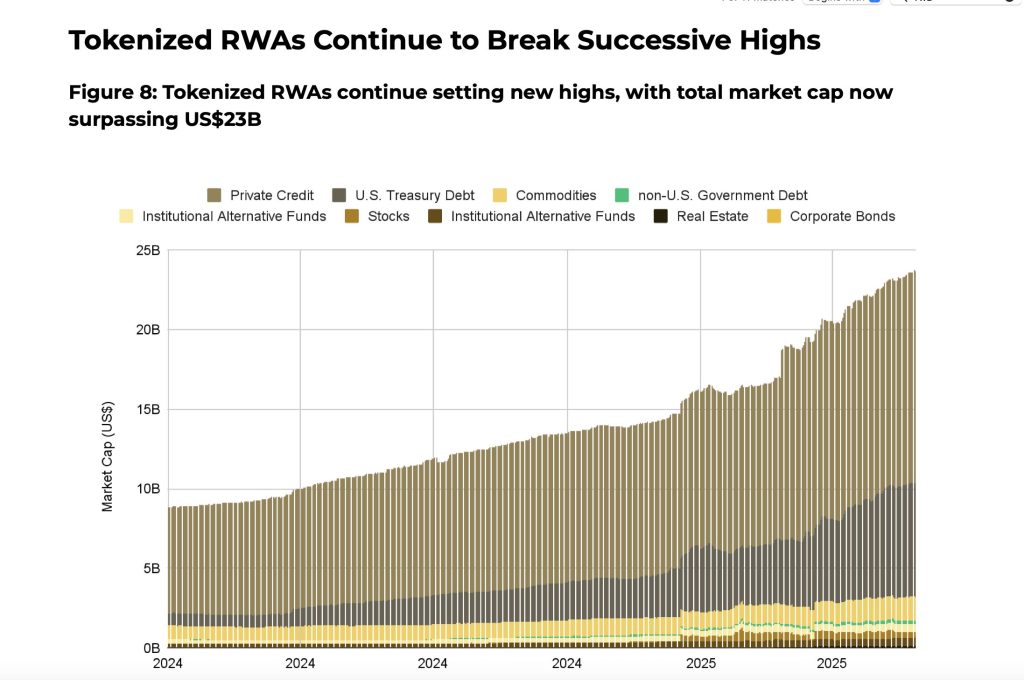

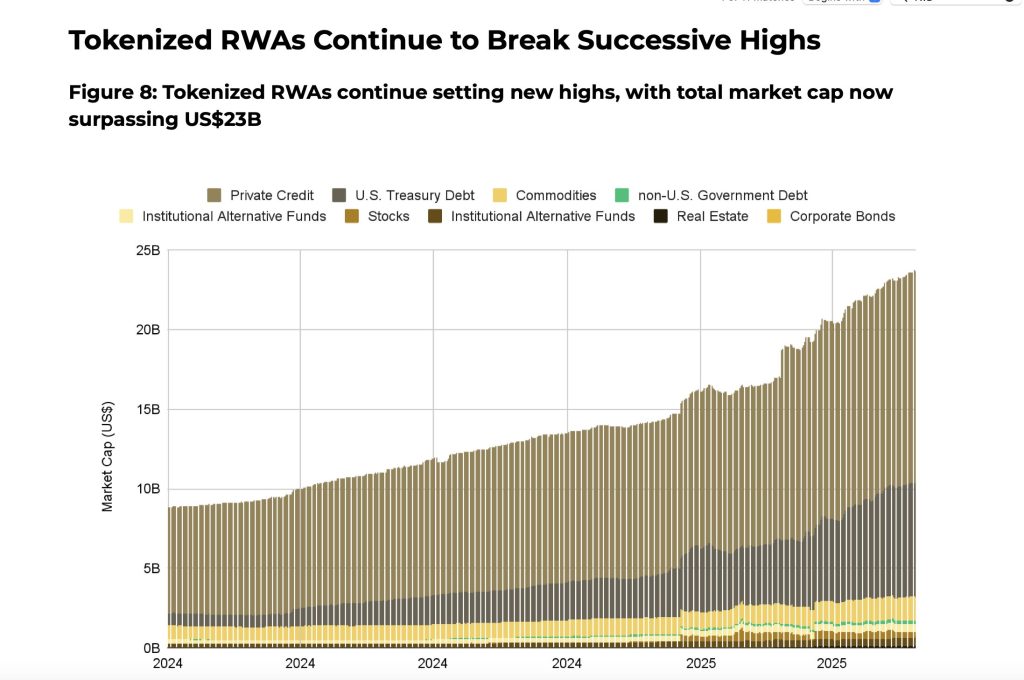

The tokenized real-world asset (RWA) sector has witnessed huge growth in 2025, according to new findings from Binance Research, authored by Moulik Nagesh, Joshua Wong, Michael JJ, and Asher Lin Jiayong.

In just the first half of the year, the RWA market has ballooned from $8.6 billion to over $23 billion—a massive 260% surge. This expansion shows a dramatic shift in how traditional financial assets are being integrated into the blockchain sector.

Tokenized Private Credit Takes the Lead

Driving this explosive growth is tokenized private credit, which now represents a dominant 58% of the total RWA market.

This asset class has outpaced even tokenized U.S. Treasuries, which hold an estimated 34% market share. The appeal of private credit lies in its yield-generating potential and growing demand from DeFi-native and institutional investors seeking alternatives to saturated lending protocols.

According to the report, a standout contributor in this category is Tradable, a protocol built on ZKSync Era that launched in January 2025.

Tradable has already tokenized more than US$2 billion in assets, becoming a clear front-runner in the race to bridge TradFi and DeFi. Its meteoric rise reflects both product-market fit and a growing appetite for tokenized debt instruments among investors and protocols.

DeFi Integration Shows Maturity

A major development in the RWA space is its increasing integration with decentralized finance. The BlackRock BUIDL fund, now the largest tokenized treasury product with $2.9 billion in assets (up from $649 million at the start of the year), recently launched its first direct DeFi integration through Euler Finance.

This allows users to lend and borrow directly against tokenized treasury assets, introducing a new era of composability and utility for on-chain financial products.

Other players, such as Centrifuge and Securitize, have launched tokenized funds on the Solana blockchain, connecting with DeFi platforms like Kamino Finance.

These integrations improve liquidity and accessibility, allowing RWAs to serve as a reliable source of yield and helping DeFi evolve from a self-contained ecosystem into a more robust and externally linked financial system.

A Broader Bull Market Boost

According to the report, the growth of tokenized RWAs also coincides with a broader bullish trend in crypto markets. In May 2025, the overall crypto market rose by 10.3% despite ongoing macroeconomic uncertainty.

U.S. spot Bitcoin ETFs saw net inflows of US$5.2 billion, the strongest since late 2024, helping Bitcoin hit a new all-time high of around US$112K. This rally was bolstered by stablecoin legislation progress in both the U.S. and Hong Kong, as well as growing corporate treasury adoption.

With 116 public companies now holding over 809,000 BTC, and firms starting to cautiously diversify into ETH, SOL, and XRP, the market is showing signs of increasing maturity.

While Gaming and Layer 2 sectors lagged, DeFi surged by 19% in May, reflecting a rotation of capital into yield-bearing sectors—like RWAs.

According to Binance Research, the fusion of RWAs with DeFi could be a defining narrative of this cycle, offering a scalable and sustainable model for blockchain-based finance.

The post Binance Research: RWA Token Market Hits $23B as Private Credit Leads 260% Surge in H1 2025 appeared first on Cryptonews.

https://cryptonews.com/news/rwa-market-23b-260-surge-private-credit-binance/

Spot ETF Flows

Spot ETF Flows https://t.co/XItAOGvn5O

https://t.co/XItAOGvn5O