Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

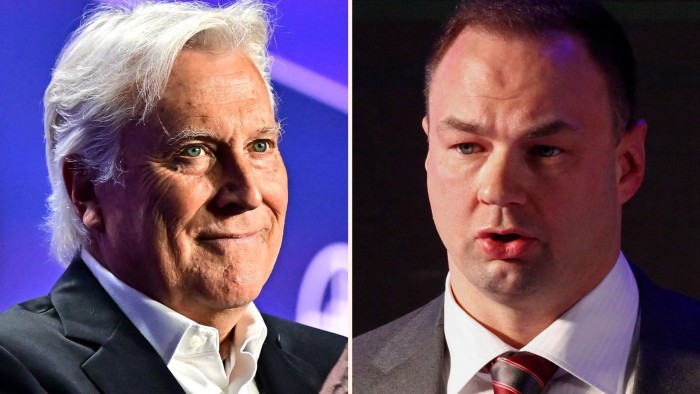

The billionaire duo of Thomas Tull and Mark Walter are preparing to make large acquisitions and seed new investments in artificial intelligence across the financial services, sports and defence sectors after launching an effort to raise $15bn from investors, including Mubadala Capital.

Tull, the former owner of movie studio Legendary Entertainment and a large investor in defence start-ups, told the Financial Times in an interview that he and Walter, chief executive of Guggenheim Partners, were on the prowl for acquisitions after combining their $40bn in personal investments to create a holding company and raise billions more in outside capital.

“Globally, there are going to be really interesting opportunities, whether it’s to acquire companies, whether it’s to invest in new technologies and get behind things,” Tull said.

Tull and Walter in recent years combined their personal assets, which span stakes in financial services giant Guggenheim investments, sports teams Chelsea FC and the Los Angeles Dodgers and bets on fast-growing start-ups in industries such as defence and cyber security, under one holding company called TWG Global.

The pair are using AI to identify acquisition opportunities and operational improvements.

“The idea was to have artificial intelligence drive everything we do . . . We would put a team together and we would weigh and measure everything,” Tull said.

TWG is close to finalising its $15bn equity fundraise and had “no shortage” of commitments, according to Tull. They include a $10bn preferred equity investment syndicated by Mubadala Capital, with TWG taking a 5 per cent stake in the Abu Dhabi investment manager.

Among TWG’s first big bets is a partnership with Elon Musk’s xAI and data intelligence company Palantir to launch an AI platform for banks and insurers to collate and analyse huge volumes of financial data, according to people briefed on the matter.

The collaboration means xAI’s model, Grok, could soon be used by financial institutions to process so-called unstructured data — information from sources that is hard to process, such as images, PDFs and audio recordings, but that make up the vast majority of data within financial institutions.

TWG has already deployed the financial data platform inside Guggenheim and its insurance business, Group 1001, according to TWG executives. The product will leverage Palantir’s software platforms for data analytics and xAI’s reasoning models and vast access to computing power. The venture will be announced later on Tuesday.

https://www.ft.com/content/fa34da69-2860-453e-ba71-12d0ad4d278b