Binance CEO Changpeng Zhao’s plan to rescue the cryptocurrency market has fallen in need of expectations eleven months after launch.

Since the launch of the Industry Recovery Initiative (IRI), the corporate has solely spent lower than $15 million out of an introduced $1 billion fund, Bloomberg wrote.

Last yr was tormented by two main falls which despatched the market to sharp lows; the Terra Network and the cryptocurrency alternate, FTX.

After the collapse of FTX, the ripple impact was seen each in plunging asset costs and in struggling companies who had been uncovered to the corporate.

Zhao grew to become a hero when he introduced a plan to associate with main business gamers to lift $1 billion to save lots of startups inside the ecosystem. Notable companies like Jump Crypto and Animoca Brands joined within the fund.

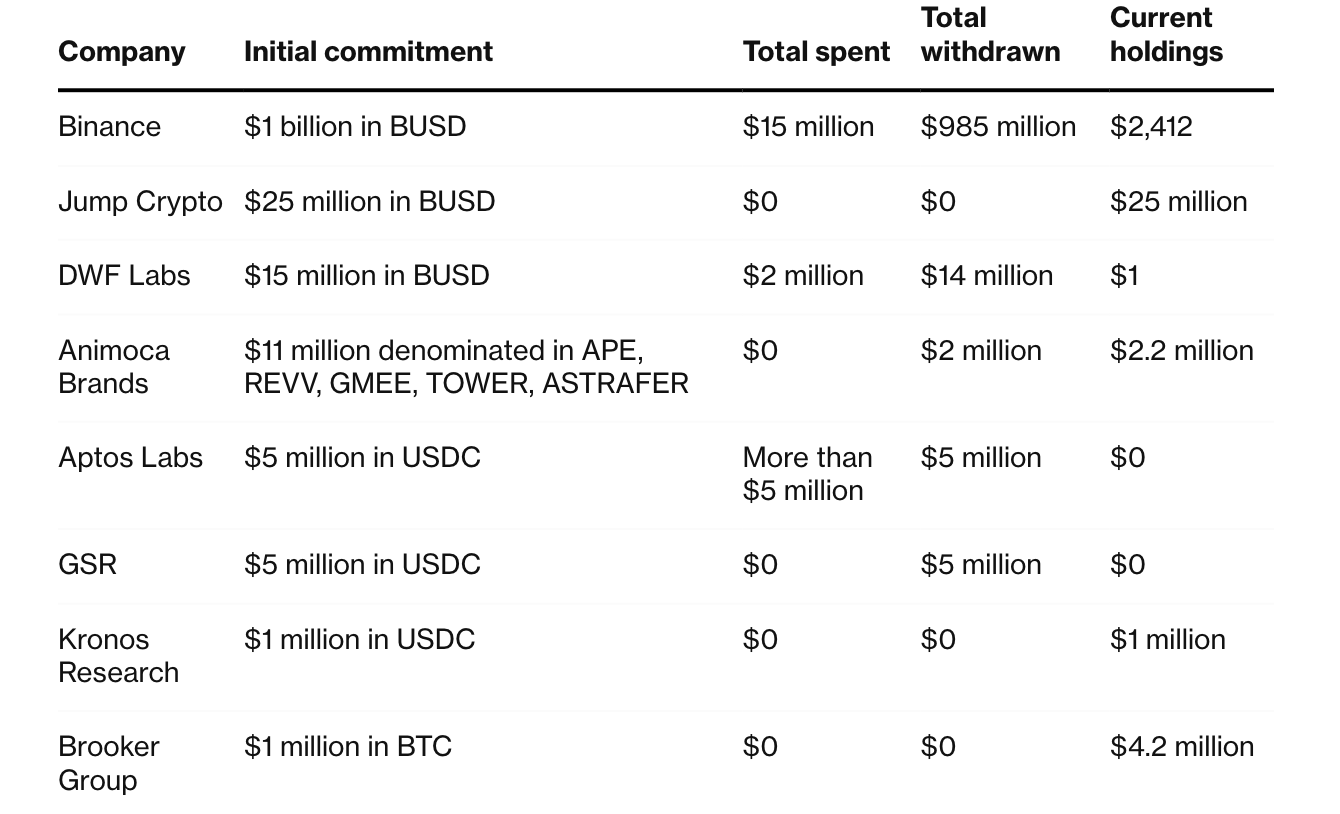

Binance has spent simply $15 million from its whole dedication and now transferred the remaining $985 million to its company treasury.

Before this, the alternate introduced a conversion from BUSD to different cryptocurrencies citing growing regulatory strain on stablecoins.

Projects funded since IRI

So far, Binance claims that the business rescue fund has been utilized to 14 initiatives though 13 of these stay undisclosed asserting solely the funding of Gopax, a South Korean cryptocurrency alternate.

At the time CZ confused the significance of the fund to save lots of web3 initiatives including that,

“The Industry Recovery Initiative was created to support promising companies that were negatively impacted by the events of last year. We hope that taking this step with GOPAX will further rebuild the Korean crypto and blockchain industry.”

A couple of months after the announcement of the IRI m, about 18 companies had additionally contributed $100 million in the direction of the trigger though solely 9 had been publicly recognized.

Jump Crypto pledged $25 million whereas DWF labs budgeted $15 million and has utilized $2 million with a withdrawal of $14 million.

Aptos alternatively pledges $5 million and has utilized the identical quantity for the undertaking. While the fund stays underutilized, Binance has defined that almost all companies failed to satisfy the standards.

Aptos alternatively pledges $5 million and has utilized the identical quantity for the undertaking. While the fund stays underutilized, Binance has defined that almost all companies failed to satisfy the standards.

“We didn’t identify as many projects who would meet our criteria, and this is the same for the other investors,” Dan Hou, head of Business Strategy and Operations at Binance.

FTX’s destructive impression on VC funding

The impacts of the post-FTX saga may be seen in plummeting enterprise capital investments from Q3 2022.

Blockchain intelligence agency, Messari famous that VC quantity final quarter stood at $2.1 billion down from its all-time excessive of $17 billion in 2021.

VC volumes in crypto slid 36% from Q2 2023 after recording slight progress on the again of quite a few spot Bitcoin ETF functions amid renewed institutional demand.

In whole, VC volumes in crypto belongings have been down by 70% because the collapse of FTX though latest developments present a slight change within the stance of institutional traders.

https://cryptonews.com/news/binance-1-billion-industry-recovery-fund-post-ftx-underperforms.htm